Business & Management

Local Governments Embrace Innovative Financing Framework for Infrastructure Development

Published

2 years agoon

Local governments across the country continue to struggle with funding for infrastructure development. The government of Uganda has been exploring ways to enhance the financial autonomy of local governments, including improving their capacity to borrow responsibly for development projects. This includes capacity-building initiatives and reforms to streamline the borrowing process albeit with little success. This is because of the stringent laws surrounding borrowing as well as the local government’s creditworthiness, which is influenced by factors such as revenue collection efficiency and financial management practices, affects its ability to borrow and the terms of borrowing.

It is against this background that researchers from the School of Business partnered with United nations Capital Development Fund to undertake a study on “Enabling new Cites to Access Private Capital for Local Investments.” The research team, led by Dr. Yusuf Kiwala, who undertook a study of Arua and Mbale city, have proposed a framework, which if adopted could help local government address their development challenges.

In a groundbreaking move, local governments in Uganda are set to revolutionize their approach to funding infrastructure projects with the introduction of a comprehensive financing framework. This new strategy aims to enhance collaboration between public and private sectors, ensuring sustainable development across the country.

Speaking during the dissemination workshop in Mbale City on August 1, 2024, Dr Kiwala while unveiling the framework said the new financing framework is built on several key elements, each designed to address specific aspects of funding infrastructure projects. These elements include the contribution of resources by various actors, diverse funding sources, external triggers of change, financing instruments, and financing structures.

- Actors Contributing Resources: The framework emphasizes collaboration and community engagement. It involves a range of stakeholders, including government entities, private investors, and commercial lenders, working together to pool resources and share risks.

- Funding Sources: The framework taps into multiple funding sources, both public and private. National, international, and local governments, along with donors and impact investors, are expected to play significant roles in financing infrastructure initiatives.

- External Triggers of Change: This element focuses on the various external factors that can initiate or accelerate infrastructure projects. These include regulatory changes, market forces, economic incentives, and financial reforms.

- Financing Instruments: A variety of financing instruments are available under the framework. These include grants, equity investments, short-term and long-term loans, user fees, loan rebates, bonds, and guarantees. This diversity allows for flexibility and adaptability in funding approaches.

- Financing Structures: The framework incorporates innovative financing structures such as pooled finance, special purpose vehicles, revolving funds, project finance, public-private partnerships (PPPs), and leasing arrangements. These structures are designed to enhance financial stability and efficiency in project implementation.

The new framework outlines specific mechanisms to operationalize these elements. These mechanisms include:

- Collaboration and community engagement to foster collective ownership of projects.

- Funding from a mix of government sources, donors, and commercial lenders.

- Regulatory and market-driven changes that create conducive environments for infrastructure investments.

- A wide range of financial instruments to meet the diverse needs of projects.

- Structured financing options to ensure robust and sustainable funding models.

Impact and Future Prospects

This innovative financing framework is poised to transform the landscape of infrastructure development in Uganda. By leveraging diverse funding sources and adopting flexible financing structures, local governments will be better equipped to undertake critical infrastructure projects that drive economic growth and improve public services.

The introduction of this framework also signals a shift towards more inclusive and sustainable development practices. With community engagement and risk-sharing at its core, the framework ensures that infrastructure projects are not only financially viable but also socially equitable.

As Uganda embarks on this new path, the success of the financing framework will likely serve as a model for other developing countries facing similar challenges in funding infrastructure development. The future looks promising as local governments, in collaboration with various stakeholders, pave the way for a brighter and more prosperous Uganda.

The Principal Assistant Town clerk – Northern Division, Ms. Annet Nandudu, expressed optimism for the future, saying that with continued collaboration and strategic planning, the challenges can be overcome. Ms. Nandudu the importance of transparency and accountability in the financing framework to ensure that resources are utilized efficiently and effectively. She also highlighted the need for ongoing capacity building to strengthen local government institutions and empower communities to participate in decision-making processes.

On his part, Mr. Julius Masereka, Principal Urban Officer, Ministry of Local Government, said the government was committed to the successful implementation of such initiatives. He emphasized the importance of collaboration between the government and local communities to ensure sustainable development. He called on the LGs to write bankable projects so that they can access funding from various sources and contribute to the overall development of their communities.

Research team

Dr. Yusuf Kiwala

Mr. Kanakulya Ronald

Ms. Maureen Nandaula

Dr. Kintu Ismail

You may like

-

Celebrating Academic Excellence: CoBAMS Presents 975 Graduands at Mak 76th Graduation Ceremony

-

Mak 76th Graduation Ceremony: CoNAS Presents 16 PhDs & Best Performing Male Student in the Sciences

-

Medical graduates urged to uphold Ethical values

-

CAES Presents Overall Best Performing Student in the Sciences & a Record 28 PhDs at the 76th Graduation Ceremony

-

Over 9,200 to graduate at Makerere University’s 76th Graduation

-

Philliph Acaye and the Making of Uganda’s Environmental Health Workforce

Business & Management

Celebrating Academic Excellence: CoBAMS Presents 975 Graduands at Mak 76th Graduation Ceremony

Published

2 days agoon

February 26, 2026

26th February 2026– The third day of Makerere University’s 76th Graduation Ceremony, held on 26th February 2026, underscored the University’s central role in shaping economic thought, business leadership, and public policy in Uganda and beyond. On this day, the College of Business and Management Sciences (CoBAMS) together with Makerere University Business School (MUBS) presented their graduands for the conferment of degrees and award of diplomas.

CoBAMS Graduation Statistics

Across the University, a total of 9,295 graduands will be presented during the 76th graduation ceremony (24th to 27th February 2026). The College of Business and Management Sciences presented 975 graduands, comprising 14 Doctor of Philosophy (PhD) degrees, 334 Master’s degrees, 2 Postgraduate Diplomas, and 625 Bachelor’s degrees. This robust academic profile reflects the College’s sustained investment in advanced research, graduate training, and industry-relevant programmes designed to equip graduates with analytical competence, ethical grounding, and leadership capacity required to contribute meaningfully to economic transformation, institutional development, and enterprise growth at national, regional, and global levels.

Prof. Nawangwe emphasized that CoBAMS remains a key pillar in advancing the University’s research agenda. Through strategic partnerships with government ministries, the business community, and the private sector, the College has produced over 60 high-quality research outputs under the CoBAMS Working Paper Series, many of which have been published in internationally recognized peer-reviewed journals. These outputs he said are aligned with the UN Sustainable Development Goals (SDGs), Uganda’s 10-fold National Economic Growth Strategy, and the University’s Strategic Plan, reinforcing CoBAMS’ role in driving evidence-based development.

The Vice Chancellor commended the College for its five dynamic research centres—Entrepreneurship and Innovation; Statistics and Demography; Public Investment Management; the Environment for Development Initiative; and the Centre of Excellence for Africa Climate-Sensitive Macroeconomic Modelling—which collectively form the backbone of the College’s research enterprise. Through these centres, he noted CoBAMS continues to advance high-level scholarship, foster interdisciplinary collaboration, and deepen policy engagement, firmly positioning itself at the forefront of national and regional economic discourse.

In his message to the graduands, Prof. Nawangwe tasked them to become job creators, who are ready to turn challenges into opportunities. He encouraged them to remain proud ambassadors of Makerere University, upholding integrity and excellence, and to utilize their knowledge to transform communities and nations.

“You are all graduating with disciplines that are needed by society. We have equipped you with the knowledge and skills that will make you employable or create your own businesses and employ others. Do not despair. If you cannot find employment, reflect on the immense opportunities around you and raise to the occasion as an entrepreneur,” Prof. Nawangwe stated.

Addressing the congregation, the Guest of Honour, Hon. Janet Kataaha Museveni, First Lady and Minister of Education and Sports commended Makerere University for its pivotal role in transforming lives and shaping Uganda’s future. She congratulated the graduands upon reaching a significant academic milestone and reflected on the broader purpose of higher education in developing both knowledge and character.

She highlighted the success of the Emerging Leaders Programme, launched at Makerere University as a deliberate initiative to cultivate a generation of leaders grounded in values, integrity, and service. Founded on the conviction that higher education must shape both mind and character, the programme equips young people to navigate real-world challenges. She noted that 20 graduates from the inaugural cohort of the Emerging Leaders Programme were being celebrated at the 76th graduation.

“We recognised that our young people face real challenges such as moral decay, violence, addiction, exploitation and sometimes a loss of purpose and direction. The Emerging Leaders Programme was a deliberate commitment to raise a generation of leaders grounded in values, integrity and service to others. Today, 20 graduates represent the early visible fruit of that vision. They have deliberately chosen to build their lives on a foundation of strong moral values and servant leadership,” the Minister said.

The Minister urged graduands to view their achievements not as an end, but as a commissioning. She called upon them to lead with courage, humility, and responsibility, emphasizing that the world needs graduates who embody not just skills and knowledge, but character, integrity, and service. She reminded graduates that as they step into society, they carry the promise of a new Uganda, one where talent, ambition, and knowledge are matched by integrity, purpose, and service,” she exhorted, celebrating the role of higher education in nurturing both excellence and character.

Delivering the commencement address, Dr. Patricia Ojangole, Managing Director of Uganda Development Bank and a proud Makerere University alumnus, lauded the University for equipping graduates with a strong intellectual foundation and the confidence to navigate the complexities of the modern world. She recognized the sacrifices of parents, guardians, and relatives, noting that behind every graduand lies a story of perseverance, encouragement, and unwavering support.

Dr. Ojangole urged the graduands to look beyond traditional employment, highlighting the vast opportunities for entrepreneurship and innovation in today’s digitally connected and globally integrated Uganda. She reminded them that the skills, exposure, and knowledge they possess, position them to create solutions, build enterprises, and drive economic and social transformation.

She emphasized lifelong learning, adaptability, and the cultivation of emotional intelligence and leadership as essential tools for sustained success, noting that the most effective leaders inspire and empower others. Above all, she urged the graduates to guard their integrity, develop strong networks, and remain resilient in the face of setbacks, framing every challenge as an opportunity to strengthen character.

“Learning does not end with this degree. The world of work is constantly evolving—technology advances, markets shift, and customer needs change. Those who stop learning quickly fall behind. Graduates must develop skills in artificial intelligence, data literacy, analytical thinking, forecasting, and strategic planning, while also cultivating emotional intelligence and leadership. These abilities are essential in the 21st-century workplace, where people follow leaders who inspire. Lifelong learning, adaptability, curiosity, and a willingness to embrace change are no longer optional—they are the new currency of corporate and business success,” she submitted.

The Makerere University Chancellor, Dr. Crispus Kiyonga urged graduates to view their time at Makerere not only as an academic journey, but as an opportunity to engage with the world around them. He encouraged them to identify opportunities within their communities and the nation at large, highlighting that while some may secure government or private sector jobs, others will need to create their own paths through entrepreneurship.

“Beyond pursuing your courses, seize the opportunities at the university to broaden your knowledge of the world, your country, and the communities in which you live. Be attentive to the opportunities around you—those you can leverage to engage in meaningful and viable activities that bring prosperity,” the Chancellor advised.

A key highlight of the day was the conferment of the Doctor of Letters (Honoris Causa), of Makerere University upon Dr. Japheth Buleetwa Katto, recognizing him as an Honorary Scholar of Makerere University. A distinguished professional with remarkable achievements, Dr. Katto has made significant contributions to Uganda, the East African region, and beyond, particularly in advancing the accountancy discipline and strengthening the capital markets industry. His work has played a transformative role in Uganda’s social and economic development while also influencing the accountancy profession on a global scale.

Accepting the Honorary Doctorate Doctorate, Mr. Japheth Buleetwa Katto expressed deep gratitude to Makerere University and those who supported his journey. Reflecting on fifty years in corporate governance and finance, he emphasized a key lesson: integrity, diligence, and ethical leadership are always noticed, and the rewards of sowing excellence will inevitably follow, even if it takes decades.

“This recognition comes as a surprise and brings with it an important lesson, I wish to share with everyone here: people are always watching. They notice when you choose integrity over shortcuts, when you champion good governance even when it is unpopular. They see not only the good, but also the bad and the ugly. We must never forget the eternal law of the harvest: we reap what we sow. If you sow excellence, diligence, and ethics, the harvest—though it may take decades—will always find you,” Dr. Katto said.

Addressing the graduands, Mr. Japheth Buleetwa Katto urged them to embrace the unexpected, recognize that integrity is their greatest strength, and harness the power of networking. He reflected on his own journey, crediting teachers, mentors, colleagues, and family for their support, and encouraged the new graduates to always strive to make a positive impact in everything they do.

Business & Management

Parliament, MoFPD and Makerere Launch Five-Day Training on Integrated Macroeconomic Modelling to Strengthen Fiscal Oversight

Published

3 days agoon

February 25, 2026By

Mak Editor

By Wilber Tumutegyereize

In a significant step toward strengthening fiscal governance and enhancing evidence-based decision-making, the Parliament of Uganda, in collaboration with the Ministry of Finance, Planning and Economic Development and Makerere University, has launched a five-day intensive training programme on Integrated Macroeconomic Modelling.

The training brings together staff of the Parliamentary Budget Office (PBO) for a comprehensive capacity-building programme designed to deepen their analytical expertise in assessing national budgets, evaluating fiscal policy options, and generating independent, data-driven advice for Members of Parliament. The initiative forms part of a broader institutional strategy to reinforce Parliament’s oversight role and ensure that national budgeting processes are aligned with Uganda’s development priorities as articulated in the National Development Plan and Parliament’s Strategic Plan.

Strengthening Evidence-Based Fiscal Oversight

Speaking at the opening session on behalf of the Manager of the Public Investment Management (PIM) Centre of Excellence at Makerere University, Dr. Peter Babyenda emphasized that the increasing complexity of Uganda’s fiscal environment demands stronger analytical capacity within Parliament.

“This training comes at a critical time when the demands on Parliament to undertake rigorous scrutiny of fiscal and economic policy have never been greater,” Dr. Babyenda stated.

He noted that Parliament’s constitutional mandate—to legislate, appropriate public funds, and oversee government expenditure—requires objective, independent, and technically sound economic analysis. The Parliamentary Budget Office plays a central role in fulfilling this mandate by providing Members of Parliament with timely assessments of revenue projections, expenditure allocations, public debt sustainability, and macroeconomic trends.

Dr. Babyenda explained that the Government’s Integrated Macroeconomic Model provides a holistic framework for understanding the interconnections between economic growth, fiscal policy, public investment, inflation, debt dynamics, and household welfare. By incorporating this model into parliamentary analysis, the PBO will be better positioned to simulate alternative policy scenarios and assess their short- and long-term implications.

Institutional Priorities

Mr. Henry Waiswa, Deputy Clerk to Parliament in charge of Corporate Affairs, contextualized the training within Parliament’s broader institutional reform agenda. He underscored Parliament’s constitutional responsibility to legislate, allocate resources, and oversee the management of public finances.

“Since its establishment under the Budget Act and its anchoring under the Administration of Parliament Act, the Parliamentary Budget Office has become a cornerstone of evidence-based fiscal oversight,” Mr. Waiswa noted.

He observed that Uganda’s public financial management landscape has become increasingly complex, with evolving fiscal pressures, development financing needs, and global economic uncertainties. In such an environment, Parliament must not only examine headline budget figures but also anticipate the macroeconomic and distributional effects of policy decisions on households, businesses, and vulnerable communities.

Mr. Waiswa further expressed appreciation to the Ministry of Finance, Makerere University, and the Resource Enhancement and Accountability Programme (REAP) for their technical and financial support in designing and facilitating the training.

Academic Expertise and Analytical Rigor

Professor Edward Bbaale, Director of the PIM Centre of Excellence at Makerere University, highlighted the critical role of academia in strengthening public sector institutions. He emphasized that collaboration between Parliament, the Ministry of Finance, and Makerere University reflects a shared commitment to improving the quality of fiscal governance.

“When our key public institutions work together, we enhance the credibility of economic management and ensure that policy decisions are informed by rigorous analysis,” Professor Bbaale said.

He explained that Integrated Macroeconomic Models combine key economic indicators, such as Gross Domestic Product (GDP), government revenue and expenditure, inflation, debt, investment, and external balances, into a unified analytical framework. These models enable analysts to conduct “what-if” simulations, test policy assumptions, and evaluate trade-offs between competing fiscal priorities.

Professor Bbaale urged participants to fully utilize the five-day training to strengthen their technical proficiency and contribute meaningfully to Parliament’s oversight function.

Practical Application and Long-Term Impact

The training programme emphasizes hands-on learning, allowing participants to work directly with the Integrated Macroeconomic Model. Through practical exercises, PBO staff will learn how to:

- Simulate alternative fiscal and macroeconomic scenarios.

- Assess revenue and expenditure implications of policy proposals.

- Evaluate public debt sustainability and fiscal risks.

- Examine distributional impacts on poverty, inequality, and household welfare.

- Develop evidence-based policy briefs for Members of Parliament.

Dr. Babyenda reiterated that the value of the training lies in its practical application.

“The ultimate measure of success will be how effectively participants apply these tools to real parliamentary analysis,” he said. “It is through this application that Parliament can maintain rigorous oversight over public finances.”

A Strategic Investment in Institutional Capacity

By institutionalizing the use of Integrated Macroeconomic Modelling within the Parliamentary Budget Office, Uganda is making a strategic investment in sustainable institutional capacity. The initiative ensures that parliamentary analysts are trained using the same analytical frameworks applied in national fiscal planning, thereby reinforcing both technical quality and independence in budget scrutiny.

As Uganda navigates evolving economic challenges, the strengthened capacity of the PBO will enable Parliament to critically evaluate budget proposals, anticipate policy outcomes, and provide informed, transparent, and accountable oversight of public resources.

The five-day Integrated Macroeconomic Modelling training thus represents a pivotal milestone in advancing Uganda’s commitment to sound fiscal management, democratic governance, and evidence-based policymaking.

Business & Management

Climate variability found to shape malaria trends in Yumbe District

Published

1 week agoon

February 20, 2026

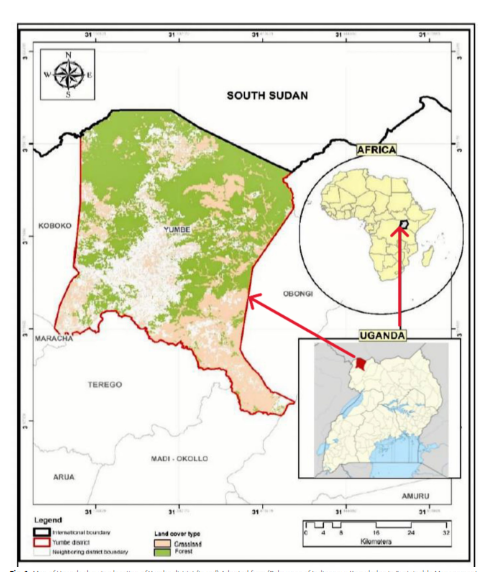

A new study led by scientists from Makerere University School of Public Health has demonstrated that short-term climate variability plays a significant role in malaria transmission in Yumbe District, West Nile sub-region of Uganda. The study, Climate variability and malaria incidence trends in Yumbe District, West Nile Sub-region of Uganda (2017–2021), by Lesley Rose Ninsiima, Rogers Musiitwa, Zaitune Nanyunja, James Muleme, Chris Maasaba, Twahiri Anule, and David Musoke, was published in February 2026 in Malaria Journal through Springer Nature Link.

Today, malaria remains a major public health burden in Uganda, where environmental conditions support sustained transmission. Despite persistent outbreaks in northern Uganda, limited local evidence exists on how the changing climate patterns influence malaria trends. This study addressed that gap by examining five years of malaria surveillance data alongside district-level rainfall and temperature records.

Using routine health facility reports from the District Health Information System (DHIS) and climate data from the Uganda National Meteorological Authority (UNMA), the researchers applied time-series analysis to assess seasonal patterns and delayed climate effects on malaria incidence. Between 2017 and 2021, Yumbe District recorded 2,066,711 malaria cases, with transmission showing clear seasonal peaks between May and July and September and November, aligning with rainy periods.

Their analysis showed that rainfall was the strongest climatic driver of malaria transmission. Increased rainfall was associated with higher malaria cases approximately one month later, reflecting the time needed for mosquito breeding and transmission cycles. In contrast, higher minimum temperatures were linked to reduced malaria incidence, while maximum temperature showed no significant effect. Together, rainfall and minimum temperature explained a substantial proportion of variation in malaria cases, highlighting malaria’s sensitivity to short-term climate fluctuations.

The study findings underscore the value of integrating climate information into malaria surveillance and early warning systems to anticipate transmission peaks and guide timely interventions. Strengthening collaboration between public health and meteorological sectors, the researchers argue, could improve preparedness and support climate-informed malaria control strategies in high-burden settings.

Further details: https://link.springer.com/article/10.1186/s12936-026-05824-0

Trending

-

Humanities & Social Sciences5 days ago

Humanities & Social Sciences5 days agoMeet Najjuka Whitney, The Girl Who Missed Law and Found Her Voice

-

Health1 week ago

Health1 week agoUganda has until 2030 to end Open Defecation as Ntaro’s PhD Examines Kabale’s Progress

-

General4 days ago

General4 days ago76th Graduation Highlights

-

Agriculture & Environment1 week ago

Agriculture & Environment1 week agoUganda Martyrs Namugongo Students Turn Organic Waste into Soap in an Innovative School Project on Sustainable Waste Management

-

General1 week ago

General1 week agoMastercard Foundation Scholars embrace and honour their rich cultural diversity