Business & Management

Address Financial Literacy to Improve Household Income-Study

Published

4 years agoon

Findings by a team of researchers from the College of Business and Management Sciences (CoBAMS) have recommended that the Government through its agencies should partner with private financial institutions to organise financial literacy trainings to teach households on how to access capital, save and invest in productive ventures. The recommendations were made at a research dissemination workshop for the project titled: Evaluation of the effectiveness of financial inclusion on household’s welfare in Uganda: A case study of Busoga region.

While officially opening the hybrid dissemination workshop held on Wednesday 29th September 2020 in the School of Business Conference Room and virtually, the Principal CoBAMS, Dr. Eria Hisali thanked the Government of Uganda for funding the project through the Makerere University Research and Innovations Fund (Mak-RIF). He equally commended the Principal Investigator (PI), Dr. Eric Nzibonera and his team on successfully completing their project and achieving the set objectives.

Dr. Hisali proposed four options to ensure that the findings from the study reach a wider audience.

- Immediately upload the findings on the College’s new working paper series website, which will enable staff to read the document and provide feedback

- Proceed to transform the working paper into a journal article so as to reach audiences from different parts of the world

- Proactively review curricular in preparation for the possibility of gradually using research from Makerere as part of course outlines and teaching materials.

- Take advantage of the College’s planned framework of engaging policy makers formally through policy labs that will be held every quarter.

Presenting the findings from the project, the PI Dr. Nzibonera thanked the Principal for his advice and his research team for their hard work. Other members of the team that sampled 430 heads of households included the Dean School of Business Dr. Godfrey Akileng and Ms. Hellen Nambi.

“Financial Inclusion is a process through which financial services are delivered to the disadvantaged and low-income sections of the society on a timely basis and at affordable costs” defined Dr. Nzibonera, adding that “the relationship between financial inclusion and poverty alleviation has been widely discussed but only few studies explore the effect of financial inclusion on household welfare.”

He therefore shared the twofold objective of the project as; to establish the extent to which the rural households engage in financial inclusion and to examine the nature of household welfare and establish the extent to which financial inclusion enhance households’ welfare. The latter, he noted, would help guide policy recommendations to the Government and private sector.

Dr. Nzibonera noted that financial inclusion is measured through establishing the extent of availability and accessibility to financial services, affordability, usage and quality of financial products. He added that household welfare is improved through access to quality education and health services, improved shelter, food production and consumption as well as access to information.

The findings on availability and accessibility to financial services revealed an interesting pattern. “Whereas households still find it hard to access formal financial services for savings and deposits’ and services provided by bank agents are irregular, they easily access mobile money services for withdrawals and payments” he shared.

In terms of affordability, findings revealed that although the cost of accessing financial institutions and withdrawing funds from mobile money agents is still high, the cost of accessing financial services through bank agents and carrying out financial transactions through financial institutions is affordable.

Investigations into the usage and quality of services showed that households find it easy to use mobile money and village SACCOs to make deposits and payments for school fees. Despite the ease of use, households find it hard to save with banks, microfinance institutions and SACCOs.

“The accounts opened in banks and SACCOs are not frequently used and the services offered by banks or their agents are not regular” added Dr. Nzibonera.

The research team’s findings showed that financial inclusion has partly enhanced the welfare if households in Busoga.

“The study revealed improvement in income levels as a result of accessing loans from financial institutions and SACCOs. The number of school going children has also increased as a result of borrowing opportunities from SACCOs” said the PI.

Dr. Nzibonera added that although it is easy for households to access information about financial services relevant for welfare improvement, “there is limited income to enable households gain access to good healthcare and carry out construction.”

The team therefore made the following policy recommendations;

- Financial and microfinance institutions should employ agents to at least every parish or sub-county to grant households easy access to financial services.

- Government through District commercial officers should encourage households to organise into village savings and credit cooperative organisations (SACCOs) at parish level and identify unique financial products that promote savings and investments for different groups.

- Government agencies such as the Micro Finance Support Centre and Operation Wealth Creation (OWC) should partner with private financial institutions to organise financial literacy trainings for households on how to save as well as identify and invest in productive investment ventures.

- The cost of financing should be reduced to rates that are affordable by households. This will improve household income for both consumption and investment.

- Financial institutions should design financial products that would enable households to access funds for construction as long as there is a clear payment plan and evidence of source of income for loan repayments.

Speaking on behalf of the Mak-RIF Grants Management Committee (GMC) Chairperson Prof. William Bazeyo, Dr. Helen Nambalirwa Nkabala congratulated the research team upon the successful dissemination and thanked Dr. Hisali for proposing policy labs as a means of engaging policy makers.

She urged Dr. Nzibonera as a firsthand witness on the state of financial inclusion to go beyond the policy recommendations and draft a successor project proposal on solutions that can clearly and precisely take financial inclusion at the grassroots level to the next level.

“You are the right people to guide Government on what unique product the community will get and how it will help improve their financial knowledge” she recommended.

Dr. Nkabala thanked the Government for funding research and innovations that inform national development priorities and the University Management for creating an environment conducive to conducting research. In the same breath she thanked the GMC for providing oversight and the GMC Secretariat for ensuring that the projects run smoothly.

“This is a clear example of taking the Ivory Tower to the community” she concluded.

Representing Mr. John Peter Mujuni, Executive Director, Microfinance Support Centre (MSC) and Chief Guest at the dissemination, Mr. Godfrey Mangeni thanked the research team for a job well done, and pledged take the findings and policy recommendations very seriously.

“Please share these findings so that we can work with you in other areas like Bukedi and Karomoja to improve our services” he remarked.

Mr. Mangeni shared that there still remains a lot of work to be done to support Government’s Parish Development Model in the Busoga region despite MSC’s zonal office in Jinja and a satellite office in Iganga and as such, called upon researchers from Makerere to share their expertise.

Delivering the concluding remarks, Dr. Akileng in his dual capacity as Research Team member and Dean noted that Financial Inclusion is an important topical issue for national development and therefore expressed happiness that the Government had found it fitting to fund the project.

“As a nation, we need to reflect reflect on Government interventions aimed at addressing gaps of financial inclusion that financial institutions have not been able to fill” he rallied. This reflection, he said, ought to be guided by the question ‘Where have been the successes in social impact and where have been the failures?’

He noted that although Financial Technology (FINTECH) is the buzzword when it comes to improving service delivery, its success is hinged on how easy it will be for end-users at the grassroots level to adopt the various solutions offered.

“I believe that a highly informed community with the ability to easily access financial services and mobilise savings is key to the improvement of household earnings as well as boost demand and productivity in the country” he added.

In the discussion that preceded the concluding remarks, Mr. John Emoi, the Manager Investments at Uganda Development Bank who joined the conversation virtually had expressed his organisation’s keen interest in the days topic and research findings. Particularly, he had urged the research team to include the development of FINTECH models as a means of disseminating financial services among their policy recommendations.

In conclusion, Dr. Akileng called for affirmative action for business teaching institutions, “Business touches every sector and it is important to appreciate that if we must make money in any sector, we must understand business.”

You may like

-

Makerere University Launches Short Course to Strengthen Climate Change Reporting

-

Makerere University and World Bank Sign Partnership to Strengthen Environmental and Social Sustainability Capacity

-

Makerere University Explores Expanded Partnership with Stanbic Bank to Advance Innovation and Investment

-

Call for Applications: Diploma Holders under Government Sponsorship 2026/2027

-

Makerere Explores Strategic Industry Partnership with Psalms Food Industries to Strengthen Manufacturing Innovation

-

Makerere University Researchers Awarded UCIF Grant to Tackle Maize Contamination with Innovative Plant-Based Fungicide

Business & Management

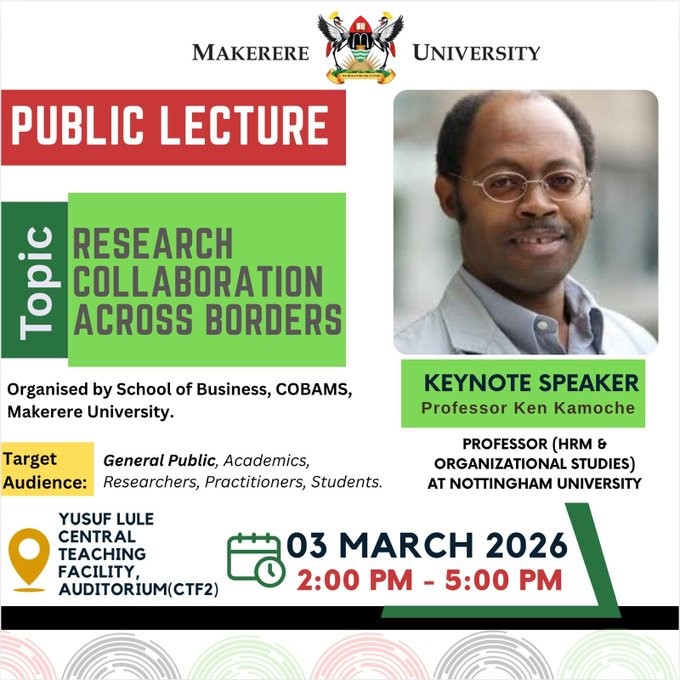

Public Lecture on Research Collaboration across borders presents enormous opportunities to researchers, faculty and students

Published

6 days agoon

March 3, 2026

Delivering the public lecture, titled: Research Collaboration across borders, Prof. Ken Kamoche from Nottingham University, urged researchers at Makerere University, to undertake research that will strengthen and empower Africa, including fields that are ignored.

“My research has focused on those pertinent issues and fields that are always ignored. I call upon you to re-consider undertaking research in the fields of knowledge management, innovations, indigenous knowledge, identity, artificial intelligence (AI) and Africa at large,” said Prof. Kamoche.

Acknowledging that he had undertaken tremendous research and publication in human resource management and organizational studies, Prof. Kamoche testified that he took a paradigm shift to focus on the values that underpin the organizational behaviour.

Held at Makerere University Yusuf Lule Central Teaching Facility Auditorium on 3rd March 2026, the public lecture attracted faculty from Makerere University, Kyambogo University, Uganda Christian University, administrators, researchers, and students. Before heading to the public lecture, Prof. Kamoche held a discipline-specific meeting with academic staff at the School of Business under the College of Business and Management Sciences (CoBAMS) at Makerere University.

The Africa Research Group: Fostering Global Scholarly Engagement and Capacity Building

Prof. Kamoche highlighted the establishment of the Africa Research Group to address the gap in engagement between scholars in Africa and their counterparts in Europe, Asia, and North America.

Established in 2012, the Africa Research Group at Nottingham University Business School provides a platform to spur knowledge transfer across disciplines and continents.

“I am here to inspire you to do research. If you are looking for a platform, I invite you to utilize the Africa Research Group. We have been able to give researchers from Africa a voice. We welcome research students at all levels,” Prof. Kamoche said.

He pointed out that the Africa Research Group provides mentorship to postgraduate and early-career researchers, supports doctoral supervision, joint publications, and funding applications. Prof. Kamoche encouraged students and faculty members to participate in future activities and pursue collaborative research opportunities.

What inspires Prof. Kamoche?

Responding to a question from the students who admired his commitment to research, publication, authorship, Prof. Kamoche said: “The desire to make a difference and share knowledge with others, and make an impact.”

Research collaboration

During the public lecture, Dr. Christopher Muganga, Dr. Seperia Wanyama, and Dr. Anthony Tibaingana from the School of Business, and Dr. John Mushomi from the School of Statistics and Planning, emphasized the importance of research and collaboration in the transformation of countries and societies in general. The members of faculty stressed the importance of knowledge sharing and exchange of ideas, authorship and publication, mentorship, joint research undertakings and networking.

Global academic collaboration

Dr. Seperia Wanyama highlighted the significance of the public lecture in creating opportunities for collaboration, knowledge exchange, and the collective advancement of academic and societal understanding.

“The event serves as a platform for fostering diversity in academia, bringing together researchers, students, and administrators to engage in shared learning,” he said.

He applauded Prof. Ken Kamoche for his distinguished contributions global academic collaboration and research. He credited Prof. Kamoche for his willingness to share valuable insights on research collaboration across borders. He urged participants to remain active and engaged throughout the session.

Talent Management and Cross-Continental Collaboration

Prof. Kamoche commended Makerere University for hosting him, reflecting on the golden opportunity to engage with students, faculty, and researchers. He shared insights from his extensive academic journey, research contributions, and initiatives to strengthen collaboration across Africa, Asia, and the West.

Reflecting on talent management and organizational leadership, Prof. Kamoche noted that he has maintained a strong focus on leveraging his international experiences to foster cross-continental academic collaborations and address challenges relevant to both African and global contexts.

Focusing on talent management, Prof. Kamoche shared insights from his extensive research, explaining how organizations often take an “exclusive” approach, concentrating resources on a small group of high-performing individuals seen as the main drivers of value. He also highlighted a different perspective: the “inclusive” approach, which recognizes that every employee has unique skills that can contribute to the organization’s success.

Using recent research in Kenya’s banking sector, published in the South African Journal of Human Resource Management, Prof. Kamoche illustrated how talent management connects closely with innovation, employee engagement, and confidence. His findings indicated that while high performers are essential, sustainable success comes from balancing focus on star performers with developing the wider workforce.

Prof. Kamoche reflected on earlier studies conducted in Hong Kong, which examined the experiences of employees identified as “high potential.” He noted that being labeled talented can be a double-edged sword, creating pressure, high expectations, and sometimes causing employees to rethink their career priorities over time.

Comparative Insights on Asian Management and Strategic African Partnerships

Prof. Kamoche shared insights from his comparative research on Asian management practices, tracing his academic interest in Asia back to his graduate studies at Oxford. There, he examined Japanese management systems at a time when Japan’s economic model was admired worldwide. Through interviews with senior human resource executives in major Japanese corporations, he sought to understand the foundations of their organizational success.

Prof. Kamoche observed that while African countries are familiar with Western business systems, their understanding of Asian management philosophies remains limited. His research highlighted key differences in operational practices, particularly in areas such as time management and efficiency.

“Some Chinese infrastructure projects run continuously, reflecting a highly results-driven approach,” he noted. He acknowledged challenges raised by local employees regarding cultural differences, labor practices, and the need for more equitable engagement.

Prof. Kamoche emphasized that Chinese investment in Africa is far from uniform, encompassing state-owned enterprises, private firms, and long-term individual entrepreneurs. “African countries must strategically leverage these partnerships to maximize both economic and social benefits while protecting local interests,” he argued.

Dr. Anthony Tibaingana commends Prof. Kamoche’s Scholarly Impact

The Acting Dean of the School of Business, Dr. Anthony Tibaingana, lauded Prof. Kamoche for delivering an insightful lecture at Makerere University, describing the presentation as an exceptional exposition of knowledge and scholarship.

Dr. Tibaingana highlighted the significance of Prof. Kamoche’s return to Africa, describing it as a meaningful reconnection with his roots and a contribution to the continent’s intellectual growth.

The Acting Dean commended the depth of the presentation, particularly its insights into human resource management, leadership, and talent development. He emphasized that Africa, with its youthful population, presents both opportunity and responsibility for scholars to generate research-based solutions to the continent’s challenges.

He underscored the need for academia to address pressing issues such as leadership gaps, institutional weaknesses, and talent retention within universities and organizations.

Dr. Tibaingana encouraged faculty and students to continue engaging through research networks and ongoing conversations facilitated by the Africa Research Group at Nottingham University Business School.

He reaffirmed the university’s commitment to teaching, research, and community outreach, noting that such engagements contribute to long-term academic partnerships and future institutional growth.

Moderated by Dr. Christopher Muganga from the School of Business, the public lecture concluded with the presentation of Makerere University Souvenirs to Prof. Kamoche and networking engagements with students.

Monica Meeme contributed to this story as a Guest Writer

Business & Management

Thirty Public Officers Certified in Integrated Regulatory Cost-Benefit Analysis

Published

6 days agoon

March 3, 2026

Thirty public officers from various Ministries, Departments and Agencies (MDAs) have successfully completed a two-week intensive training in Integrated Regulatory Cost-Benefit Analysis (IRCBA), culminating in the award of certificates at a closing ceremony held on 27th February 2026 at the Pearl on the Nile Hotel in Jinja.

The training was jointly organized by the Public Investment Management Centre of Excellence at Makerere University and the Ministry of Finance, Planning and Economic Development (MoFPED), in collaboration with the Infrastructure and Social Services Department (ISSD) and the National Planning Authority (NPA). It focused on operationalizing the Revised Guidelines for the Issuance of Certificates of Financial Implication (CFIs), which came into effect on 1st July 2025.

A Strategic Reform for Fiscal Credibility

In closing remarks delivered on by Commissioner Paul Patrick Mwanja behalf of the Permanent Secretary/Secretary to the Treasury, participants were commended for undertaking the training during a demanding budget cycle, when many MDAs are simultaneously preparing the FY 2026/27 Budget, executing the FY 2025/26 Budget, and implementing the National Development Plan IV and the Tenfold Growth Strategy.

The PS/ST emphasized that the revised Guidelines mark a significant shift toward a more transparent, data-driven, consultative, and analytically rigorous approach to evaluating policy and legislative proposals. Participants were equipped to assess fiscal implications, evaluate economic and socio-economic impacts, analyze distributional effects, and address uncertainty using structured analytical tools.

They were reminded that training alone is not sufficient, the real test lies in consistent application. As members of the third cohort, they were challenged to serve as reform ambassadors, championing evidence-based policymaking and strengthening analytical standards across government.

Bridging Academia and Public Service

Delivering the official closing remarks, the Director of the PIM Centre of Excellence, Prof. Edward Bbaale, commended participants for their active engagement and unwavering commitment throughout the training.

He described the programme as both timely and strategic, designed to equip officers with practical tools to prepare robust Statements of Financial Implication (SFIs) that support credible issuance of CFIs. He noted that strong financial analysis enhances fiscal discipline, policy coherence, and the overall quality of legislation and public policy in Uganda.

Prof. Bbaale underscored the longstanding partnership between Makerere University and the Ministry of Finance, highlighting how it continues to bridge academia and public service by combining analytical rigor with practical policy experience. He emphasized that the collaborative model — bringing together faculty from the College of Business and Management Sciences and practitioners from Government, reflects the core vision of the PIM Centre of Excellence: strengthening national systems through evidence-based policymaking.

During the two weeks, participants gained hands-on experience in applying cost-benefit analysis across four critical dimensions: budgetary analysis, socio-economic analysis, distributive impacts, and risk assessment. Prof. Bbaale encouraged them to return to their institutions as agents of transformation, improving evaluation frameworks, strengthening regulatory decisions, and ensuring that public interventions deliver value for money and long-term development impact.

He also reaffirmed the Centre’s broader mandate beyond training, noting its recent support to the revision of Development Committee Guidelines, assessment of public investment performance since NDP I, and hosting of the Second Public Investment Management Conference in August 2025.”

Building from “Zero Kilometre”

Earlier, the Manager of the PIM Centre of Excellence highlighted the practical approach adopted during the training. Participants began with blank Excel sheets and built analytical models from scratch, likened to the engineering concept of starting at “zero kilometre,” where construction begins from the very starting point and progresses step by step.

The interactive sessions enabled participants from diverse disciplines, including policy analysts, planners and statisticians, to interrogate assumptions, refine costing approaches, and debate implementation and enforcement frameworks. Their sector-specific insights enriched the learning process and strengthened the analytical models developed.

The Manager noted that excellence is not about knowing everything, but about bringing together the right expertise. Facilitators from MoFPED, NPA, the Office of the President, and Makerere University ensured that theory remained grounded in practical government realities.

Participants Applaud Practical and Engaging Sessions

Speaking on behalf of the cohort, a participant described the training as highly engaging and transformative. The combination of theory and practical application, coupled with patient facilitation, allowed officers from varied professional backgrounds to learn from one another.

The participant highlighted the final day’s discussions as the most impactful, expressing confidence that the knowledge gained would enhance policy analysis and improve the quality of programmes and projects across MDAs.

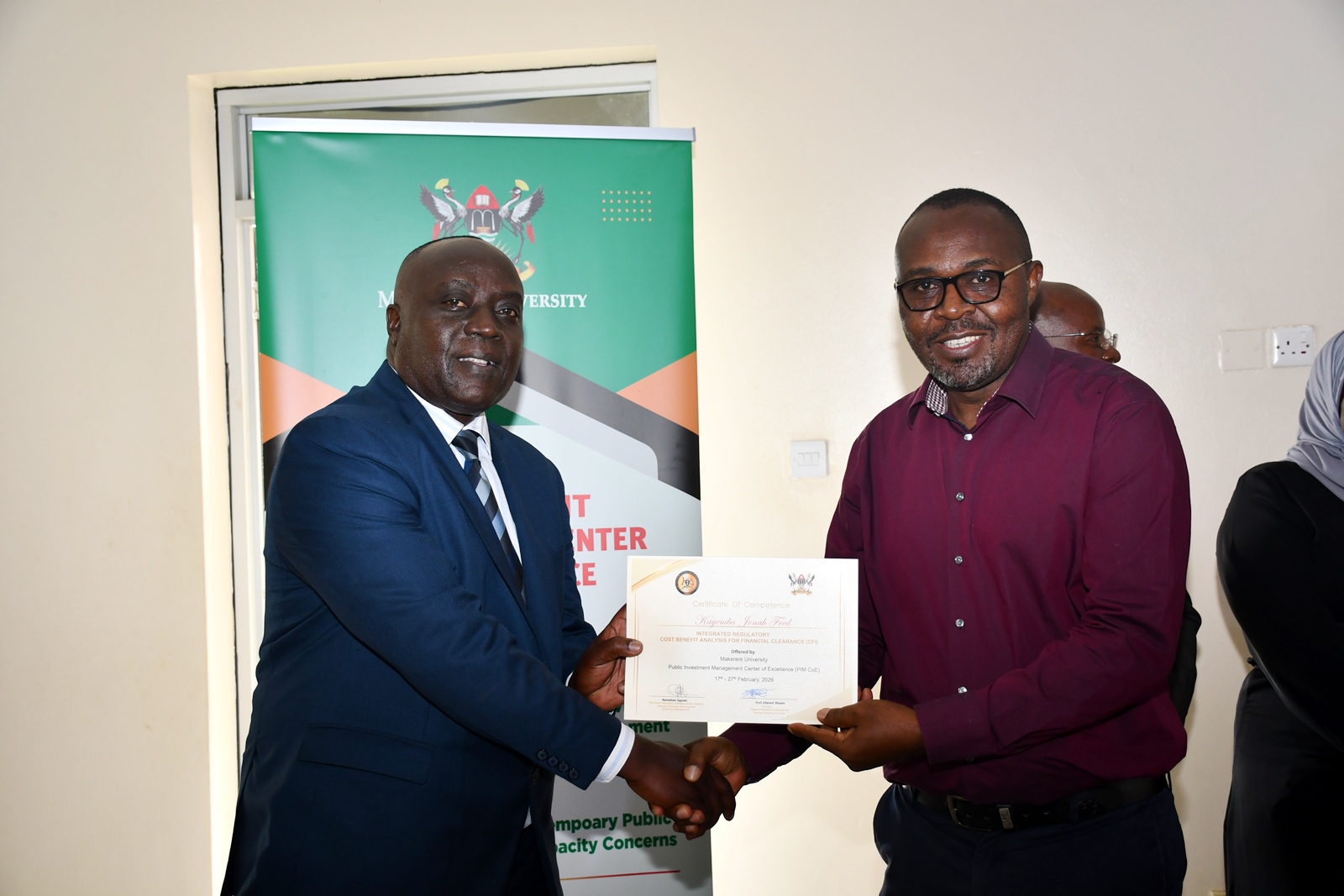

Certificates Awarded

The ceremony concluded with the award of certificates to all 30 participants in recognition of their successful completion of the IRCBA training. The certification marks another milestone in Government’s effort to build a critical mass of experts capable of institutionalizing rigorous financial and economic analysis in public policy processes.

As the workshop was formally declared closed, participants were encouraged to apply their newly acquired skills consistently, mentor colleagues, and contribute to strengthening fiscal governance across Government.

The PIM Centre of Excellence reaffirmed its commitment to continuous research, policy advisory support, and capacity building as Uganda advances toward more credible, transparent, and sustainable public decision-making.

Business & Management

Botswana Delegation Visits Makerere’s Public Investment Management Centre to Study Sustainable Training Model

Published

6 days agoon

March 3, 2026

Kampala, Uganda – 25 February 2026

A delegation from Botswana’s public investments sector on 25th February 2026 visited Makerere University’s Public Investment Management Centre of Excellence to benchmark its sustainable training model and draw lessons from Uganda’s well-established Public Investment Management (PIM) framework.

The team, composed of specialists in public investments, is exploring ways to strengthen capacity within Botswana’s public sector institutions. The delegation underscored the importance of structured and sustainable capacity-building programmes, noting that effective public investment management is central to driving national development and ensuring value for money in public projects.

During the engagement, the Botswana team sought to understand the Centre’s operational model, including how it designs and delivers training programmes that remain impactful over time. Particular interest was placed on the Centre’s approach to sustainable training delivery, the documentation of challenges and successes, and mechanisms used to ensure that public officers acquire long-term, practical skills that translate into improved project planning, appraisal, and implementation.

The visiting delegation commended Uganda’s commitment to institutionalizing PIM training and emphasized that cross-country learning is vital for strengthening public financial management systems across Africa. They observed that Uganda’s experience offers practical insights into building a resilient and responsive PIM framework anchored in continuous professional development.

As part of their recommendations, the delegation proposed the introduction of a hybrid training model to enhance accessibility for international participants. Under this approach, the theoretical components of PIM courses would be delivered online, allowing participants to engage remotely from Botswana and other countries. This would then be followed by in-person sessions in Uganda focused on hands-on, experiential learning at the Centre.

According to the delegation, such a model would significantly reduce travel costs and time while preserving the value of face-to-face practical training. The hybrid approach would also provide flexibility for busy public officers, enabling them to balance professional responsibilities with structured learning.

The visit further strengthened regional collaboration and reaffirmed the role of Uganda’s Public Investment Management Centre of Excellence as a hub for capacity development in public investment management across the continent.

Trending

-

General4 days ago

General4 days agoCall for Applications: Diploma Holders under Government Sponsorship 2026/2027

-

General4 days ago

General4 days agoAdvert: Admissions for Diploma/Degree Holders under Private Sponsorship 2026/27

-

General2 weeks ago

General2 weeks ago76th Graduation Highlights

-

Agriculture & Environment2 weeks ago

Agriculture & Environment2 weeks agoCAES Presents Overall Best Performing Student in the Sciences & a Record 28 PhDs at the 76th Graduation Ceremony

-

General4 days ago

General4 days agoExtension of Application Deadline for Diploma/Degree Holders 2026/2027