Business & Management

Mak-RIF Plugs Tax Education Gaps in Uganda’s Informal Sector

Published

5 years agoon

According to statistics from the Uganda Revenue Authority (URA) Annual Data Book 2018/19, at 12.44%, Uganda’s average tax to GDP ratio over the last five years is one of the lowest in the region, and far below the sub-Saharan Africa average of 16%. Simply put, the total tax collected by URA has on average over the past five years accounted for only 12.44% of the size of Uganda’s economy. Comparatively, Kenya, Tanzania, Rwanda and Burundi recorded average tax to GDP ratios of 16.10%, 12.83%, 15.80% and 13.55% respectively over the same period.

This should not come as a surprise, given that 2016 statistics from the Uganda Bureau of Statistics (UBOS) indicated that approximately 98% of Uganda’s population of working age (14-64) were engaged in the informal sector. The title of a 2017 article published by the Economic Policy Research Centre (EPRC) based on the same statistics put it aptly, “Informality Growing Faster than Formality”.

Expanding the tax base by tapping into semi-formal economic activities is going to be one of the major focus areas in the Third National Development Plan (NDPIII) 2020/21-2024/25. It is against this background that researchers in the College of Business and Management Sciences (CoBAMS) led by the Principal, Dr. Eria Hisali conducted a study that sought to understand which gaps exist in tax education and how these gaps can be packaged into improving compliance and subsequently broadening the tax base in Uganda.

Funded by the Government of Uganda through the Makerere University Research and Innovations Fund (Mak-RIF) the research undertaken in 2020 targeted over 500 respondents with particular focus on the informal sector. In addition to the Principal Investigator (PI) Dr. Eria Hisali, the research team consisted of Dr. Ismail Kintu, Dr. Fred Bateganya, Ms. Marion Atukunda, Ms. Winfred Nalwoga, Mr. Nicholas Musoke, Mr. Patrick Lumala and Dr. Kagarura Willy.

Speaking at the research dissemination workshop held on 10th February 2021 in the School of Business Conference Room, Dr. Hisali shared that “The research advocates for a comprehensive review of Uganda Revenue Authority’s tax education programme with focus on linking tax collection to better service delivery,”

The research team’s interaction with members of the informal sector revealed that tax education being provided is not well suited to the informal sector. “For instance, tax exhibitions, messages on websites and brochures do not provide the best approach to reach out to the informal sector. The informal sector needs more engagement with emphasis on field visits and face-to-face interaction,” explained Dr. Hisali.

The Principal Investigator however pointed to some quick wins that could be adopted as URA evaluates and updates its tax education programme. He noted that approximately UGX 6 Trillion had been allocated to livelihood programmes by the Government of Uganda between the 2018/19 and current financial years. “How can tax education be included as part of the package that these Government livelihood programmes contain? I think we could see some quick wins because as recipients benefit from livelihood programmes, they could be asked to register as tax payers.”

Findings shared by the research team further revealed a limited coverage of tax education. Whereas 53% had been told or heard about the importance of paying taxes, only 40% had received education on how to register for taxes while only 38% had heard about filing tax returns. Furthermore, only 32% had received tax education on fines and penalties, 29% on the benefits of paying taxes and only 16% on audits and assessments.

Nevertheless, some of the registered respondents who admitted to not paying taxes cited low tax morale as well as poor service delivery and unfairness as reasons for their noncompliance. Researchers further took note of the limited personal touch with potential taxpayers in the informal sector, disconnect between the current taxpayer education modality and unique features of the informal sector, as well as the cost implications and overly technical language in existing modalities as some of the reasons for nonpayment of taxes.

The Study concluded that:

- Majority of the respondents had limited or no knowledge about the Tax Identification Number (TIN), a critical requirement for tax payment. More than half of respondents did not know how to acquire a TIN.

- Actors in the informal sector cannot differentiate between taxes paid to URA and those paid to local governments and other bodies that bring together operators.

- Most respondents did not know how to formalize their business/enterprise, another important factor for tax registration.

- There exists some form of registration of informal businesses/enterprises upon which formalization can build.

- The URA tax education campaigns messaging and targeting has left out some potential tax payers. Messaging and targeting of tax education is key to realizing intended results of growing the tax base and ultimately the tax revenues.

The Research Dissemination attracted participants from URA, Kampala City Traders Association (KACITA), Academia, Private Sector, Civil Society, the Media, Mak-RIF Grants Management Committee (GMC) as well as staff and students from Makerere University.

Painting a picture on the new ideas and innovations to foster a taxpaying culture through tax education, URA’s Mr. Nicholas Musoke who represented the Assistant Commissioner Research Planning and Development-Ms. Milly Nalukwago, noted that whereas Uganda’s population is approximately 45.7million, the taxpayer register stands at only 1.59million. Approximately 953,000 of those registered are active taxpayers, while 906 URA clients pay 80% of the tax. The informal sector currently contributes less than 1% (0.03%) of tax collected.

To help achieve this, URA plans to roll out the AEN strategy. AEN stands for Awareness, Empower and Nurture. Under Awareness, URA intends to intentionally engage the public on tax laws, roles, rights, obligations and opportunities relating to tax. Under Empower, URA will guide taxpayers on their rights as well as how and when to fulfil their tax obligations, while under Nurture, the Authority will set up and support mechanisms to cultivate and maintain a taxpaying culture.

Dr. John Mutenyo who represented the Chairperson of MakRIF GMC- Prof. William Bazeyo in his address commended the Government of Uganda for prioritizing research at Makerere University. “In phase One of Mak-RIF, the Government committed UGX 30billion and this was one of the research projects that

was funded under that phase. To date, over 500 competitive research grants have been supported.”

Prof. Bazeyo congratulated Dr. Hisali and the entire research team for undertaking a study geared towards strengthening the implementation of NDPIII and supporting the development of Uganda. “Most importantly, I would like to thank Dr. Hisali and the team for having a collaborative study that involved the key stakeholders such as URA. These are the stakeholders that are going to make it easy to buy into and implement the outcomes of this research.”

Commenting on the findings, the other stakeholders at the research dissemination workshop pointed out the need to embark on trust building programmes with the taxpayer. They equally emphasised the need to consider reducing the load on the tax payer. The taxpayer in Uganda is subject to taxes such as;

Value Added Tax (VAT), Pay As You Earn (PAYE), Customs, Demurrage, Income Tax, Withholding Tax, Excise Duty, Over-The-Top (OTT)/Social Media Tax among others.

Article by Public Relations Office

You may like

-

Makerere University Launches Short Course to Strengthen Climate Change Reporting

-

Makerere University and World Bank Sign Partnership to Strengthen Environmental and Social Sustainability Capacity

-

Makerere University Explores Expanded Partnership with Stanbic Bank to Advance Innovation and Investment

-

Call for Applications: Diploma Holders under Government Sponsorship 2026/2027

-

Makerere University Researchers Awarded UCIF Grant to Tackle Maize Contamination with Innovative Plant-Based Fungicide

-

Makerere Graduation Underscores Investment in Africa’s Public Health Capacity

Business & Management

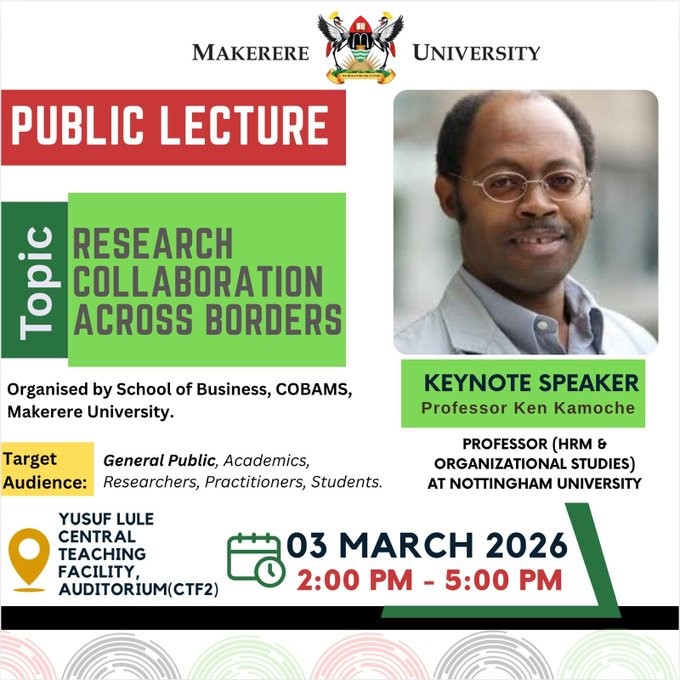

Public Lecture on Research Collaboration across borders presents enormous opportunities to researchers, faculty and students

Published

7 days agoon

March 3, 2026

Delivering the public lecture, titled: Research Collaboration across borders, Prof. Ken Kamoche from Nottingham University, urged researchers at Makerere University, to undertake research that will strengthen and empower Africa, including fields that are ignored.

“My research has focused on those pertinent issues and fields that are always ignored. I call upon you to re-consider undertaking research in the fields of knowledge management, innovations, indigenous knowledge, identity, artificial intelligence (AI) and Africa at large,” said Prof. Kamoche.

Acknowledging that he had undertaken tremendous research and publication in human resource management and organizational studies, Prof. Kamoche testified that he took a paradigm shift to focus on the values that underpin the organizational behaviour.

Held at Makerere University Yusuf Lule Central Teaching Facility Auditorium on 3rd March 2026, the public lecture attracted faculty from Makerere University, Kyambogo University, Uganda Christian University, administrators, researchers, and students. Before heading to the public lecture, Prof. Kamoche held a discipline-specific meeting with academic staff at the School of Business under the College of Business and Management Sciences (CoBAMS) at Makerere University.

The Africa Research Group: Fostering Global Scholarly Engagement and Capacity Building

Prof. Kamoche highlighted the establishment of the Africa Research Group to address the gap in engagement between scholars in Africa and their counterparts in Europe, Asia, and North America.

Established in 2012, the Africa Research Group at Nottingham University Business School provides a platform to spur knowledge transfer across disciplines and continents.

“I am here to inspire you to do research. If you are looking for a platform, I invite you to utilize the Africa Research Group. We have been able to give researchers from Africa a voice. We welcome research students at all levels,” Prof. Kamoche said.

He pointed out that the Africa Research Group provides mentorship to postgraduate and early-career researchers, supports doctoral supervision, joint publications, and funding applications. Prof. Kamoche encouraged students and faculty members to participate in future activities and pursue collaborative research opportunities.

What inspires Prof. Kamoche?

Responding to a question from the students who admired his commitment to research, publication, authorship, Prof. Kamoche said: “The desire to make a difference and share knowledge with others, and make an impact.”

Research collaboration

During the public lecture, Dr. Christopher Muganga, Dr. Seperia Wanyama, and Dr. Anthony Tibaingana from the School of Business, and Dr. John Mushomi from the School of Statistics and Planning, emphasized the importance of research and collaboration in the transformation of countries and societies in general. The members of faculty stressed the importance of knowledge sharing and exchange of ideas, authorship and publication, mentorship, joint research undertakings and networking.

Global academic collaboration

Dr. Seperia Wanyama highlighted the significance of the public lecture in creating opportunities for collaboration, knowledge exchange, and the collective advancement of academic and societal understanding.

“The event serves as a platform for fostering diversity in academia, bringing together researchers, students, and administrators to engage in shared learning,” he said.

He applauded Prof. Ken Kamoche for his distinguished contributions global academic collaboration and research. He credited Prof. Kamoche for his willingness to share valuable insights on research collaboration across borders. He urged participants to remain active and engaged throughout the session.

Talent Management and Cross-Continental Collaboration

Prof. Kamoche commended Makerere University for hosting him, reflecting on the golden opportunity to engage with students, faculty, and researchers. He shared insights from his extensive academic journey, research contributions, and initiatives to strengthen collaboration across Africa, Asia, and the West.

Reflecting on talent management and organizational leadership, Prof. Kamoche noted that he has maintained a strong focus on leveraging his international experiences to foster cross-continental academic collaborations and address challenges relevant to both African and global contexts.

Focusing on talent management, Prof. Kamoche shared insights from his extensive research, explaining how organizations often take an “exclusive” approach, concentrating resources on a small group of high-performing individuals seen as the main drivers of value. He also highlighted a different perspective: the “inclusive” approach, which recognizes that every employee has unique skills that can contribute to the organization’s success.

Using recent research in Kenya’s banking sector, published in the South African Journal of Human Resource Management, Prof. Kamoche illustrated how talent management connects closely with innovation, employee engagement, and confidence. His findings indicated that while high performers are essential, sustainable success comes from balancing focus on star performers with developing the wider workforce.

Prof. Kamoche reflected on earlier studies conducted in Hong Kong, which examined the experiences of employees identified as “high potential.” He noted that being labeled talented can be a double-edged sword, creating pressure, high expectations, and sometimes causing employees to rethink their career priorities over time.

Comparative Insights on Asian Management and Strategic African Partnerships

Prof. Kamoche shared insights from his comparative research on Asian management practices, tracing his academic interest in Asia back to his graduate studies at Oxford. There, he examined Japanese management systems at a time when Japan’s economic model was admired worldwide. Through interviews with senior human resource executives in major Japanese corporations, he sought to understand the foundations of their organizational success.

Prof. Kamoche observed that while African countries are familiar with Western business systems, their understanding of Asian management philosophies remains limited. His research highlighted key differences in operational practices, particularly in areas such as time management and efficiency.

“Some Chinese infrastructure projects run continuously, reflecting a highly results-driven approach,” he noted. He acknowledged challenges raised by local employees regarding cultural differences, labor practices, and the need for more equitable engagement.

Prof. Kamoche emphasized that Chinese investment in Africa is far from uniform, encompassing state-owned enterprises, private firms, and long-term individual entrepreneurs. “African countries must strategically leverage these partnerships to maximize both economic and social benefits while protecting local interests,” he argued.

Dr. Anthony Tibaingana commends Prof. Kamoche’s Scholarly Impact

The Acting Dean of the School of Business, Dr. Anthony Tibaingana, lauded Prof. Kamoche for delivering an insightful lecture at Makerere University, describing the presentation as an exceptional exposition of knowledge and scholarship.

Dr. Tibaingana highlighted the significance of Prof. Kamoche’s return to Africa, describing it as a meaningful reconnection with his roots and a contribution to the continent’s intellectual growth.

The Acting Dean commended the depth of the presentation, particularly its insights into human resource management, leadership, and talent development. He emphasized that Africa, with its youthful population, presents both opportunity and responsibility for scholars to generate research-based solutions to the continent’s challenges.

He underscored the need for academia to address pressing issues such as leadership gaps, institutional weaknesses, and talent retention within universities and organizations.

Dr. Tibaingana encouraged faculty and students to continue engaging through research networks and ongoing conversations facilitated by the Africa Research Group at Nottingham University Business School.

He reaffirmed the university’s commitment to teaching, research, and community outreach, noting that such engagements contribute to long-term academic partnerships and future institutional growth.

Moderated by Dr. Christopher Muganga from the School of Business, the public lecture concluded with the presentation of Makerere University Souvenirs to Prof. Kamoche and networking engagements with students.

Monica Meeme contributed to this story as a Guest Writer

Business & Management

Thirty Public Officers Certified in Integrated Regulatory Cost-Benefit Analysis

Published

7 days agoon

March 3, 2026

Thirty public officers from various Ministries, Departments and Agencies (MDAs) have successfully completed a two-week intensive training in Integrated Regulatory Cost-Benefit Analysis (IRCBA), culminating in the award of certificates at a closing ceremony held on 27th February 2026 at the Pearl on the Nile Hotel in Jinja.

The training was jointly organized by the Public Investment Management Centre of Excellence at Makerere University and the Ministry of Finance, Planning and Economic Development (MoFPED), in collaboration with the Infrastructure and Social Services Department (ISSD) and the National Planning Authority (NPA). It focused on operationalizing the Revised Guidelines for the Issuance of Certificates of Financial Implication (CFIs), which came into effect on 1st July 2025.

A Strategic Reform for Fiscal Credibility

In closing remarks delivered on by Commissioner Paul Patrick Mwanja behalf of the Permanent Secretary/Secretary to the Treasury, participants were commended for undertaking the training during a demanding budget cycle, when many MDAs are simultaneously preparing the FY 2026/27 Budget, executing the FY 2025/26 Budget, and implementing the National Development Plan IV and the Tenfold Growth Strategy.

The PS/ST emphasized that the revised Guidelines mark a significant shift toward a more transparent, data-driven, consultative, and analytically rigorous approach to evaluating policy and legislative proposals. Participants were equipped to assess fiscal implications, evaluate economic and socio-economic impacts, analyze distributional effects, and address uncertainty using structured analytical tools.

They were reminded that training alone is not sufficient, the real test lies in consistent application. As members of the third cohort, they were challenged to serve as reform ambassadors, championing evidence-based policymaking and strengthening analytical standards across government.

Bridging Academia and Public Service

Delivering the official closing remarks, the Director of the PIM Centre of Excellence, Prof. Edward Bbaale, commended participants for their active engagement and unwavering commitment throughout the training.

He described the programme as both timely and strategic, designed to equip officers with practical tools to prepare robust Statements of Financial Implication (SFIs) that support credible issuance of CFIs. He noted that strong financial analysis enhances fiscal discipline, policy coherence, and the overall quality of legislation and public policy in Uganda.

Prof. Bbaale underscored the longstanding partnership between Makerere University and the Ministry of Finance, highlighting how it continues to bridge academia and public service by combining analytical rigor with practical policy experience. He emphasized that the collaborative model — bringing together faculty from the College of Business and Management Sciences and practitioners from Government, reflects the core vision of the PIM Centre of Excellence: strengthening national systems through evidence-based policymaking.

During the two weeks, participants gained hands-on experience in applying cost-benefit analysis across four critical dimensions: budgetary analysis, socio-economic analysis, distributive impacts, and risk assessment. Prof. Bbaale encouraged them to return to their institutions as agents of transformation, improving evaluation frameworks, strengthening regulatory decisions, and ensuring that public interventions deliver value for money and long-term development impact.

He also reaffirmed the Centre’s broader mandate beyond training, noting its recent support to the revision of Development Committee Guidelines, assessment of public investment performance since NDP I, and hosting of the Second Public Investment Management Conference in August 2025.”

Building from “Zero Kilometre”

Earlier, the Manager of the PIM Centre of Excellence highlighted the practical approach adopted during the training. Participants began with blank Excel sheets and built analytical models from scratch, likened to the engineering concept of starting at “zero kilometre,” where construction begins from the very starting point and progresses step by step.

The interactive sessions enabled participants from diverse disciplines, including policy analysts, planners and statisticians, to interrogate assumptions, refine costing approaches, and debate implementation and enforcement frameworks. Their sector-specific insights enriched the learning process and strengthened the analytical models developed.

The Manager noted that excellence is not about knowing everything, but about bringing together the right expertise. Facilitators from MoFPED, NPA, the Office of the President, and Makerere University ensured that theory remained grounded in practical government realities.

Participants Applaud Practical and Engaging Sessions

Speaking on behalf of the cohort, a participant described the training as highly engaging and transformative. The combination of theory and practical application, coupled with patient facilitation, allowed officers from varied professional backgrounds to learn from one another.

The participant highlighted the final day’s discussions as the most impactful, expressing confidence that the knowledge gained would enhance policy analysis and improve the quality of programmes and projects across MDAs.

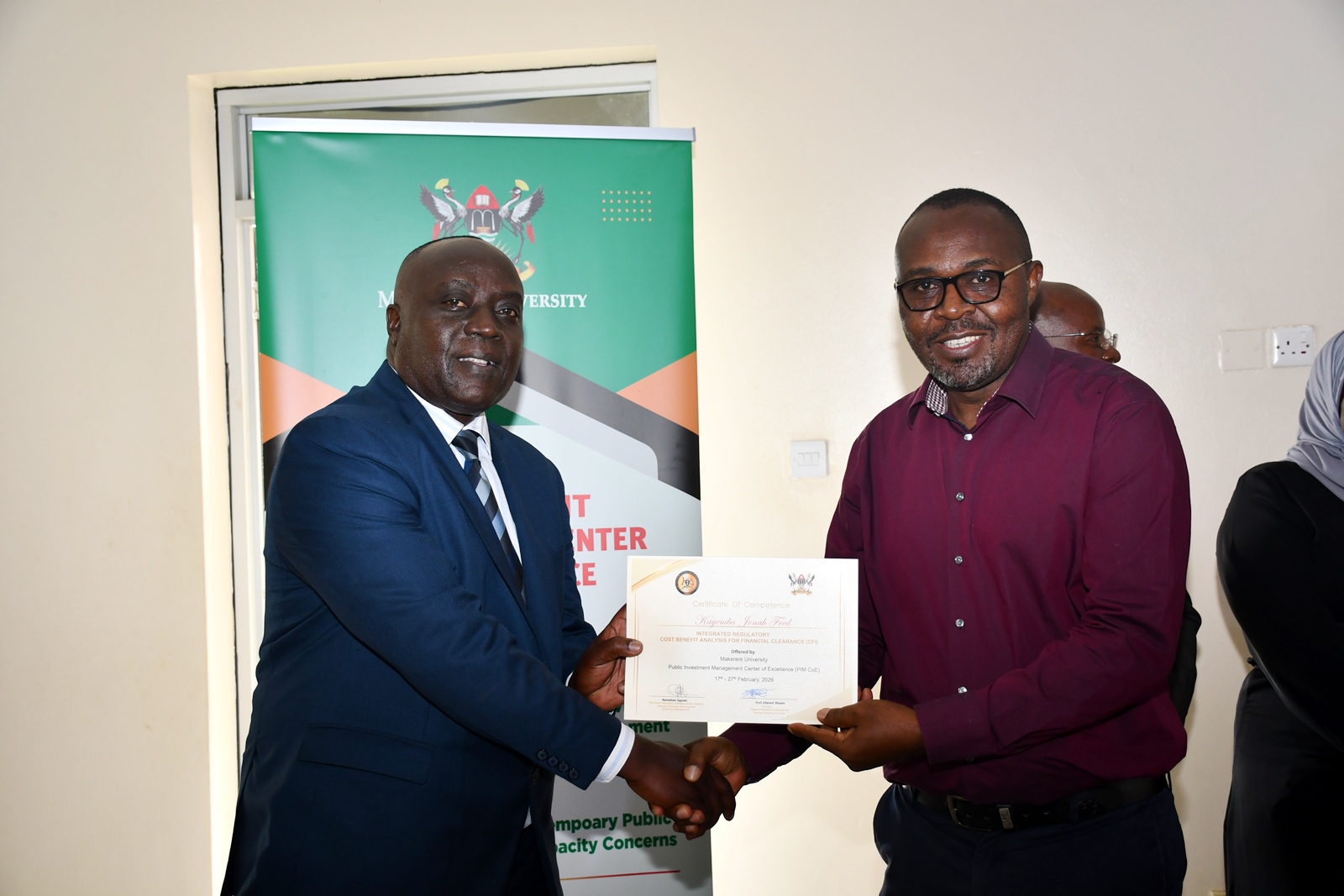

Certificates Awarded

The ceremony concluded with the award of certificates to all 30 participants in recognition of their successful completion of the IRCBA training. The certification marks another milestone in Government’s effort to build a critical mass of experts capable of institutionalizing rigorous financial and economic analysis in public policy processes.

As the workshop was formally declared closed, participants were encouraged to apply their newly acquired skills consistently, mentor colleagues, and contribute to strengthening fiscal governance across Government.

The PIM Centre of Excellence reaffirmed its commitment to continuous research, policy advisory support, and capacity building as Uganda advances toward more credible, transparent, and sustainable public decision-making.

Business & Management

Botswana Delegation Visits Makerere’s Public Investment Management Centre to Study Sustainable Training Model

Published

7 days agoon

March 3, 2026

Kampala, Uganda – 25 February 2026

A delegation from Botswana’s public investments sector on 25th February 2026 visited Makerere University’s Public Investment Management Centre of Excellence to benchmark its sustainable training model and draw lessons from Uganda’s well-established Public Investment Management (PIM) framework.

The team, composed of specialists in public investments, is exploring ways to strengthen capacity within Botswana’s public sector institutions. The delegation underscored the importance of structured and sustainable capacity-building programmes, noting that effective public investment management is central to driving national development and ensuring value for money in public projects.

During the engagement, the Botswana team sought to understand the Centre’s operational model, including how it designs and delivers training programmes that remain impactful over time. Particular interest was placed on the Centre’s approach to sustainable training delivery, the documentation of challenges and successes, and mechanisms used to ensure that public officers acquire long-term, practical skills that translate into improved project planning, appraisal, and implementation.

The visiting delegation commended Uganda’s commitment to institutionalizing PIM training and emphasized that cross-country learning is vital for strengthening public financial management systems across Africa. They observed that Uganda’s experience offers practical insights into building a resilient and responsive PIM framework anchored in continuous professional development.

As part of their recommendations, the delegation proposed the introduction of a hybrid training model to enhance accessibility for international participants. Under this approach, the theoretical components of PIM courses would be delivered online, allowing participants to engage remotely from Botswana and other countries. This would then be followed by in-person sessions in Uganda focused on hands-on, experiential learning at the Centre.

According to the delegation, such a model would significantly reduce travel costs and time while preserving the value of face-to-face practical training. The hybrid approach would also provide flexibility for busy public officers, enabling them to balance professional responsibilities with structured learning.

The visit further strengthened regional collaboration and reaffirmed the role of Uganda’s Public Investment Management Centre of Excellence as a hub for capacity development in public investment management across the continent.

Trending

-

General5 days ago

General5 days agoCall for Applications: Diploma Holders under Government Sponsorship 2026/2027

-

General5 days ago

General5 days agoAdvert: Admissions for Diploma/Degree Holders under Private Sponsorship 2026/27

-

Agriculture & Environment2 weeks ago

Agriculture & Environment2 weeks agoCAES Presents Overall Best Performing Student in the Sciences & a Record 28 PhDs at the 76th Graduation Ceremony

-

General5 days ago

General5 days agoExtension of Application Deadline for Diploma/Degree Holders 2026/2027

-

General2 weeks ago

General2 weeks agoOver 9,200 to graduate at Makerere University’s 76th Graduation