General

MURBS Trustees Declare 12.34% Interest for FY 2022/2023

Published

2 years agoon

The Makerere University Retirements Benefits Scheme (MURBS) on 26th October 2023 declared an interest of 12.34% on members’ balances for the financial ended 30th June 2023. The declaration was made at the MURBS 13th Annual General Meeting (AGM) held on Thursday 26th October 2023 in the Yusuf Lule Central Teaching Facility Auditorium. The MURBS Fund value grew from UGX 299billion at the start of Financial Year 2022/2023 to UGX 352billion as at 30th June 2023. This growth resulted in a net return of UGX 42billion, which was distributed to members as interest.

The declaration was preceded by a presentation of the MURBS Performance for Financial Year 2022/2023 to members of the University Council and Management at a meeting held on Tuesday 24th October 2023 at the Telepresence Centre, Senate Building, Makerere University. The presentation was attended by the Chairperson of Council, Mrs. Lorna Magara represented by the Chairperson Finance, Planning, Administration and Investment Committee (FPAIC) of Council, Mr. Bruce Balaba Kabaasa, the Vice Chancellor, Prof. Barnabas Nawangwe represented by the University Secretary, Mr. Yusuf Kiranda, Acting Deputy Vice Chancellor (Finance and Administration), Prof. Winston Tumps Ireeeta, Director Quality Assurance, Dr. Cyprian Misinde, Acting Director Human Resources, Mr. Deus Tayari Mujuni and Acting Dean of Students, Mr. Peter Rivan Muhereza. The CEO Uganda Retirements Benefits Authority (URBRA), Mr. Martin A. Nsubuga was represented by his Head of Supervision, Mr. Lubega Rodgers.

During the Year, the Trustees operationalised the Trust Deed and Scheme Rules (TDSR) as amended on 30th May 2023. Overall, the amendments facilitated governance, policy, and operational changes and enhancements, further streamlining and strengthening the Scheme. Effective with the new TDSR, the Board composition changed from five (5) to seven (7) Trustees. As at 30 June 2023, the Board was composed of six (6) Trustees, pending appointment of the independent Trustee.

Changes in the Board of Trustees

During the year, the Board discharged one member and appointed three members. The changes involved the retirement of Mr. Wilber Grace Naigambi who completed his term on 31 March 2023 and he was replaced by Dr. Elizabeth Patricia Nansubuga as MUASA’s representative. In a special way, the Trustees recognise and appreciate the contribution of Mr. Wilber Grace Naigambi, who served on the Board of Trustees from 2016 to 2023. In addition, Dr. Deus Kamunyu Muhwezi and Mr. George Bamugemereire, who are Council representatives, joined the Board in May and June 2023 respectively.

Presentation of FY 2022/2023 Performance

Presenting the 2022/2023 performance on behalf of the Chairperson, Dr. Elizabeth Patricia Nansubuga, the Secretary Board of Trustees, Dr. Godwin Kakuba announced that on June 2021, MURBS became the first mandatory Employer-based Scheme in Uganda. Furthermore, he shared that the aforementioned TDSR amendment of 30th May 2023 that changed the Board of Trustees’ size from five to seven also introduced the “Midterm” access by members to 12% of their accrued benefits, provided they are at least 45 years old and have saved with the Scheme for at least ten years .

The Chairperson’s presentation nevertheless cautioned that whereas members were entitled to Midterm access of their funds, it had long-term effects on fund value and return on investment of their cummulative retirement benefits. For example, due to Midterm access in 2022/2023, sixteen Members’ savings shifted from the UGX 200-250million to the UGX 150-200million range, while five members shifted from the UGX 50-100million to the below UGX 50million range.

The shifts due to Midterm access notwithstanding, one members’ savings moved from the UGX 400-450million to the UGX 450-500million range, while three members joined the UGX 400-450million range. The largest number of members; 1,640 out of a total of 3,041 active accounts (53.9%) fall in the category of savings below UGX 50million, a slight improvement from 54.8% last year.

“In a period of five years the Scheme has moved from no one holding benefits above UGX 250million to having 270 members holding benefits above UGX 250million with five of them being above UGX 400million as of 30th June 2023… The Scheme strives to move more members from the lower bands to the upper bands by ensuring timely collection and prudent investment of their contributions” remarked Dr. Kakuba on behalf of the Chairperson.

Dr. Kakuba concluded the Chairperson’s presentation by thanking the University Council and Management for their cooperation and timely remittance of all members’ contributions to the fund. “We thank all the stakeholders who have worked with MURBS to ensure a successful Financial Year, in a special way, we thank you the sponsor for making time for this occasion.”

Responses to Chairperson’s presentation

Responding to the presentation, Mr. Bruce Balaba Kabaasa appreciated the Board for successfully sustaining the Scheme’s operations for the last thirteen years. He nevertheless urged the Trustees to consider a long and detailed strategic plan to serve as the blueprint for the Scheme Funds’ management and investment, so as to safeguard member benefits from challenges that may arise as the value appreciates.

“I am particularly happy that those of you who have been at the forefront of agitating for staff welfare are now very close to the management of MURBS”, he added in reference to Dr. Deus Kamunyu, former Makerere University Academic Staff Association (MUASA) Chairperson.

Mr. Kabaasa nevertheless took difference with the MURBS opinion that Midterm access to funds before retirement should be discouraged. He noted that from the sustainable development perspective, “you don’t compromise today because you are planning for the future.

“My view therefore, is that man or woman should be given an opportunity closer to retirement to start putting one leg into the waters to test how deep they are in order to be able to put in both legs later, well knowing the depth of the river or lake” he remarked. This he justified by noting that it is better for one to lose 12% of their retirement benefits to poorly researched investment now, than lose 100% at retirement when they have no chance for reprieve.

On this note, Chairperson FPAIC urged MURBS to step up its member education programmes on what works or doesn’t work for various investment vehicles they are likely to engage in. “You should be involved in making sure that our people have the required skill, the required mindset and the required understanding of the opportunities available within our economies and beyond.”

Delivering the Vice Chancellor’s remarks, Mr. Kiranda noted “the story of MURBS is simply one of the many good stories that will continue to stream out of Makerere year after year.” He added that “The Chairperson’s presentation of MURBS’ good performance for the year 2022/2023 is very much appreciated by the University Management for it encourages the employees of Makerere University to remain focused on their core mandate, confident that their retirement benefits are secure.”

He lauded the MURBS Board of Trustees for upholding professionalism and integrity, noting that the University Management has not received complaints concerning retirement benefits from any former employee of Makerere University over the last five years. The Vice Chancellor equally acknowledged the tremendous contribution by the Government of Uganda to a thriving sector by paying salaries on time, contributing to retirement benefits and creating an enabling environment for Schemes and their service providers to invest member funds.

On the subject of Midterm access, Mr. Kiranda re-echoed the Chairperson Council’s call to invest more in training members on how best to invest their retirement benefits. “Chairperson (of MURBS Board of Trustees), Management committed to work with you to do further sensitization and that commitment is still open.”

On behalf of the CEO URBRA, Mr. Lubega commended the MURBS Board for always addressing matters raised by the regulator during onsite inspections. He noted that the retirement benefits sector growth over the last ten years has not been by coincidence, but rather due to strengthened supervision. According to the URBRA website, Uganda currently has UGX 20.56trillion worth of assets under management in the retirement benefits sector.

“I am happy to communicate that Makerere University Retirement Benefits Scheme is one of those schemes that have really implemented these regulations of retirement benefits… the controls put in place by this Scheme can actually show you that they are moving in the right direction so thank you so much Board” commended Mr. Lubega.

Delivering the closing remarks at the presentation, Mr. Bamugemereire thanked all members and service providers for attending the event, reminding all present that planning for retirement starts the day one is employed. As a Trustee, he appreciated the lengths that URBRA goes through to ensure that Trustees are well trained and equipped to perform their duties. “I want to inspire you with confidence that the Scheme is in safe hands.”

You may like

-

Support Staff Trained to Promote Safety of Students and Stakeholders

-

Call For Applications: MakNCD Masters and PhD Training Opportunities

-

Holistic Retirement Planning includes Psychological, Emotional & Social well-being across all Career Stages

-

From Knowledge to Impact: Empowering Youth Leaders and Young Women with Transformative Leadership Skills

-

Department of Tourism Hosts Prof. Sofia Asonitou

-

How transformative education is shaping Africa’s next generation of innovators

Students with disabilities at Makerere University have been requested to stop seeking for special attention and instead look for solutions and opportunities for personal growth.

This was during a mental wellness, inclusion and safeguarding session organized by the Dean of Students office and the Mastercard Foundation Scholars Program at Makerere University.

Addressing students on mental health and disability inclusion, Mr. Marvin Ggaliwango, a lecturer at the College of Computing and Information Sciences (CoCIS), noted that if the students stop complaining, they will become empowered to take charge of their own development, build resilience and engage confidently in both academic and social environments.

“Turn your lived experiences into tools for innovation. Stop complaining and start creating solutions for yourselves. You are the one living this life, and that gives you the authority to be an expert. When you develop a solution, it doesn’t just benefit you, it helps others too, by removing barriers,” Mr. Marvin Ggaliwango, said.

He encouraged students to see themselves not as victims of circumstance, but as active participants and co-creators of the inclusive environment they wish to experience.

“Learn how to communicate effectively and humbly. If you have a problem, express yourself clearly. Do not isolate yourself or feel resentful. You are not defined by disability, you may face disadvantages, but you still have ability,” he encouraged.

Throughout the session, students listened attentively as he emphasized the importance of self-awareness and personal responsibility, urging them to understand their strengths, acknowledge their limitations and take deliberate steps toward personal growth while contributing positively to the University community.

“We must enhance and ensure that our mental health is number one. Always choose yourself first. Choose what makes you happy and protect your peace. If you are at peace with yourself, your academics will improve. There is a strong link between mental wellness and academic success,” Mr. Ggaliwango, noted.

In his speech, Mr. Musa Mwambu, the Disability Inclusion Advisor at Light for the World Uganda, called upon the students with disabilities to enhance and ensure that their mental health is prioritized.

“As students living with disabilities, sometimes you over expect, because you have a disability you should be given, listened to and when people do not listen to you, you attribute it to your disability, get it from me, even those without disabilities are not listened too. Things are not happening to you because of your disability it is because of the world we live in. Everything that happens to you can happen to others,” Mr Mwambu, noted.

“Have fun with your life. Make yourself happy and be smart. Present yourself in public confidently wherever you go. The way you carry yourself can improve your mental health and how others perceive you,” Mr. Mwambu said.

He reminded the students that gaining admission to Makerere is itself a milestone.

“There are many people without disabilities who have never stepped at Makerere University. Find something that empowers you and hold on to it. You may have a physical impairment, but if you are brilliant in class, you can lead discussions and inspire others,” he added.

During the session, Dr. Rodney Rugyema, the Acting Principal Warden, welcomed the students back from the long holiday. He assured them that the University is committed to their safety and well-being while on campus.

Dr. Rugyema emphasized that the University has systems in place to protect students, both physically and psychologically and encouraged them to report any concerns promptly.

“When you are at the University, you are not on your own, we are always here for you. For us to engage you on mental wellness and inclusion, we want you to be in the right state of mind, whole and complete,” Dr Rugyema, said.

He added: “We are here to empower you and we are calling upon you not be a risk for yourself and always be able to detect risks that are likely to affect your mental health and works towards avoiding them and reporting them to ensure that the University manages them before they escalate into real harm whose impact is more serious than you can think,”

During the session, Ms. Diane Nabikolo Osiru highlighted the University’s broader commitment to safeguarding.

Safeguarding at Makerere University refers to measures put in place to promote safety and wellness of all students, staffs and other stakeholders.

“At Makerere University, safety is not a luxury for few. but it is a right for every student. As the semesters begins, we are urging you to learn how to identify signs of harm or abuses and report them to the appropriate safeguarding contact points,” Ms Nabikolo, said.

For support in case of any harm or abuse, International and Refugee Students, can access support through the Advancement and International Office, while Students with Disabilities, can utilize the Disability Support Center. Those with personal and emotional challenges, can visit the Counselling and Guidance Centre.

In his speech, Dr Joab Agaba, a Lecturer in the College of Computing and Information Sciences, guided students how to report risks and incidences to the MakSafeSpace, the e-reporting platform complimenting the other University traditional reporting channels.

Mr. Henry Nsubuga, the Manager of the Counselling and Guidance Center, shared practical strategies for coping with stress effectively including time management, setting realistic goals, seeking support from peers or counsellors.

Students speak out

Shanitah Nahamya, 2nd year student of the Bachelor of Adult and Community Education

“I have learned how to respectfully and appropriately engage with students with disabilities. In the past, I often felt pity when I encountered them, but now I understand that what they need is not pity, it is respect, support, and equal opportunity.”

Guo Dorothy Geri, 1st year student of the Bachelor of Commerce

“I have learnt how to use inclusive language. Before offering help to a student with a disability, I will first ask them, because not all the time do they need our help. You might think someone wants to be helped to cross the road, yet they are waiting for someone.”

Valentines Doris Aduka, 1st Year student of the Bachelor of Biomedical Science

“I have been calling students with disabilities special names, thinking it was kind. But I have learned that they do not want to be treated differently or labeled in a special way. What they value most is being treated like everyone else, with respect, dignity, and fairness.”

General

Strengthening Global Partnerships to Advance Research, Innovation, and Graduate Training: Makerere University Hosts Delegation from the University of Warwick

Published

4 days agoon

February 19, 2026

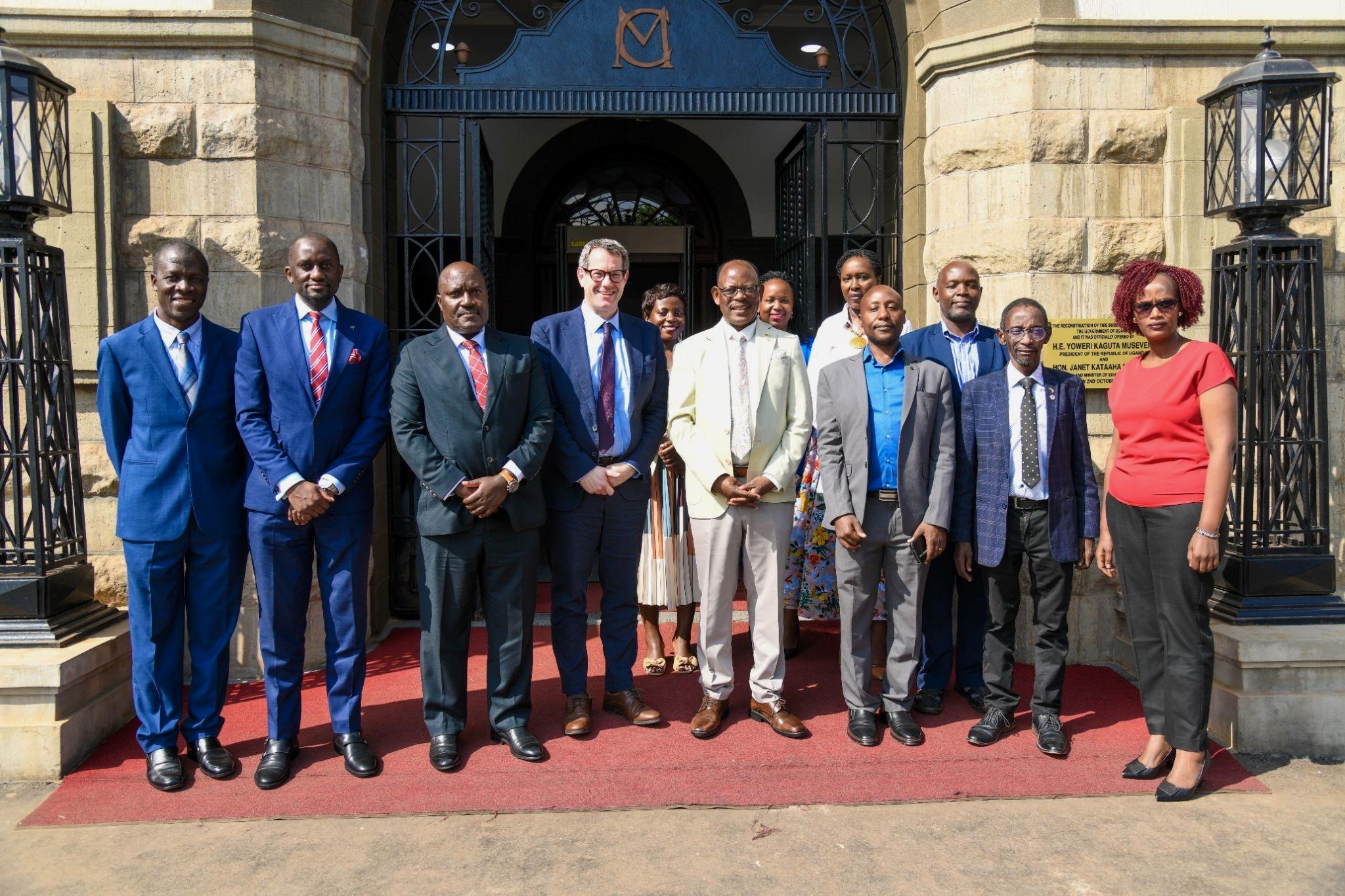

Makerere University continues to deepen its global engagement agenda through strategic partnerships that enhance research, innovation, and graduate training. On Friday, 13th February, 2025, during a recent engagement with a delegation from the University of Warwick (UK), university leaders, researchers, and administrators explored potential collaborations to address pressing development challenges and strengthen institutional capacity.

Expanding Collaboration in Research and Innovation

Welcoming the delegation, Prof. Fred Masagazi-Masaazi, Chairperson of the Makerere University Research and Innovations Fund (Mak-RIF) Grants Management Committee, emphasized the growing dialogue between Makerere University and the University of Warwick. He noted that ongoing discussions are focused on resource mobilization to support research and innovation, as well as building sustainable academic exchanges for both staff and students.

Dr. Roy Mayega, Mak-RIF Coordinator, together with Mrs. Phoebe Lutaaya Kamya, Deputy Coordinator, and members of the Mak-RIF team, highlighted the Fund’s role in catalyzing collaborative research and strengthening partnerships that translate research into societal impact.

Mr. Simon Kizito, Deputy University Secretary, outlined key areas identified for collaboration, including joint research and innovation initiatives, benchmarking visits across disciplines such as law, science, and ICT, and student exchanges designed to strengthen applied research skills. He also pointed to opportunities for training Makerere staff in specialized areas such as tropical diseases and innovation ecosystems, drawing lessons from Warwick’s strong linkages with industry partners located within its campus.

Makerere’s Strategic Priorities and Global Role

In his remarks, the Vice Chancellor underscored the longstanding relationship between Makerere University and the University of Warwick, dating back to the early 1980s, initially through staff training and more recently through collaborative research.

He highlighted Makerere’s historic contribution to leadership development across Africa and beyond, and the University’s continued growth following faculty rebuilding efforts in the 1980s, which have strengthened its research capacity. Today, Makerere has over 1,300 academic staff, more than 1,000 of whom hold PhDs, positioning the institution to play a leading role in knowledge production.

The Vice Chancellor also outlined major thematic areas where partnerships are critical:

- Climate change and food security: Researchers at the College of Agricultural and Environmental Sciences (CAES) are developing drought-resistant and high-yield seed varieties to address changing weather patterns and food insecurity.

- Public health and infectious diseases: Uganda faces frequent outbreaks of diseases such as Ebola and Marburg, and Makerere has built strong capacity in outbreak response and tropical medicine. The University’s medical school and the Infectious Diseases Institute (IDI) continue to play a pivotal role in research and treatment.

- Peace and conflict studies: Through initiatives such as the Rotary Peace Centre, Makerere contributes to training global leaders in conflict resolution.

- Climate-sensitive macroeconomic modelling: Makerere recently hosted a conference in collaboration with the Ministry of Finance, Planning and Economic Development to advocate for climate-responsive macroeconomic modelling and to plan for the establishment of a Centre of Excellence in this field.

- Innovation and technology: The University’s innovation ecosystem has produced notable outputs, including Africa’s first electric vehicle and ongoing work to expand incubation facilities to enable students to graduate with viable enterprises.

The Vice Chancellor emphasized that addressing youth unemployment remains a central priority, noting that innovation, entrepreneurship, and graduate training are essential to building stable societies.

He further stressed the importance of expanding graduate education. Africa currently produces a small proportion of global research output, and increasing PhD and Master’s training supported by international partnerships remains critical to accelerating knowledge production and development outcomes.

Internationalization and Shared Learning

Speaking on behalf of the University of Warwick, Professor Daniel Branch, Deputy Vice Chancellor, reflected on Warwick’s own institutional journey, noting that its growth has been driven by a strong focus on internationalization, innovation, and research. He expressed Warwick’s commitment to building productive partnerships with African universities, including Makerere, to advance joint research, training, and innovation.

Professor Branch also highlighted the importance of university-industry linkages, citing examples such as collaborations with major manufacturing firms that provide practical training opportunities and inform curriculum development.

Showcasing Research and Innovation at CEDAT

A second session of the engagement was held at the College of Engineering, Design, Art and Technology (CEDAT), where academic leaders and researchers presented ongoing work across multiple disciplines.

Presentations included:

- Development of a solar water pump through reverse engineering (Dr. Edmund Tumusiime)

- Crane Cloud, a locally developed cloud-computing platform (team from the College of Computing and Information Sciences)

- Profiling gaseous emissions associated with burnt bricks (Dr. Nathan)

- Integration of centralized grid and decentralized renewable off-grid systems: a techno-economic analysis (Dr. Abubaker Waswa)

- Innovation and digitalization pathways for affordable housing in Sub-Saharan Africa (Prof. Stephen Mukiibi)

The session was attended by CEDAT leadership, including the Principal, Prof. Moses Musinguzi, as well as deans and heads of department from engineering, built environment, and industrial and fine arts. The day’s activities were concluded with a tour of Makerere University’s Innovation Hub.

The engagement reaffirmed Makerere University’s commitment to building strong, mutually beneficial partnerships that accelerate research, strengthen graduate training, and drive innovation. As global challenges such as climate change, public health threats, and youth unemployment intensify, collaboration among universities remains essential to developing scalable, evidence-based solutions.

Through partnerships such as the one Makerere University and the University of Warwick hope to activate through a Memorandum of Understanding in the near future, Makerere continues to position itself as a leading research-intensive university dedicated to transforming society through knowledge, innovation, and global cooperation.

Caroline Kainomugisha is the Communications Officer, Advancement Office, Makerere University.

General

Mastercard Foundation Scholars embrace and honour their rich cultural diversity

Published

5 days agoon

February 18, 2026

On the evening of Friday, 13th February 2026, the Scholars of Mastercard Foundation embraced the new semester with enthusiasm and celebration, showcasing their rich cultural diversity at the annual cultural dinner. This event not only fostered a sense of community but also highlighted the importance of cultural exchange and understanding among the scholars. The purpose of the cultural dinner is to foster unity in diversity within the Scholars community and to enable young people to appreciate and respect each other’s cultural differences.

The Mastercard Foundation Scholars community at Makerere University is a vibrant tapestry of countries, cultures, and backgrounds. In recognition of this richness, the Program team has proposed organising an annual cultural dinner to kick off each new semester. This event aims to achieve several important objectives:

- Promote mutual understanding and cross-cultural appreciation among Scholars.

- Celebrate and highlight the unique cultural identities within our community.

- Encourage confidence and creativity through a dynamic talent showcase.

- Foster a sense of unity and excitement as we embark on the new academic semester together.

During the event, the Scholars proudly showcased their diverse cultures through a vibrant display of traditional attire, engaging dances, delectable dishes, and meaningful expressions in their native languages. The event showcased a rich tapestry of cultures, including the Baganda from Central Uganda; the Banyankore, Bakiga, Batooro, and Banyoro from Western Uganda; the Acholi from the North; the Karamojong from the Northeast; and the Basoga and Bagisu from the Eastern region, among many other indigenous tribes in Uganda. Additionally, attendees enjoyed cultural performances from South Sudan, Rwanda, and the Democratic Republic of Congo, celebrating the unique heritage of each community.

The event also featured a vibrant showcase of cultural attire, accompanied by traditional songs and dances. Attendees enjoyed cultural dress modelling, engaging performances, art displays, and interactive quizzes, culminating in exciting prizes awarded to outstanding performers. This diverse array of activities contributed to a rich celebration of creativity and cultural exchange.

The Mastercard Foundation Scholars Program at Makerere University is committed to fostering holistic development, community building, and leadership among Scholars. At the start of each semester, the Program Team hosts a cultural dinner to reconnect the Scholars community, share key Program updates, and create an inclusive space to strengthen belonging and engagement. The cultural dinner is a critical platform for raising awareness of the need to appreciate and respect cultural diversity.

Bernard Buteera is the Principal Communications Officer for the Mastercard Foundation Scholars Program at Makerere University.

More Photos from the Dinner

Trending

-

General2 weeks ago

General2 weeks agoAptitude Exam (Paper 1) Results for the Mature Age Entry Scheme 2026/2027

-

Health4 days ago

Health4 days agoUganda has until 2030 to end Open Defecation as Ntaro’s PhD Examines Kabale’s Progress

-

Health2 weeks ago

Health2 weeks agoHow Jimmy Osuret Turned Childhood Trauma into Evidence for Safer School Crossings

-

General2 weeks ago

General2 weeks agoFor Youth by Youth – Call for Second Cohort Applications

-

General5 days ago

General5 days agoMastercard Foundation Scholars embrace and honour their rich cultural diversity