Business & Management

Mak Launches Public Investment Management Centre of Excellence

Published

4 years agoon

The Public Investment Management (PIM) Centre of Excellence, housed at the College of Business and Management Sciences was on March 10, 2022, launched during the Public Investment Management Open Day held at Makerere University. The launch and Open Day were presided over by Mr. Ashaba Hannington, the Commissioner Projects Analysis and Public Investment Department, who represented the Minister of Finance, Planning and Economic Development, Hon. Matia Kasaija.

The center, with funding from the Foreign Commonwealth and Development Office of the UK government (FCDO) through the World Bank, is expected to build capacity of officers involved in management of public investments. The launch of the center was preceded by an Open Day themed “promoting good practices in managing public investments to raise returns”.

The Centre of Excellence awarded certificates to 26 trainees from various government agencies, following a rigorous training in Financial and Risk Analysis.

In a quest to strengthen public investment management, the government of Uganda through the World Bank Group and Commonwealth and Development Office of the UK Government (FCDO) Multi Donor Trust Fund (MDTF), have supported Implementation of the National Development Plans with interventions carried out through at least seven government institutions. The interventions aimed to strengthen institutions, build technical capacity for relevant government officers, and develop decision making tools including relevant strategies, policies and guidelines, in line with the theory of change and having more efficient and effective systems for public investment management that will ultimately increase the returns on investments and thereby promoting faster growth and the country’s capacity to manage its debt.

In his opening remarks, Professor Eria Hisali the Principal College of Business and Management Sciences (CoBAMS) who represented Prof. Barnabas Nawangwe the Makerere University Vice Chancellor highlighted how 0.6 of every dollar invested is lost hence the need for capacity building and research amongst government institutions to maximize returns. “Having done this we shall have created a huge data bank for policy makers, it is our sincere hope that then all government projects will be subjected to public scrutiny of our center so that we enhance productivity of our public investment”, added Prof Hisali. He extended the University’s appreciation to the World Bank and the Foreign, Commonwealth and Development Office of the UK Government (FCDO) through UKaid for the tremendous financial support rendered in establishing the PIM Centre of Excellence.

On behalf of the World Bank, Ms. Mukami Kariuki, the World Bank Country Manager for Uganda said that such policies help to provide economic stimulus and enhance the stock of public assets even in the times of crisis like the Covid 19 pandemic, which can contribute to the achievement of the long-term development goals of growth and development and poverty reduction.

Ms. Kariuki reiterated how clear it is that high levels of investment cannot yield returns if the quality of projects remains poor and that it should take government and stakeholders high efforts in combating such a big challenge through favorable policies and considerable reforms.

She commended the Government of Uganda for aiming at building capacity of government officials and other stakeholders, and developing decision making tools to increase return on investment thereby promoting more rapid growth.

“We are happy to witness the progress made on strengthening the ‘gate-keeping’ role of the Ministry of Finance. Through tapping into technology, the Government of Uganda has developed the Integrated Bank of Projects, an online information portal to streamline preparation, appraisal, and monitoring of execution of public projects,” said Ms. Kariuki. “The World Bank will further engage the government on its Public Investment Management (PIM) agenda, especially on strengthening its PIM policy and regulatory framework, and a financing strategy to manage public debt and ensure a return on investment”.

She closed off by asking government to focus on demonstrating value for money of public investments, building capacity of ministries and its officials and other implementing agencies in project preparation, reserving resources to facilitate implementation of feasibility studies during the pre-investment stage and formulating a policy framework for public investment management to allow the public scrutinize such investments.

Jordan Martindale who represented the FCDO and British High Commission highlighted the importance of Public Investment scrutiny as a business to every tax payer. She said the systems underlying the appraisal, implementation and monitoring of these projects need to be strengthened.

“It has been great partnering with Government with Uganda as they increase their ability to effectively deliver improved Public Investment Management. Delivering government’s investment pipeline in a manner that offers value for money, timely delivery and the attainment of development outcomes is crucial for achieving the National Development Plan III goals. The UK’s investment of Ush 42.3 billion over the past 5 years has led to evident efficiency gains including an improvement in the capital spending absorption rate which has risen from 60% in 2017 to 86% in 2021, a 4-fold increase in the use of Cost Benefit Analysis to assess projects submitted for approval into the Public Investment Plan, and the successful leveraging of about $600 million in additional development finance,’’ Jordan Martindale, said.

While launching the Public Investment Management (PIM) Center of Excellence, Mr. Ashaba Hannington on behalf of Hon. Matia Kasaija said the theme for the open day was in line with the government strategy for Economic Development through strengthening the country’s competitiveness for sustainable wealth creation, employment and hopes to achieve it all through the implementation of the Nation Development Plans.

“Through this reform agenda, the Government has improved her processes including improvement on screening projects before admission in the public investment plan, decrease in number of non-performing projects, accountability on finances through verifiable output and improvement in mechanism of entry and exit of projects from the public investment plan” he said.

Commissioner Ashaba thanked the funders, implored them for more support and pledged government’s support for the Center to ensure successful implementation of government interventions including the newly launched Parish Develop Model.

Professor Edward Bbaale, the Dean School of Economics and the Principal Investigator of the Center of Excellence said the center looks at building capacity amongst trainers to effectively deliver standardized PIM content, and conducting short courses to improve the country’s capacity in PIM. The Centre also aims at offering professional support as an independent external evaluator to the development committee of Ministry of Finance, Planning and Economic Development (MoFPED) and carrying out research towards improving the PIM framework in Uganda.

He therefore thanked the World Bank and the UK government for the grant, and the Ministry of Finance Planning and Economic Development, Department of Project Analysis for the support. Prof. Bbaale equally thanked the Makerere University Management particularly the Office of the Vice Chancellor for offering space to house the PIM center of Excellence, as well as CoBAMS fraternity and Cambridge resources international for the support and collaboration.

About eight government institutions showcased innovations and research findings from the grant given by the World Bank and FCDO among which included the PIM Center of Excellence that disseminated research findings on the impact of Covid-19 on public investment management in Uganda and the impact evaluation of the Uganda clean cooking supply chain expansion project that focuses on households’ access to cleaner cooking technologies and the Impact of the Luwero Rwenzori Development Program. The National Planning Authority exhibited their building planning capacity for spatial data and greater Kampala metropolitan Area while the Public Procurement and Disposal of Public Assets Authority (PDDA) showcased the Electronic Government Procurement system that enables disposal and procurement of public supplies, works and services through the internet.

Uganda Revenue Authority (URA) showcased its contact center upgrade with voice and chat infrastructure containing interactive video response and incident management to enhance simplicity to clientele and innovations in revenue mobilization. The Uganda Ministry of Lands, Housing and Urban Development exhibited its program that focuses on readying the country for actualization of shared infrastructure corridor and physical development plans operationalization.

The Ministry of Agriculture, Animal Industry and Fisheries exhibited the UgIFT Micro-scale irrigation program, an intensified solar sprinkler system offered at a subsidized price to empower farmers while the Office of the Prime Minister showcased its Enhancement of Productivity, Accountability and Knowledge Systems for Improved Public Investment Outcomes in Education and Health Project.

The newly launched PIM Center for Excellence is equipped with high-tech IT equipment and videoconferencing technologies to support training.

You may like

-

Makerere Explores Strategic Industry Partnership with Psalms Food Industries to Strengthen Manufacturing Innovation

-

Makerere Graduation Underscores Investment in Africa’s Public Health Capacity

-

Thirty Public Officers Certified in Integrated Regulatory Cost-Benefit Analysis

-

Botswana Delegation Visits Makerere’s Public Investment Management Centre to Study Sustainable Training Model

-

Makerere University commemorates 13 transformative years of partnership with Mastercard Foundation

-

200 UVTAB students graduate: CEES emphasizes Skills, Integrity and Community Impact

Business & Management

Thirty Public Officers Certified in Integrated Regulatory Cost-Benefit Analysis

Published

1 day agoon

March 3, 2026

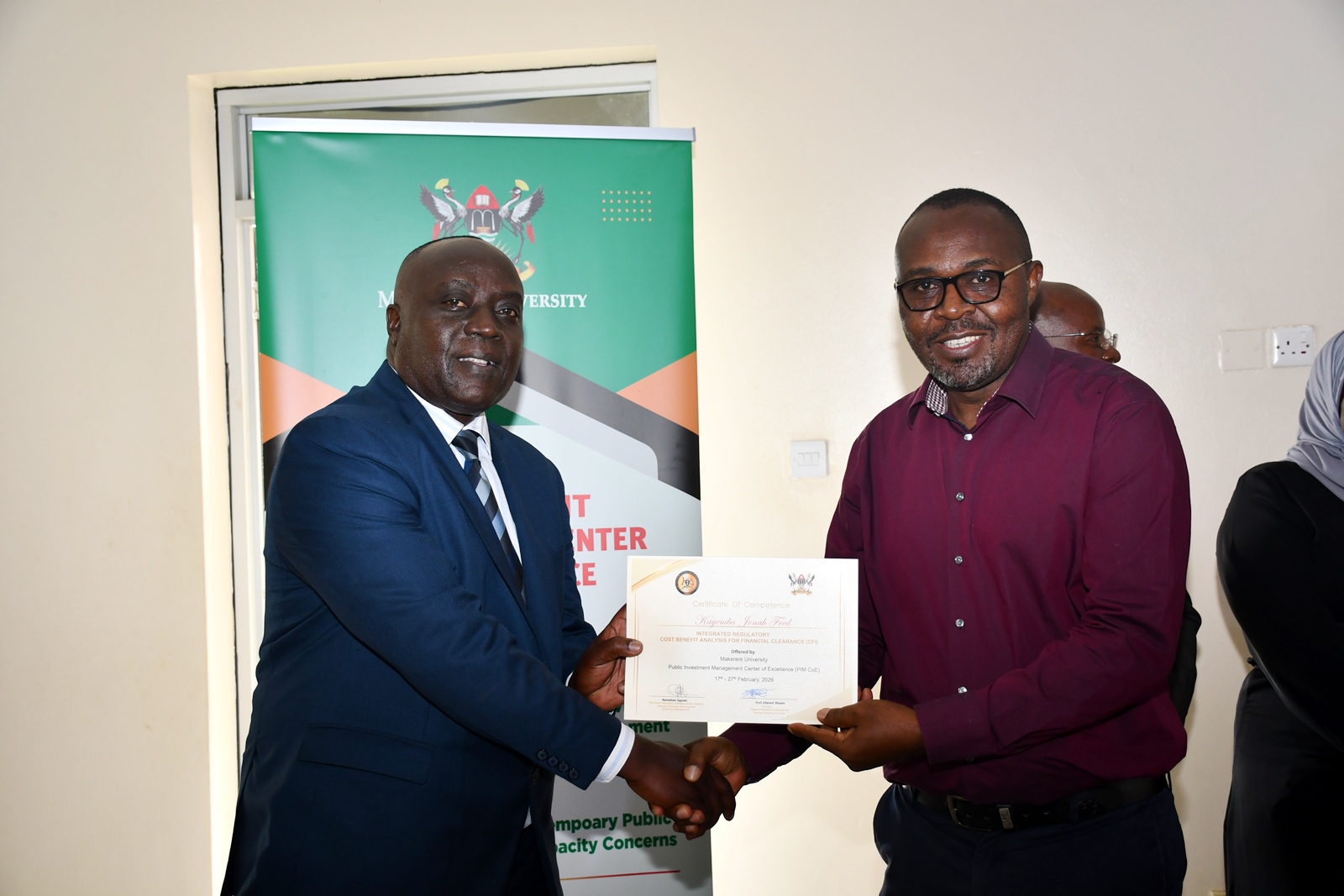

Thirty public officers from various Ministries, Departments and Agencies (MDAs) have successfully completed a two-week intensive training in Integrated Regulatory Cost-Benefit Analysis (IRCBA), culminating in the award of certificates at a closing ceremony held on 27th February 2026 at the Pearl on the Nile Hotel in Jinja.

The training was jointly organized by the Public Investment Management Centre of Excellence at Makerere University and the Ministry of Finance, Planning and Economic Development (MoFPED), in collaboration with the Infrastructure and Social Services Department (ISSD) and the National Planning Authority (NPA). It focused on operationalizing the Revised Guidelines for the Issuance of Certificates of Financial Implication (CFIs), which came into effect on 1st July 2025.

A Strategic Reform for Fiscal Credibility

In closing remarks delivered on by Commissioner Paul Patrick Mwanja behalf of the Permanent Secretary/Secretary to the Treasury, participants were commended for undertaking the training during a demanding budget cycle, when many MDAs are simultaneously preparing the FY 2026/27 Budget, executing the FY 2025/26 Budget, and implementing the National Development Plan IV and the Tenfold Growth Strategy.

The PS/ST emphasized that the revised Guidelines mark a significant shift toward a more transparent, data-driven, consultative, and analytically rigorous approach to evaluating policy and legislative proposals. Participants were equipped to assess fiscal implications, evaluate economic and socio-economic impacts, analyze distributional effects, and address uncertainty using structured analytical tools.

They were reminded that training alone is not sufficient, the real test lies in consistent application. As members of the third cohort, they were challenged to serve as reform ambassadors, championing evidence-based policymaking and strengthening analytical standards across government.

Bridging Academia and Public Service

Delivering the official closing remarks, the Director of the PIM Centre of Excellence, Prof. Edward Bbaale, commended participants for their active engagement and unwavering commitment throughout the training.

He described the programme as both timely and strategic, designed to equip officers with practical tools to prepare robust Statements of Financial Implication (SFIs) that support credible issuance of CFIs. He noted that strong financial analysis enhances fiscal discipline, policy coherence, and the overall quality of legislation and public policy in Uganda.

Prof. Bbaale underscored the longstanding partnership between Makerere University and the Ministry of Finance, highlighting how it continues to bridge academia and public service by combining analytical rigor with practical policy experience. He emphasized that the collaborative model — bringing together faculty from the College of Business and Management Sciences and practitioners from Government, reflects the core vision of the PIM Centre of Excellence: strengthening national systems through evidence-based policymaking.

During the two weeks, participants gained hands-on experience in applying cost-benefit analysis across four critical dimensions: budgetary analysis, socio-economic analysis, distributive impacts, and risk assessment. Prof. Bbaale encouraged them to return to their institutions as agents of transformation, improving evaluation frameworks, strengthening regulatory decisions, and ensuring that public interventions deliver value for money and long-term development impact.

He also reaffirmed the Centre’s broader mandate beyond training, noting its recent support to the revision of Development Committee Guidelines, assessment of public investment performance since NDP I, and hosting of the Second Public Investment Management Conference in August 2025.”

Building from “Zero Kilometre”

Earlier, the Manager of the PIM Centre of Excellence highlighted the practical approach adopted during the training. Participants began with blank Excel sheets and built analytical models from scratch, likened to the engineering concept of starting at “zero kilometre,” where construction begins from the very starting point and progresses step by step.

The interactive sessions enabled participants from diverse disciplines, including policy analysts, planners and statisticians, to interrogate assumptions, refine costing approaches, and debate implementation and enforcement frameworks. Their sector-specific insights enriched the learning process and strengthened the analytical models developed.

The Manager noted that excellence is not about knowing everything, but about bringing together the right expertise. Facilitators from MoFPED, NPA, the Office of the President, and Makerere University ensured that theory remained grounded in practical government realities.

Participants Applaud Practical and Engaging Sessions

Speaking on behalf of the cohort, a participant described the training as highly engaging and transformative. The combination of theory and practical application, coupled with patient facilitation, allowed officers from varied professional backgrounds to learn from one another.

The participant highlighted the final day’s discussions as the most impactful, expressing confidence that the knowledge gained would enhance policy analysis and improve the quality of programmes and projects across MDAs.

Certificates Awarded

The ceremony concluded with the award of certificates to all 30 participants in recognition of their successful completion of the IRCBA training. The certification marks another milestone in Government’s effort to build a critical mass of experts capable of institutionalizing rigorous financial and economic analysis in public policy processes.

As the workshop was formally declared closed, participants were encouraged to apply their newly acquired skills consistently, mentor colleagues, and contribute to strengthening fiscal governance across Government.

The PIM Centre of Excellence reaffirmed its commitment to continuous research, policy advisory support, and capacity building as Uganda advances toward more credible, transparent, and sustainable public decision-making.

Business & Management

Botswana Delegation Visits Makerere’s Public Investment Management Centre to Study Sustainable Training Model

Published

1 day agoon

March 3, 2026

Kampala, Uganda – 25 February 2026

A delegation from Botswana’s public investments sector on 25th February 2026 visited Makerere University’s Public Investment Management Centre of Excellence to benchmark its sustainable training model and draw lessons from Uganda’s well-established Public Investment Management (PIM) framework.

The team, composed of specialists in public investments, is exploring ways to strengthen capacity within Botswana’s public sector institutions. The delegation underscored the importance of structured and sustainable capacity-building programmes, noting that effective public investment management is central to driving national development and ensuring value for money in public projects.

During the engagement, the Botswana team sought to understand the Centre’s operational model, including how it designs and delivers training programmes that remain impactful over time. Particular interest was placed on the Centre’s approach to sustainable training delivery, the documentation of challenges and successes, and mechanisms used to ensure that public officers acquire long-term, practical skills that translate into improved project planning, appraisal, and implementation.

The visiting delegation commended Uganda’s commitment to institutionalizing PIM training and emphasized that cross-country learning is vital for strengthening public financial management systems across Africa. They observed that Uganda’s experience offers practical insights into building a resilient and responsive PIM framework anchored in continuous professional development.

As part of their recommendations, the delegation proposed the introduction of a hybrid training model to enhance accessibility for international participants. Under this approach, the theoretical components of PIM courses would be delivered online, allowing participants to engage remotely from Botswana and other countries. This would then be followed by in-person sessions in Uganda focused on hands-on, experiential learning at the Centre.

According to the delegation, such a model would significantly reduce travel costs and time while preserving the value of face-to-face practical training. The hybrid approach would also provide flexibility for busy public officers, enabling them to balance professional responsibilities with structured learning.

The visit further strengthened regional collaboration and reaffirmed the role of Uganda’s Public Investment Management Centre of Excellence as a hub for capacity development in public investment management across the continent.

Business & Management

76th Graduation Ceremony: CoBAMS Staff and Graduates Win Excellence Awards

Published

6 days agoon

February 26, 2026

26th February 2026-During the 76th Graduation Ceremony (24th to 27th February 2026), Makerere University invoked its tradition of recognizing outstanding performance and excellence in academics, research, teaching, knowledge transfer, publication and authorship.

The College of Business and Management Sciences (CoBAMS) presented students for graduation on the third day of the 76th graduation ceremony. Consequently, on 26th February 2026, entities within the University namely the Office of the Vice Chancellor, Makerere University Press, the Directorate of Research, Innovations and Partnerships, Directorate of Graduate Training, and partners including the Economic Policy and Research Centre (EPRC), Association of Chartered Certified Accountants (ACCA Uganda), Prudential Uganda, lined up awards, to celebrate achievements and excellence.

The award ceremony brought onboard invited guests from public and private sectors, the business community, Makerere University officials, faculty members, alumni, industry partners and graduating students. The awards were presented during the Makerere University Convocation Graduation Luncheon.

The ceremony provided a platform for celebrating academic excellence, strengthening alumni engagement, and reinforcing collaboration between the University and its professional and industry partners.

2026 Research Excellence Awards

The Vice Chancellor’s Research Excellence Awards were presented to college members whose research output and scholarly contributions have significantly advanced knowledge and strengthened the College’s academic profile.

At CoBAMS, the recipients of the Vice Chancellor’s Research Excellence Awards in the various categories included the following:

- Associate Professor Faisal Buyinza, Overall top research award

- Associate Professor Faisal Buyinza, Senior-Career Research award

- Stephen Ojiambo Wandera, Mid-Career Research award

- Ruth Mpirirwe and Richard Ssempala, Early-Career Research award

The awardees were honored for their exceptional research productivity, impactful publications, and contribution to building a vibrant research culture.

The awards underscore Makerere University’s emphasis on high-quality research that addresses national and global development challenges.

Recognition of Book Author

Prof. John Ddumba-Ssentamu, a renowned economist, administrator, former Vice Chancellor of Makerere University, and the pioneer Principal of the College of Business and Management Sciences, was honoured for his contribution to scholarship and knowledge transfer through authorship.

Published by Makerere University Press, Prof. Ddumba-Ssentamu’s book titled, The Journey: Beginnings, Trials and Triumphs of Centenary Bank, highlights the evolution, resilience, and growth of Centenary Bank and reflects his continued contribution to academic literature and thought leadership in the fields of economics and financial development.

Prof. Ddumba-Ssentamu’s recognition reflects the University’s appreciation of distinguished scholars whose published works contribute to intellectual discourse, policy engagement, and the advancement ofscholarship.

Reputable partners recognize excelling graduates

ACCA Uganda- Best Accounting Student

Prudential Uganda-Actuarial Science Award

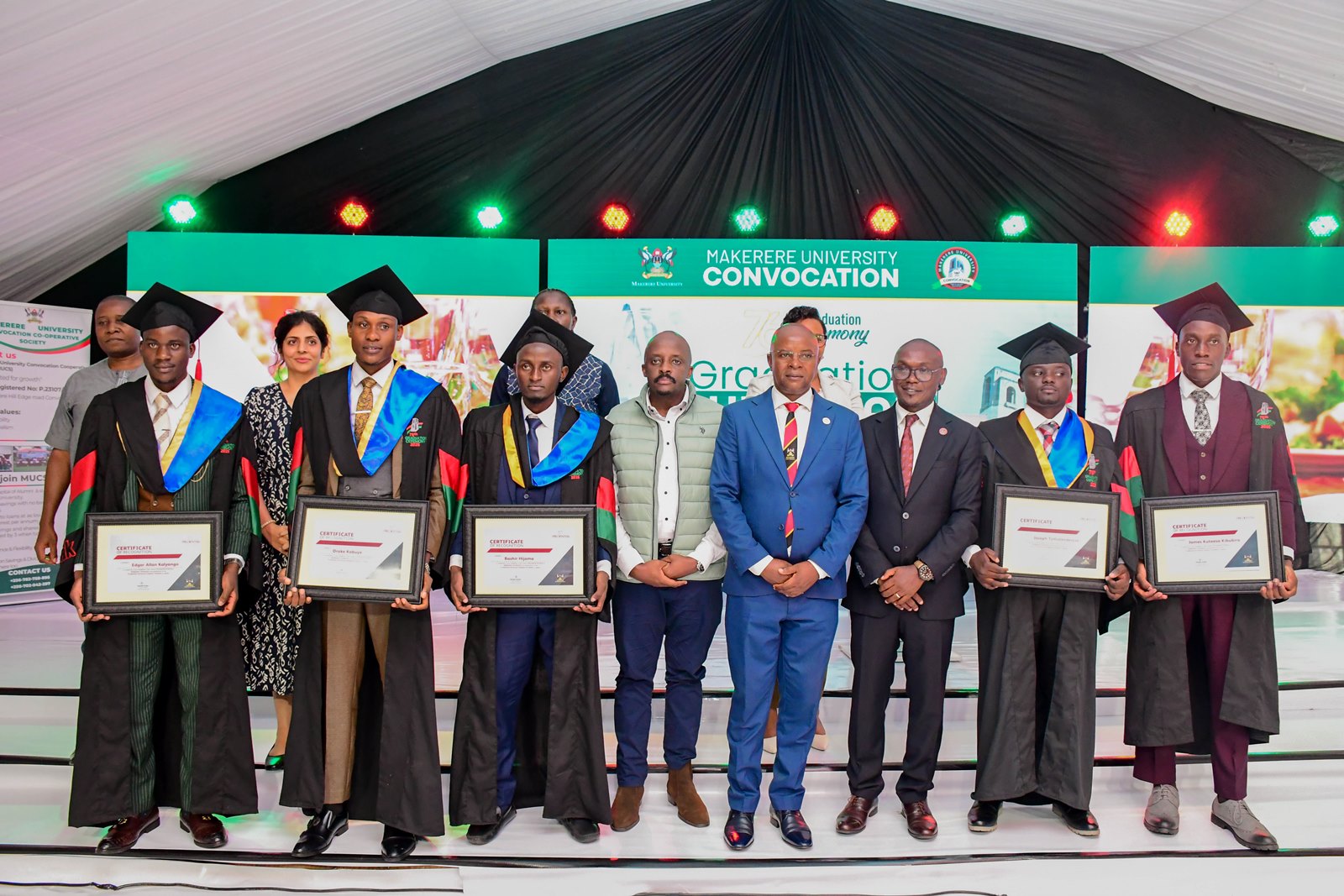

Celebrating academic excellence, Prudential Uganda recognized the fourth cohort of outstanding actuarial science graduates under the Prudential Actuarial Science Support Scheme (PASS). The initiative reflects Prudential’s long-term commitment to building local actuarial expertise and strengthening Uganda’s financial services sector for generations to come.

The top five graduates of Bachelor of Science in Actuarial Science who received the PASS awards included: Drake Kabuye, Edgar Allan Kalyango, Kuteesa Kikubira James, Tumutendereze Joseph, and Bashir Hijoma. These were honored for their outstanding academic performance and commitment to actuarial career. Through PASS, Prudential Uganda provides high-potential graduates with mentorship, internship opportunities, and guidance toward globally recognized actuarial qualifications.

Commenting on the milestone, Tetteh Ayitevie, CEO of Prudential Uganda, said that investing in actuarial talent is critical to building a resilient and sustainable financial services industry. He noted that actuaries play a central role in risk management, pricing, product development, and long-term financial planning, making their contribution vital to the growth of Uganda’s insurance sector.

Prof. Edward Bbaale, the Principal, College of Business and Management Sciences, applauded Prudential Uganda for its ongoing support, highlighting that programmes such as PASS inspire students to excel academically while preparing them for the realities and demands of the actuarial profession.

EPRC Young Professional Award

Recognizing excellence, EPRC presented the Young Professional award to Emmanuel Menya, the best Master of Arts in Economics graduate. The award includes a two-year employment contract. Ibrahim Kasirye, the Director of Research at EPRC presented the award on behalf of Dr. Sarah Ssewanyana, the Executive Director.

The EPRC Young Professional Award, recognizes and celebrates exemplary performance. The award underscores the importance of nurturing young professionals who exhibit excellence, innovation, and a strong commitment to national development.

Significance of the Award ceremony

Prof. Edward Bbaale, Principal of College of Business and Management Sciences (CoBAMS), underscored the significance of the ceremony, noting that it served three key purposes: to recognize academic excellence among students, to honor faculty members excelling in teaching, research, and service, and to celebrate Prof. John Ddumba-Ssentamu, former Vice-Chancellor of Makerere University, for his continued contribution to scholarship through authorship.

Prof. Bbaale described Prof. Ddumba-Ssentamu’s ongoing scholarly work as inspirational, stating that it demonstrates a steadfast commitment to knowledge creation beyond leadership roles. He commended both students and staff for their hard work and discipline, emphasizing that university success is a shared achievement.

Collaboration, Responsibility, and Excellence

Congratulating the awardees, the Principal of Makerere University Business School (MUBS), Prof. Moses Muhwezi, reminded graduates that being a product of Makerere University is both a privilege and a responsibility.

“Uphold the university’s internationally respected brand, defend it, and take pride in it, while maintaining unity and avoiding internal conflicts that could harm its reputation,” he urged. The Principal of MUBS encouraged graduates to remain committed, diligent, and focused in their pursuit of excellence.

Highlights about Makerere University Convocation

CPA George Mugabi Turyamureeba, Chairperson of the Makerere University Convocation, informed the audience, that the Convocation is a legally established and influential platform for alumni and staff.

Rallying alumni and staff to join Makerere University Convocation, CPA Turyamureeba outlined the achievements and ongoing activities. He reported that during his tenure, the Convocation Executive, had expanded and beautified the permanent home for the Convocation. Some of the ongoing activities include: strengthening alumni engagement, introduction of a cross-generational mentorship program, and the formation of a cooperative society (SACCO) aimed at providing affordable loans and potentially establishing a bank.

He tipped the fresh graduates on resilience, continuous self-improvement, and lifelong learning, stressing the importance of staying connected to their alma mater and the Makerere University Convocation community.

He cautioned the graduates on emerging fraud risks, including digital scams, and fraudulent job offers. He urged them to safeguard their personal information, uphold integrity, and avoid becoming either victims or perpetrators of fraud.

Trending

-

Humanities & Social Sciences1 week ago

Humanities & Social Sciences1 week agoMeet Najjuka Whitney, The Girl Who Missed Law and Found Her Voice

-

General1 week ago

General1 week ago76th Graduation Highlights

-

Agriculture & Environment2 weeks ago

Agriculture & Environment2 weeks agoUganda Martyrs Namugongo Students Turn Organic Waste into Soap in an Innovative School Project on Sustainable Waste Management

-

Health2 weeks ago

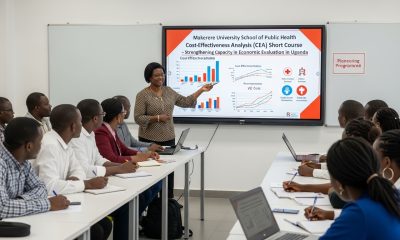

Health2 weeks agoMakerere University School of Public Health Graduates First Cohort of Cost-Effectiveness Analysis Short Course

-

Agriculture & Environment1 week ago

Agriculture & Environment1 week agoCAES Presents Overall Best Performing Student in the Sciences & a Record 28 PhDs at the 76th Graduation Ceremony