Business & Management

School of Business Staff undertake Capacity Building

Published

4 years agoon

In a bid to keep abreast with the changing trends in the business sector, staff of the School of Business, College of Business and Management Sciences (CoBAMS), led by the Dean Dr. Akileng Godfrey on November 3, 2021 spent the day interacting with players in the private sector. The staff undertook the capacity building as part of their continuous professional development.

The staff heard from Mr. Kakande Robert, the MD of Finca Uganda who shared an analysis of the performance of the financial sector in Uganda. The participants learnt that despite the Covid–19 pandemic, the banks saw an increase in cash deposits by 20% and a decline in the loan portfolios by 14%. This was attributed to the decline in trade, owing to the travel restrictions. This was also compounded by the fact that Ugandans are generally a risk averse population. Many people, about 49%, borrow from informal lenders such as friends, family and investment groups. It was noted that only 11% of the population keep their money in banks. About 43% keep money in saving groups, 27% keep it at home while 23% keep it on mobile phones.

This, Mr. Kakande said calls for a national financial inclusion strategy. Some of the emerging and contemporary issues in the financial sector include digitization. The world is growing exponentially, which calls for new ways of doing things. The development of the internet, artificial Intelligence, Internet of things has forced banks to digitize all their services. This Mr. Kakande said, has helped improve customer experiences and reduce the number of people transacting in the banking hall. Today, Uganda has 28 million mobile phone users, 12.1 million internet users and 3.6 million social media users. This means the financial sector also has got to evolve and meet the demands of these customers. This has seen the development of online banking, bank to phone transactions, which have greatly improved the financial sector.

The participants learnt that Bank of Uganda, had issued new regulations for commercial banks, in an effort to secure depositors money. This, Mr. Kakande called the BASEI 11 Capital Accord Framework. Commercial banks are now required to have operating capital of Shs150 billion up from Shs25 billion, while tier 4 institutions such microfinance institutions are required to have capital of Shs5billion up from Shs500 million. BOU has also set out to regulate the Mobile Money business which is being run by the telecommunication companies.

Another emerging issue is Bancassurance. This is a relationship between a bank and an insurance company that is aimed at offering insurance products or insurance benefits to the bank’s customers. In this partnership, bank staff and tellers become the point of sale and point of contact for the customer. Agency banking is another contemporary trend that the financial institutions have adopted. This has also been done in an effort to extend the bank to the clients.

On the issue of high interest rates charged by the banks, Mr. Kakande said, this is because the credit risk among the population is high. The emergence of Infrastructure bonds is something the financial sector players also have to look at in the future.

The staff also got an opportunity to interact with Mrs. Immaculate Ngulumi, the Marketing Manager of Centenary Bank. She shared how the service industry has been able to attract and retain clients. Mrs. Ngulumi said that because service is not a tangible product, the service providers have to appeal to the emotions of people. This, she said calls for investment in 3 Ps (People, processes and physical evidence). The people/staff, she said, have to be well trained, motivated and treated well, so that they can pass on this positivity to the clients. The processes have to be quick and seamless while the ambiance must be good. She shared with the team, the 4 aspects of managing services

- Managing customer relationships

- Managing service quality

- Managing service productivity

- Managing staff and positioning services

Mrs. Ngulumi concluded by saying that in the service industry, the customer does not buy a product, they buy the experience, so give them the best experience.

Other topics discussed included the International Financial Reporting Standards and the role of the private sector in public sector procurement.

The Dean School of Business, Dr. Godfrey Akileng thanked the participants for attending and the facilitators for making time to share with his team.

Betty Kyakuwa is the Principal Communication Officer, CoBAMS

You may like

-

82% Stressed: Uncovering the Hidden Mental Health Burden Among Kampala’s Taxi Drivers

-

Makerere University and International Partners Sign MoU for the 9th Kampala Geopolitics Conference

-

Farmers’ Preferences Drive Success in Tree-Planting, Duke Scholar Finds

-

Makerere University Students Triumph in National Conservation Competition

-

Mak Cooperative Society holds AGM: Growth, Transparency and Member Welfare Take Centre Stage

-

From Campus to Community: Universities Lead Teso in Fight Against Greenhouse Gas Emissions

Business & Management

Farmers’ Preferences Drive Success in Tree-Planting, Duke Scholar Finds

Published

1 day agoon

March 12, 2026By

Jane Anyango

Study Finds Farmers Prefer Boundary Tree Planting, Challenging Conventional Afforestation Programs

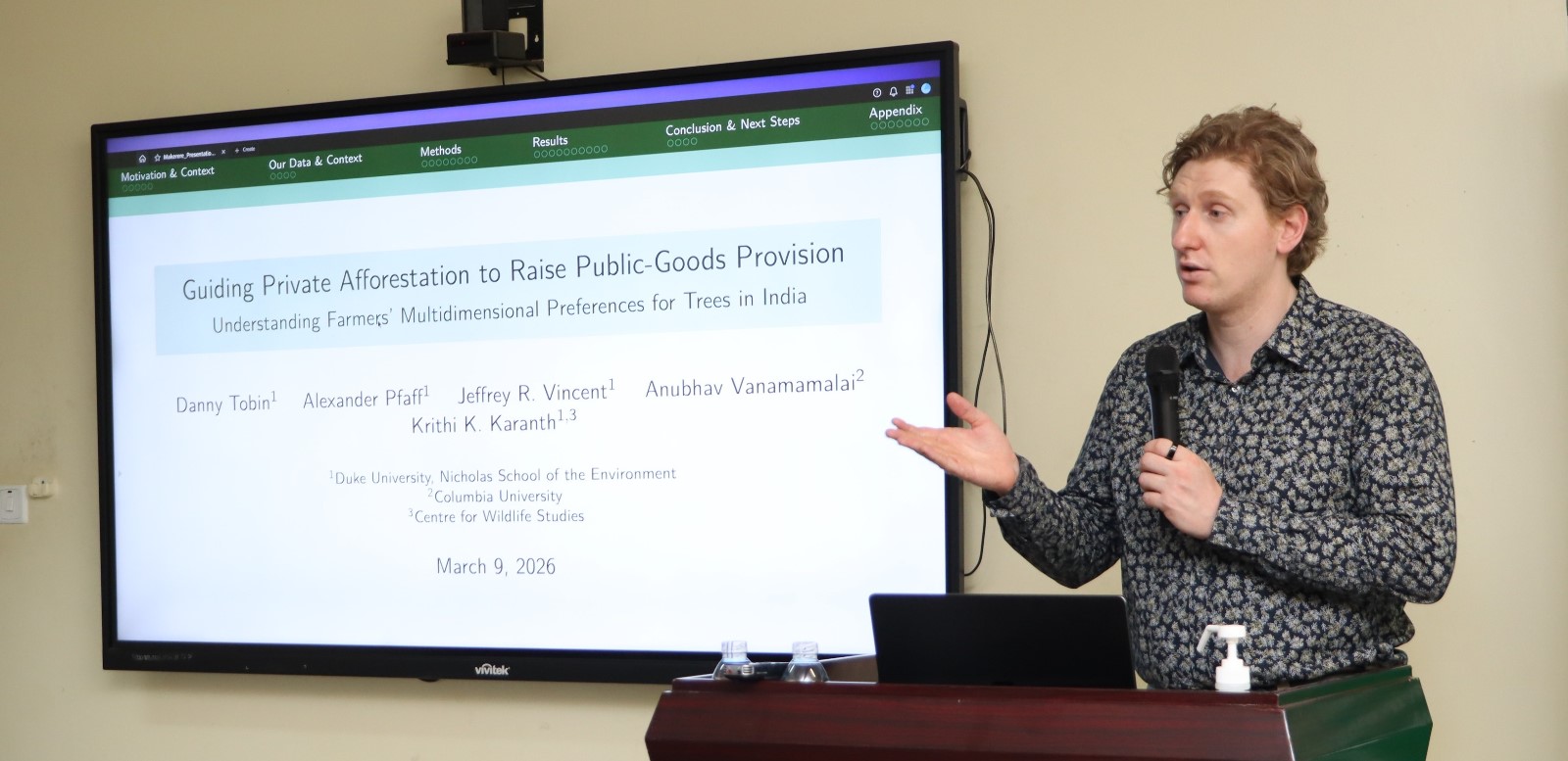

UK-based Duke University Postdoctoral Scholar Dr. Danny Tobin has highlighted the crucial role of farmers’ preferences in shaping successful tree-planting programs. Speaking at Makerere University’s Environment for Development (EfD) Centre, Tobin presented findings from a study on smallholder farmers in southern India, exploring why they choose certain tree species and planting systems within an NGO-led afforestation program.

The study titled, “Guiding Private Afforestation to raise public-Goods Provision : Exploring Farmers preferences for trees within an NGO Tree planting program in Southern India” was presented to a research seminar at Makerere University on March 9, 2026.

Dr. Tobin presented what drives communities to take up different kinds of tree species, and even the planting system that they use, either planting on the boundary, intercropping, or cluster planting these different trees, either forest trees, timber trees, or the fruit and medicinal plants.

The study revealed that smallholder farmers strongly prefer planting trees along farm boundaries rather than within their crop fields, a finding that could significantly reshape the design of afforestation and agroforestry programs aimed at addressing climate change and biodiversity loss. The research examined how farmers make decisions about tree planting on private agricultural land and found that preferences vary widely depending on farmers’ economic conditions, farming practices, and environmental challenges. The study emphasizes that tree-planting initiatives must be carefully designed to align with farmers’ priorities if they are to deliver both environmental and livelihood benefits.

The research focused on smallholder farmers living within five kilometers of two protected areas in the southern Indian state of Karnataka. Using a structured survey method known as a discrete choice experiment, the study collected responses from 400 farmers who were presented with different tree-planting options, including timber, fruit, mixed species, and medicinal trees arranged in various planting patterns such as farm boundaries, intercropping within fields, or clustered plots. The results showed a clear preference for planting timber trees along farm boundaries, which farmers viewed as the least disruptive to crop production and farm management.

According to the study findings, most farmers were willing to adopt boundary planting even without financial incentives. In contrast, options that required planting trees within crop fields such as fruit intercropping or clustered mixed-species plantations generally required compensation to encourage adoption. Programs that aimed to create dense clusters of mixed trees to support biodiversity would require the highest level of incentives, as these arrangements compete directly with agricultural land use.

The study also identified several factors that influence farmers’ willingness to plant trees. Farmers with better resources such as higher income levels, irrigation systems, and higher education were generally more willing to adopt tree planting. Conversely, farmers with smaller land holdings, lower incomes, and harsher environmental conditions were less likely to adopt tree planting options. These results highlight how economic capacity and farm productivity shape decisions about integrating trees into agricultural landscapes.

Another important finding relates to human-wildlife conflict, a major challenge for farmers living near protected areas. The study found that farmers experiencing frequent wildlife damage were significantly less interested in planting fruit trees along their farm boundaries because fruit trees could attract animals such as elephants and wild boar. Instead, these farmers preferred timber trees, which they believed might help shield crops from wildlife intrusion.

Despite the overall preference for boundary planting, the research also revealed a surprising opportunity for biodiversity-focused interventions. About one-third of the farmers surveyed indicated that they would be willing to plant fruit trees inside their fields through intercropping or orchard-style arrangements without requiring compensation. This group represents a key target for programs seeking to increase tree cover and habitat connectivity in agricultural landscapes.

Based on these findings, the study recommends that afforestation programs avoid rigid, one-size-fits-all approaches. Instead of targeting farmers based on observable characteristics such as age, income, or land size which the study found to be unreliable predictors of preferences the research suggests offering farmers a menu of tree-planting options. This flexible approach would allow farmers to choose arrangements that best fit their land, resources, and risk tolerance while still contributing to environmental goals.

The study concludes that successful tree-planting programs must balance environmental objectives with farmers’ economic realities. By incorporating farmers’ preferences into program design and offering flexible participation options, policymakers and environmental organizations can increase adoption rates, improve tree survival, and enhance the long-term benefits of afforestation initiatives for both rural livelihoods and the environment.

In his welcome remarks the Director EfD Makerere Centre, Prof. Edward Bbaale, underscored the importance of aligning environmental programs with farmers’ needs if afforestation initiatives are to succeed.

Prof. Bbaale said the EfD committed to rigorous research at the intersection of environment, natural resources, and economic development. He noted that the centre regularly organizes research seminars to create a platform for scholars, policymakers, and practitioners to exchange ideas, present ongoing research, and engage in constructive academic dialogue on pressing development challenges.

Welcoming Dr. Tobin to the seminar, Bbaale highlighted the longstanding collaboration between the EfD Mak Centre and Jeffrey Vincent, Professor of Forest Economics and Management at the Nicholas School of the Environment at Duke University. He explained that the partnership has produced important research on forestry, land use, and rural livelihoods over the past several years.

He pointed to a recent joint study conducted under the leadership of Patrick Byakagaba, a Senior Research Fellow at the EfD MakCentre, which examines the livelihood impacts of forest plantations on state-owned land. The research, titled Differential Livelihood Impacts of Eucalyptus and Pine Plantations on State-Owned Land, has been accepted for publication in the Journal of Forest Economics, marking what Prof. Bbaale described as the culmination of more than four years of collaborative work involving data collection and analysis.

According to Bbaale, the seminar by Dr. Tobin builds on this strong partnership and reflects the growing collaboration between Makerere researchers and international scholars. He said the study being presented was co-authored with Prof. Vincent and addresses an issue of growing global and regional importance—how tree-planting programs can be designed to meet both environmental goals and the livelihood needs of farmers.

“The topic is highly relevant, not only to the global agenda on climate change mitigation and landscape restoration, but also to policy discussions taking place in Africa and Uganda in particular,” Prof. Bbaale said. He explained that as countries expand afforestation and reforestation initiatives, it is essential to understand farmers’ incentives, preferences, and livelihood realities to ensure that such programs achieve their intended ecological and social outcomes.

He noted that research like Dr. Tobin’s provides valuable insights into how private land-use decisions can be guided to generate both private benefits for farmers and broader public goods such as carbon sequestration, biodiversity conservation, and improved ecosystem services.

Prof. Bbaale also emphasized that the seminar reflects Makerere University’s growing focus on internationalization and research partnerships as the institution strengthens its position as a research-led university. He said collaborations with global institutions such as Duke University are critical for advancing knowledge, producing impactful research, and addressing complex environmental and development challenges.

He welcomed Dr. Tobin’s visit to Uganda as an important opportunity for knowledge exchange and engagement with students and researchers at the university. Prof. Bbaale concluded by expressing appreciation for the continued collaboration with Duke University scholars and said the centre looked forward to further joint research initiatives in the future.

Call for Stronger Research–Private Sector Linkages in Environmental Conservation

The Deputy Director of the EfD Mak Centre, Dr. Alice Turinawe, emphasized the need for stronger collaboration between researchers, the private sector, and other stakeholders to ensure that environmental conservation research translates into practical solutions.

Speaking during the closing session, Dr. Turinawe thanked participants for their active engagement and highlighted the importance of sharing research widely so that it can be improved through feedback and dialogue. She noted that meaningful environmental solutions emerge when research findings are openly discussed and refined by diverse stakeholders.

Dr. Turinawe also commended the seminar presentation by visiting researcher Dr. Tobin, which explored conservation approaches and partnerships with farmers. She said the presentation underscored the importance of examining both private and public benefits in environmental interventions. According to her, such partnerships are essential for ensuring that conservation initiatives are both economically viable and socially beneficial.

She stressed that the EfD Mak Centre places strong emphasis on research that bridges the gap between academic work and real-world application. “One of our key goals is to ensure that the research conducted in our offices and in the field is connected to the private sector and other stakeholders who can implement the findings,” she said.

Dr. Turinawe further encouraged researchers to ensure that their findings are disseminated widely through platforms that can influence policy, development programs, and community practices. She noted that the impact of research depends largely on how effectively the results are shared and utilized.

She concluded by appreciating the scholars and participants who attended the seminar despite their busy academic schedules, noting that their engagement keeps the centre’s research community vibrant and productive.

The EfD Mak Centre, based at Makerere University, focuses on generating evidence to support environmental and natural resource policy decisions. The centre brings together academia, policymakers, and practitioners to strengthen the use of economic evidence in addressing environmental challenges.

Practical and Policy-Relevant Insights Appreciated

Overall, participants noted that the seminar provided both practical and policy-relevant insights into understanding farmers’ preferences, improving tree-planting programs,and supporting sustainable environmental and economic outcomes.

EfD-Mak Centre Manager Gyaviira Ssewankambo said the study offered valuable insights into what motivates farmers to adopt different tree species such as forest trees, timber varieties, and medicinal plants. He explained that the research also addressed challenges faced by farmers, including the risks posed by wildlife. In some cases, farmers living near game parks avoid planting fruit trees for fear that animals such as elephants could destroy their crops. According to Ssewankambo, these experiences mirror situations in communities near protected areas in Uganda, suggesting that lessons from India could help shape local strategies for promoting afforestation.

“Dr. Danny Tobin presented a very insightful study from India about forestry—what drives communities to take up different tree species, and the planting systems they use, whether on boundaries, intercropping, or cluster planting. We hope our Ugandan community can learn lessons, especially on issues like wildlife affecting fruit tree planting near game parks.”

He added that the study also examined the economic trade-offs farmers face when allocating land to trees rather than crops. While tree planting offers environmental and long-term economic benefits, farmers must weigh these gains against the immediate need for space to grow food crops. Ssewankambo expressed optimism that once the research is fully completed, it could provide important lessons for Uganda, just as EfD previously drew inspiration from forestry experiences in Nepal.

For Joab Wamani, an assistant lecturer at the School of Economics, the seminar was particularly valuable for its methodological insights. He noted that beyond the presentation’s clear communication, the research design and conceptualisation stood out. Wamani said the way the study framed its research questions and selected methods offered important learning points for researchers seeking to conduct rigorous environmental economics studies.

“His slides were clear and inspiring, but what really interested me was the research design—the way he conceptualised the topic, developed his research questions, and chose his methods. That was the main knowledge I took away.”

Students who attended the seminar also reflected on practical lessons for farming and environmental management. Nyeko Francis, a Master’s student in Economic and Investment Modelling, said the discussion encouraged him to view tree planting as a routine agricultural activity rather than something done only for environmental protection.

“I learned that tree planting can be normalised like any other crop activity. For example, planting mangoes or oranges in a designated area can be planned and managed like a crop garden. Tree planting is more than just protecting boundaries—it can be integrated into regular farming for better yield.”

Similarly, doctoral student Mansur Sewali, a development economist specialising in economic policy and planning, said the seminar highlighted the broader benefits of afforestation. While tree planting brings direct returns to farmers, he noted that the environmental benefits extend to society as a whole, illustrating the connection between private investment and public good.

“Despite tree planting benefiting the individual farmer, these benefits can also pass on to society at large. That was the key point I took from the seminar.”

EfD research fellow Aisha Nanyiti emphasised the importance of incentives in promoting tree planting. She explained that countries like Uganda, where forests are rapidly being depleted, can benefit from policies that encourage farmers to adopt sustainable practices. Nanyiti said the study showed that many farmers prefer planting trees along farm boundaries, though some also favour intercropping trees with other crops. She added that continuous training and community sensitisation are essential to ensure both the adoption and survival of trees.

“Farmers in India appreciated planting trees along boundaries and in intercropping systems. The key takeaway is that incentivising farmers is essential for adoption, but ongoing training and community sensitisation are equally important to ensure tree survival and environmental restoration.”

Another student, Nichirange Edida, said the seminar reinforced the importance of tree planting in addressing climate change and environmental conservation. He noted that boundary planting and intercropping allow farmers to maintain crop production while also protecting the environment. Inspired by the discussion, Edida said he hopes to apply these practices in his own farming activities.

“This seminar taught me how farmers can address climate change through planting trees, especially on boundaries and through intercropping. It conserves the environment while allowing farmers to grow fruit and timber trees. I believe I can apply this in my own farming.”

Jane Anyango is the Communication Officer, EfD-Mak Centre

Business & Management

Public Lecture on Research Collaboration across borders presents enormous opportunities to researchers, faculty and students

Published

1 week agoon

March 3, 2026

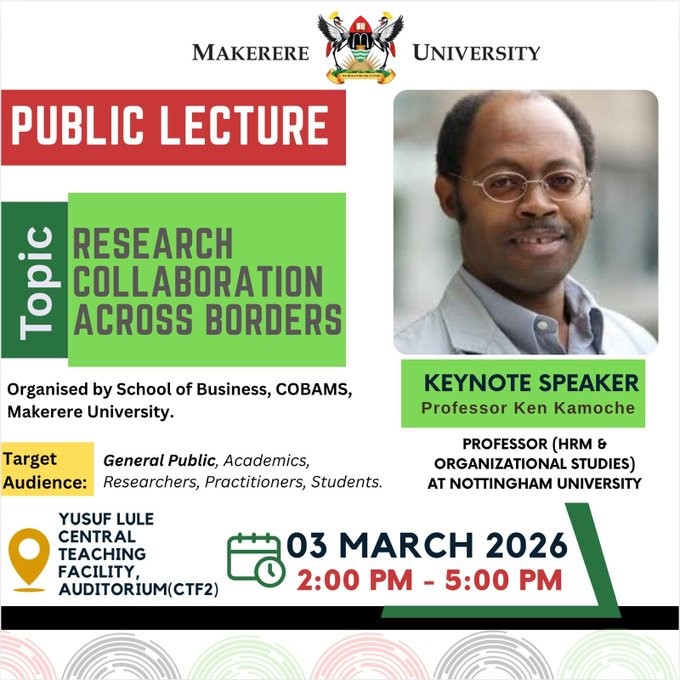

Delivering the public lecture, titled: Research Collaboration across borders, Prof. Ken Kamoche from Nottingham University, urged researchers at Makerere University, to undertake research that will strengthen and empower Africa, including fields that are ignored.

“My research has focused on those pertinent issues and fields that are always ignored. I call upon you to re-consider undertaking research in the fields of knowledge management, innovations, indigenous knowledge, identity, artificial intelligence (AI) and Africa at large,” said Prof. Kamoche.

Acknowledging that he had undertaken tremendous research and publication in human resource management and organizational studies, Prof. Kamoche testified that he took a paradigm shift to focus on the values that underpin the organizational behaviour.

Held at Makerere University Yusuf Lule Central Teaching Facility Auditorium on 3rd March 2026, the public lecture attracted faculty from Makerere University, Kyambogo University, Uganda Christian University, administrators, researchers, and students. Before heading to the public lecture, Prof. Kamoche held a discipline-specific meeting with academic staff at the School of Business under the College of Business and Management Sciences (CoBAMS) at Makerere University.

The Africa Research Group: Fostering Global Scholarly Engagement and Capacity Building

Prof. Kamoche highlighted the establishment of the Africa Research Group to address the gap in engagement between scholars in Africa and their counterparts in Europe, Asia, and North America.

Established in 2012, the Africa Research Group at Nottingham University Business School provides a platform to spur knowledge transfer across disciplines and continents.

“I am here to inspire you to do research. If you are looking for a platform, I invite you to utilize the Africa Research Group. We have been able to give researchers from Africa a voice. We welcome research students at all levels,” Prof. Kamoche said.

He pointed out that the Africa Research Group provides mentorship to postgraduate and early-career researchers, supports doctoral supervision, joint publications, and funding applications. Prof. Kamoche encouraged students and faculty members to participate in future activities and pursue collaborative research opportunities.

What inspires Prof. Kamoche?

Responding to a question from the students who admired his commitment to research, publication, authorship, Prof. Kamoche said: “The desire to make a difference and share knowledge with others, and make an impact.”

Research collaboration

During the public lecture, Dr. Christopher Muganga, Dr. Seperia Wanyama, and Dr. Anthony Tibaingana from the School of Business, and Dr. John Mushomi from the School of Statistics and Planning, emphasized the importance of research and collaboration in the transformation of countries and societies in general. The members of faculty stressed the importance of knowledge sharing and exchange of ideas, authorship and publication, mentorship, joint research undertakings and networking.

Global academic collaboration

Dr. Seperia Wanyama highlighted the significance of the public lecture in creating opportunities for collaboration, knowledge exchange, and the collective advancement of academic and societal understanding.

“The event serves as a platform for fostering diversity in academia, bringing together researchers, students, and administrators to engage in shared learning,” he said.

He applauded Prof. Ken Kamoche for his distinguished contributions global academic collaboration and research. He credited Prof. Kamoche for his willingness to share valuable insights on research collaboration across borders. He urged participants to remain active and engaged throughout the session.

Talent Management and Cross-Continental Collaboration

Prof. Kamoche commended Makerere University for hosting him, reflecting on the golden opportunity to engage with students, faculty, and researchers. He shared insights from his extensive academic journey, research contributions, and initiatives to strengthen collaboration across Africa, Asia, and the West.

Reflecting on talent management and organizational leadership, Prof. Kamoche noted that he has maintained a strong focus on leveraging his international experiences to foster cross-continental academic collaborations and address challenges relevant to both African and global contexts.

Focusing on talent management, Prof. Kamoche shared insights from his extensive research, explaining how organizations often take an “exclusive” approach, concentrating resources on a small group of high-performing individuals seen as the main drivers of value. He also highlighted a different perspective: the “inclusive” approach, which recognizes that every employee has unique skills that can contribute to the organization’s success.

Using recent research in Kenya’s banking sector, published in the South African Journal of Human Resource Management, Prof. Kamoche illustrated how talent management connects closely with innovation, employee engagement, and confidence. His findings indicated that while high performers are essential, sustainable success comes from balancing focus on star performers with developing the wider workforce.

Prof. Kamoche reflected on earlier studies conducted in Hong Kong, which examined the experiences of employees identified as “high potential.” He noted that being labeled talented can be a double-edged sword, creating pressure, high expectations, and sometimes causing employees to rethink their career priorities over time.

Comparative Insights on Asian Management and Strategic African Partnerships

Prof. Kamoche shared insights from his comparative research on Asian management practices, tracing his academic interest in Asia back to his graduate studies at Oxford. There, he examined Japanese management systems at a time when Japan’s economic model was admired worldwide. Through interviews with senior human resource executives in major Japanese corporations, he sought to understand the foundations of their organizational success.

Prof. Kamoche observed that while African countries are familiar with Western business systems, their understanding of Asian management philosophies remains limited. His research highlighted key differences in operational practices, particularly in areas such as time management and efficiency.

“Some Chinese infrastructure projects run continuously, reflecting a highly results-driven approach,” he noted. He acknowledged challenges raised by local employees regarding cultural differences, labor practices, and the need for more equitable engagement.

Prof. Kamoche emphasized that Chinese investment in Africa is far from uniform, encompassing state-owned enterprises, private firms, and long-term individual entrepreneurs. “African countries must strategically leverage these partnerships to maximize both economic and social benefits while protecting local interests,” he argued.

Dr. Anthony Tibaingana commends Prof. Kamoche’s Scholarly Impact

The Acting Dean of the School of Business, Dr. Anthony Tibaingana, lauded Prof. Kamoche for delivering an insightful lecture at Makerere University, describing the presentation as an exceptional exposition of knowledge and scholarship.

Dr. Tibaingana highlighted the significance of Prof. Kamoche’s return to Africa, describing it as a meaningful reconnection with his roots and a contribution to the continent’s intellectual growth.

The Acting Dean commended the depth of the presentation, particularly its insights into human resource management, leadership, and talent development. He emphasized that Africa, with its youthful population, presents both opportunity and responsibility for scholars to generate research-based solutions to the continent’s challenges.

He underscored the need for academia to address pressing issues such as leadership gaps, institutional weaknesses, and talent retention within universities and organizations.

Dr. Tibaingana encouraged faculty and students to continue engaging through research networks and ongoing conversations facilitated by the Africa Research Group at Nottingham University Business School.

He reaffirmed the university’s commitment to teaching, research, and community outreach, noting that such engagements contribute to long-term academic partnerships and future institutional growth.

Moderated by Dr. Christopher Muganga from the School of Business, the public lecture concluded with the presentation of Makerere University Souvenirs to Prof. Kamoche and networking engagements with students.

Monica Meeme contributed to this story as a Guest Writer

Business & Management

Thirty Public Officers Certified in Integrated Regulatory Cost-Benefit Analysis

Published

1 week agoon

March 3, 2026

Thirty public officers from various Ministries, Departments and Agencies (MDAs) have successfully completed a two-week intensive training in Integrated Regulatory Cost-Benefit Analysis (IRCBA), culminating in the award of certificates at a closing ceremony held on 27th February 2026 at the Pearl on the Nile Hotel in Jinja.

The training was jointly organized by the Public Investment Management Centre of Excellence at Makerere University and the Ministry of Finance, Planning and Economic Development (MoFPED), in collaboration with the Infrastructure and Social Services Department (ISSD) and the National Planning Authority (NPA). It focused on operationalizing the Revised Guidelines for the Issuance of Certificates of Financial Implication (CFIs), which came into effect on 1st July 2025.

A Strategic Reform for Fiscal Credibility

In closing remarks delivered on by Commissioner Paul Patrick Mwanja behalf of the Permanent Secretary/Secretary to the Treasury, participants were commended for undertaking the training during a demanding budget cycle, when many MDAs are simultaneously preparing the FY 2026/27 Budget, executing the FY 2025/26 Budget, and implementing the National Development Plan IV and the Tenfold Growth Strategy.

The PS/ST emphasized that the revised Guidelines mark a significant shift toward a more transparent, data-driven, consultative, and analytically rigorous approach to evaluating policy and legislative proposals. Participants were equipped to assess fiscal implications, evaluate economic and socio-economic impacts, analyze distributional effects, and address uncertainty using structured analytical tools.

They were reminded that training alone is not sufficient, the real test lies in consistent application. As members of the third cohort, they were challenged to serve as reform ambassadors, championing evidence-based policymaking and strengthening analytical standards across government.

Bridging Academia and Public Service

Delivering the official closing remarks, the Director of the PIM Centre of Excellence, Prof. Edward Bbaale, commended participants for their active engagement and unwavering commitment throughout the training.

He described the programme as both timely and strategic, designed to equip officers with practical tools to prepare robust Statements of Financial Implication (SFIs) that support credible issuance of CFIs. He noted that strong financial analysis enhances fiscal discipline, policy coherence, and the overall quality of legislation and public policy in Uganda.

Prof. Bbaale underscored the longstanding partnership between Makerere University and the Ministry of Finance, highlighting how it continues to bridge academia and public service by combining analytical rigor with practical policy experience. He emphasized that the collaborative model — bringing together faculty from the College of Business and Management Sciences and practitioners from Government, reflects the core vision of the PIM Centre of Excellence: strengthening national systems through evidence-based policymaking.

During the two weeks, participants gained hands-on experience in applying cost-benefit analysis across four critical dimensions: budgetary analysis, socio-economic analysis, distributive impacts, and risk assessment. Prof. Bbaale encouraged them to return to their institutions as agents of transformation, improving evaluation frameworks, strengthening regulatory decisions, and ensuring that public interventions deliver value for money and long-term development impact.

He also reaffirmed the Centre’s broader mandate beyond training, noting its recent support to the revision of Development Committee Guidelines, assessment of public investment performance since NDP I, and hosting of the Second Public Investment Management Conference in August 2025.”

Building from “Zero Kilometre”

Earlier, the Manager of the PIM Centre of Excellence highlighted the practical approach adopted during the training. Participants began with blank Excel sheets and built analytical models from scratch, likened to the engineering concept of starting at “zero kilometre,” where construction begins from the very starting point and progresses step by step.

The interactive sessions enabled participants from diverse disciplines, including policy analysts, planners and statisticians, to interrogate assumptions, refine costing approaches, and debate implementation and enforcement frameworks. Their sector-specific insights enriched the learning process and strengthened the analytical models developed.

The Manager noted that excellence is not about knowing everything, but about bringing together the right expertise. Facilitators from MoFPED, NPA, the Office of the President, and Makerere University ensured that theory remained grounded in practical government realities.

Participants Applaud Practical and Engaging Sessions

Speaking on behalf of the cohort, a participant described the training as highly engaging and transformative. The combination of theory and practical application, coupled with patient facilitation, allowed officers from varied professional backgrounds to learn from one another.

The participant highlighted the final day’s discussions as the most impactful, expressing confidence that the knowledge gained would enhance policy analysis and improve the quality of programmes and projects across MDAs.

Certificates Awarded

The ceremony concluded with the award of certificates to all 30 participants in recognition of their successful completion of the IRCBA training. The certification marks another milestone in Government’s effort to build a critical mass of experts capable of institutionalizing rigorous financial and economic analysis in public policy processes.

As the workshop was formally declared closed, participants were encouraged to apply their newly acquired skills consistently, mentor colleagues, and contribute to strengthening fiscal governance across Government.

The PIM Centre of Excellence reaffirmed its commitment to continuous research, policy advisory support, and capacity building as Uganda advances toward more credible, transparent, and sustainable public decision-making.

Trending

-

General1 week ago

General1 week agoCall for Applications: Diploma Holders under Government Sponsorship 2026/2027

-

General1 week ago

General1 week agoAdvert: Admissions for Diploma/Degree Holders under Private Sponsorship 2026/27

-

General1 week ago

General1 week agoExtension of Application Deadline for Diploma/Degree Holders 2026/2027

-

General2 weeks ago

General2 weeks agoMakerere University commemorates 13 transformative years of partnership with Mastercard Foundation

-

General2 weeks ago

General2 weeks agoMak News Magazine: February 2026