General

Business and financial experts to build a powerful network to end illicit financial flows in Uganda

Published

8 years agoon

Experts in business and financial transactions have appreciated the need to build a powerful network of stakeholders committed to substantially reduce Illicit Financial flows in Uganda. This was during a Public Discourse organised by FIDA Uganda and the Vice Chancellor of Makerere University Prof. Barnabas Nawangwe to discuss the Illicit Financial Flows and their impact on Africa’s economic development. Held on 4th June 2018, the Public Discourse was organised under a theme: “Illicit Financial flow exploring conceptual and practical challenges in Uganda”.

During the intensive discussion, participants from government, civil societies, Non-governmental Organisations, private sector and media said that developing countries and financial centres must collaborate to adopt and enforce policies that promote good governance, tackle corruption and implement transparent tax systems.

Participants also suggested that countries must have the right laws in place with the capacity to implement them. A system for exchanging tax information on preventing tax evaders and money launderers should be initiated and countries should ensure that cross-border financial flows use formal financial systems.

Illicit Financial Flows are cross-border capital movements purposed for concealing illegal activities and evading taxes. (Marc Herkenrath, 2014). It involves money that is illegally earned, illegally transferred, or illegally utilized. According to the President of Global Financial Integrity, Washington DC Dr. Raymond Baker, Illicit money comes in three forms; the proceeds of bribery and theft, the proceeds of criminal activities including drugs, racketeering, and terrorist financing that combined slosh around the globe and the proceeds of tax evasion and laundered commercial transactions.

In a keynote address on Democratic-Capitalism at risk imperilling the 21st Century, Dr. Raymond Baker said that democratic capitalist system has undergone an unrecognisable change over the past half of the 21st Century. To him, today Capitalists have a second hidden motive of facilitating their shadow financial system.

“The primary threat to the democratic capitalist system does not come from corrupt governments or terrorists, but from us and our failure to operate the capitalist system legally and ethically. It is an uphill effort to do this entirely on moral and ethical grounds. To combat illicit financial flows and tax havens, we have to strengthen the laws that regulate the market,” he said.

Illicit financial flows are an increasing concern of resource drainage from Africa. They reduce domestic resources and tax revenue needed to fund poverty-reducing programs and infrastructure in developing countries. They pose a huge challenge to political and economic security. Funds for public priorities are diverted by harmful practices, such as corruption, organized crime, illegal exploitation of natural resources, fraud in international trade and tax evasion.

According to Dr. Raymond Baker, for years, African countries have been severely hit by illicit financial flows. The global financial report released in 2015 clearly indicated that Africa is estimated to be losing more than $50 billion per year in illicit financial flows and Uganda loses an average of $509 million in illicit financial outflows annually.

“This challenge has left behind a very big income gap among individuals and countries, drained hard the currency reserves, heightened inflation, reduced tax collection, worsened income gaps and undermined trade. It has shortened lives for millions of people and deprived existences for billions more. Within the economic realm, as distinguishable from political affairs or environmental constraints, nothing else approaches the harmful effects of massive outflows of illicit money from poor countries to rich countries,” he said.

He noted that there is need for a whole-of-government approach in which all agencies collaborate and share information. “Governments should indicate the beneficial ownership of stolen funds, effectively use the legislation and develop better monitoring systems. There is need for countries to draw attention to their money, provide Entity Identifier Numbers and understand the power of signature,” he stated.

During the Public Discourse held on 4th June 2018, the Ambassador of Denmark to Uganda H.E Mogens Pedersen mentioned that the rate at which Uganda mobilises revenue currently stands at only 13% of the GDP. Therefore there is need for the country to close its revenue leakages given their negative effects to the economic growth.

“In order to facilitate identification of a remedy to this problem, the Danish Embassy has commissioned a study to help us get a better understanding of the nature and extent of Illicit financial flows in Uganda. We hope that this study which will be completed in 3 months will guide both government and development partners to design specific and targeted interventions to fight illicit financial flows. On behalf of Denmark, I want to assure you of our unwavering commitment to engage with the key stakeholders and to support efforts to curb illicit financial flows in Uganda,” the Ambassador said.

The Acting Vice Chancellor of Makerere University Dr. Eria Hisali said, “When talking about the rampant illicit financial flows in Uganda, it’s either the systems such as Human Resource and legal frameworks that are compromised or it has to do with the outright corruption the custodians of our systems.”

He thanked the Danish Embassy to Uganda for sponsoring a study that is geared towards finding the causes and implications of illicit financial flows in Uganda. In the same spirit Dr. Hisali appreciated the keynote speaker Dr. Raymond Baker for his knowledgeable and informative presentation.

He applauded FIDA Uganda and Makerere University for organising the long awaited dialogue and acknowledged the Danish Embassy for the support to ensure its success.

The Chairperson of FIDA Uganda Dr. Damalie E. Naggita-Musoke said that it is high time Ugandans understand the implications of illicit financial flows to the economic development of the country. “We have come to realise that issues that affect societies, women and children have a certain extent of illicit financial flows and resource utilization. Therefore there is a need for us to learn about illicit financial flows not only in the academic sense but also the implication of illicit financial flow generally,” she said.

The Public discourse involved an interactive panel discussion on “Illicit Financial flow exploring conceptual and practical challenges in Uganda”. Moderated by Mr. Charles Odongotho, the panellists included; Hon. Irene Ovonji Odida- the Executive Director of FIDA Uganda, Mr. Ezra Francis Munyambonera- Head of the Macroeconomics Department at Economic Policy Research Centre, Ms. Stella Nyapendi- Assistant Commissioner Board Affairs, Policy and Rulings at Uganda Revenue Authority, Ms. Jane Seruwagi Nalunga-Country Director at SEATINI Uganda and Dr. Robert Mugabe from Makerere University Business School.

Article by Proscovia Nabatte, Mak Public Relations Office.

You may like

General

Simplicity, Service & Scholarship: Hallmarks of Professor Livingstone Luboobi’s Legacy

Published

9 hours agoon

July 18, 2025By

Eve Nakyanzi

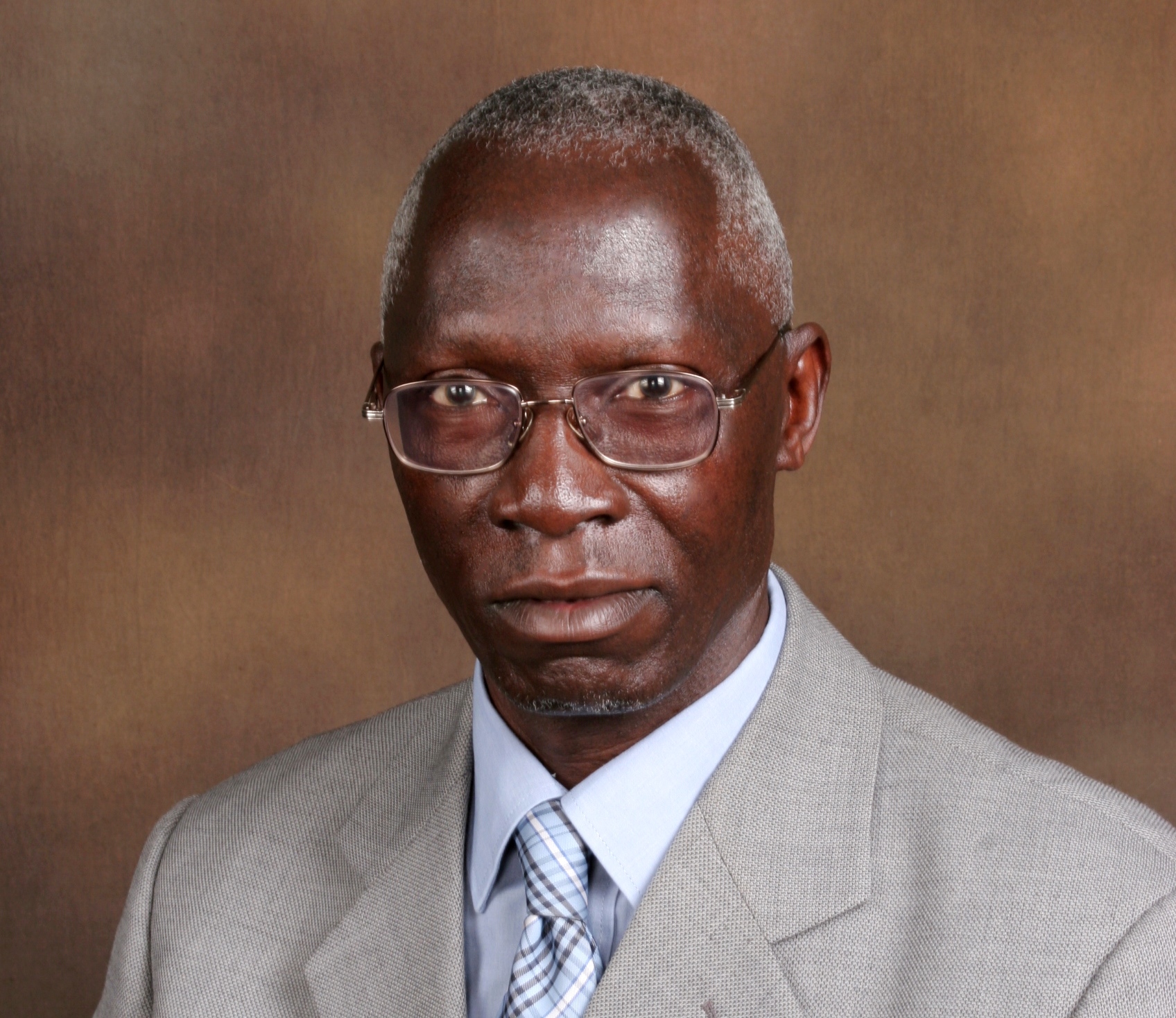

On Wednesday 16th July 2025, Makerere University lost one of its most cherished sons, Professor Livingstone Sserwadda Luboobi. Described as a mathematician, academic leader, and humble servant, Professor Luboobi devoted more than five decades to the university, rising through the ranks to become Vice Chancellor, and leaving a legacy defined by simplicity, service, and scholarship.

Born to Lameka Serwadda and Sanyu Serwadda on 25th December 1944 in Mitondo, Kalisizo, Kyotera District, Professor Luboobi’s academic career begun as a third-year student at Makerere and continued with unwavering loyalty until his passing. His life’s work reflected not only a commitment to mathematics but also nurturing generations of scholars and leaders across Uganda and beyond.

A funeral service was held in his honour at St. Francis Chapel, Makerere University on 18th July 2025. It was a moment of solemn remembrance and heartfelt tribute. Rev. Canon Dr. John Senyonyi delivered the sermon titled “Only God Knows,” reminding mourners of the mystery and grace of life’s journey. Rev. Canon Geoffrey Byarugaba represented the Kampala Diocese at the service, while former St. Francis Chaplain, Rev. Dr. Canon Johnson Ebong thanked Professor Luboobi for spearheading the Chapel’s expansion. Friends, colleagues, and family members filled the chapel, joined in mourning but also in gratitude for a life that had deeply touched theirs.

Mrs. Lorna Magara, Chairperson of the University Council, spoke movingly about Professor Luboobi’s faithfulness, likening his life to the biblical call in Mark 10:43, “Whoever wants to become great among you must be your servant.”

In his condolence message, the Vice Chancellor, Professor Barnabas Nawangwe, hailed Professor Luboobi as a visionary leader whose legacy is deeply woven into Makerere’s identity as a research-led institution. He credited Professor Luboobi with laying the groundwork for a culture of inquiry—championing graduate programmes, encouraging doctoral training, and fostering international collaborations that strengthened the university’s research profile. “He believed in building systems, not just structures,” noting that many of Makerere’s current research policies stem from his leadership. Even in retirement, Professor Luboobi remained a source of wisdom and guidance, quietly shaping the future of the university he so deeply loved.

Speaker after speaker painted a portrait of a man who led not by pomp, but by quiet strength and deep conviction. The Principal, Professor Winston Tumps Ireeta, speaking on behalf of the College of Natural Sciences (CoNAS), described Professor Luboobi as a foundational figure whose influence is deeply etched in the structures and spirit of the college. He spoke with emotion about Luboobi’s unwavering commitment to academic integrity and his belief in the power of mentorship.

“He was not just a mathematician,” Professor Ireeta said, “he was a visionary who understood the soul of the university. Even in retirement, he remained an advisor, a guide, and a quiet force of wisdom.” He concluded by saying that the college would continue to draw from his example as it navigates the future of science and innovation in Uganda.

Professor Luboobi’s illustrious career at Makerere University included serving as Head, Department of Mathematics from 1990 to 1991. The current Head of Department, Dr. Ismail Mirumbe remembered him as a pillar in the teaching and development of mathematics in Uganda

Professor John Mango, who served as Head, Department of Mathematics during Professor Luboobi’s term as Vice Chancellor from 2004 to 2009 described him as a towering figure of integrity and principle, someone who not only upheld the highest standards of academic conduct but insisted that others around him do the same. “He was a pillar in the department,” Prof. Mango remarked, “and his moral compass was unwavering.”

He recalled instances where Professor Luboobi made firm decisions, including terminating contracts when integrity was compromised, setting a tone that shaped the department’s reputation for honesty and excellence. Even as Vice Chancellor, he remained deeply involved in the department’s affairs, teaching, supervising students, all the while handling top administrative duties punctually. Prof. Mango spoke with great admiration of a man who led by example, mentored many, and whose contributions to mathematics education, research, and policy-making continue to shape the future of the discipline in Uganda and beyond.

According to an article from 1990 written by Dr. Vincent Ssembatya and Andrew Vince at the University of Florida, the Uganda Mathematical Society (UMS), which was formally established on 25th November, 1972 has since inception enjoyed major support from Makerere University and Kyambogo University in terms of infrastructure and leadership. Professor Paul Mugambi, who was also present at Professor Luboobi’s funeral service was elected first president of the UMS. Dr. Saul Nsubuga from the Department of Mathematics represented UMS at the service, honouring Professor Luboobi’s pioneering role in the discipline.

The service also featured tributes from close friends and family. Loved ones shared stories of a man who remained grounded no matter how high he rose, a man who valued relationships and walked closely with his faith. His children and grandchildren remembered him as a father who was ever-present, a listener, and a source of steady guidance.

Professor Daniel Kibuule, son of the late Professor Luboobi and Dean, Faculty of Health Sciences at Busitema University, delivered a deeply personal tribute that painted a full portrait of his father’s life, values, and final days. He expressed gratitude to the University leadership, family, friends, and medical professionals who stood with them during a challenging period. He particularly thanked his siblings, Dr. David Kimera and Dr. Irene Nakiyimba for their unwavering role in caring for Professor Luboobi through illness.

He spoke of a man who, despite great academic accolades, remained deeply humble and committed to discipline, simplicity, and faith. From instilling punctuality and responsibility to ensuring his children charted their own paths, none bearing his surname “Luboobi”, Prof. Luboobi was intentional in every lesson he passed on. Kibuule recalled his father’s insistence on being at home even in his final moments, his strong connection to Christ, and his quiet strength despite his failing health.

Former students and mentees echoed the same sentiments, of a teacher who was generous with his time and invested deeply in others’ growth. The community that gathered was not only there to grieve but to celebrate the quiet legacy of a man whose example continues to live on.

Among the mourners were public figures and leaders, including Hon. Abed Bwanika, Member of Parliament for Kimanya-Kabonera, Hon. Nyombi Thembo, the Executive Director Uganda Communications Commission, and Hon. Dr. Ham-Mukasa Mulira, former Minister of ICT, among others.

In his passing, Makerere University has lost a pillar, but his life reminds us that greatness lies in consistency, in humility, and in service to others. Professor Luboobi’s memory will continue to live on in the minds he shaped, the systems he built, and the values he embodied. He ran his race with grace.

The Writer is a Volunteer in the Public Relations Office, Makerere University

Please click the embedded video below to view the service livestream

General

Public University Legal and Accounting Officers Trained on Governance and Compliance

Published

2 days agoon

July 17, 2025By

Eve Nakyanzi

Legal and accounting officers from public universities across Uganda have convened, for a high-level training workshop organized by Makerere University. The three-day training, taking place from July 16th to 18th, 2025, is aimed at strengthening legal frameworks, improving institutional governance, and ensuring compliance with public finance and procurement laws within higher education institutions.

Ms. Lorna Magara, Chairperson of the Makerere University Council and Guest of Honour at the opening session, commended the initiative as timely and necessary. She addressed the growing backlog of court cases affecting Makerere and other public universities and outlined measures already taken to mitigate legal risks. These include the establishment of a Legal Rules and Privileges Committee and the Directorate of Legal Affairs, part of a broader strategy to improve legal compliance and foster good governance.

Representing the Vice Chancellor, Prof. Winston Tumps – Ag. Deputy Vice Chancellor (Finance and Administration), described the training as both strategic and practical. “It is imperative that we learn from each other, especially in how we handle employee litigation and institutional legal risks,” he remarked. He added that the program is designed to promote experience-sharing across universities and enhance collective institutional growth.

In his address, Mr. Yusuf Kiranda, University Secretary at Makerere University, emphasized the urgent need for robust legal oversight and more effective case management mechanisms within public universities.

The training featured a keynote address by the Attorney General of Uganda, Hon. Kiryowa Kiwanuka, who provided critical insights into legal expectations for public institutions. He warned that failure to heed legal advice could result in personal liability for accounting officers, citing a precedent involving the Uganda Cancer Institute. “Universities must consult the Attorney General’s chambers before entering into major contractual obligations,” he advised, urging legal officers to document decisions meticulously as proper record-keeping forms the first line of defense in legal disputes.

Hon. Kiwanuka further discussed the government’s ongoing efforts to recentralize legal services to ensure alignment with the Attorney General’s office. He cautioned in-house counsel against becoming overly entangled in decision-making processes, stressing the need for objectivity. Other key issues he addressed included contract approvals, misuse of Memoranda of Understanding (MoUs), and lapses in procurement processes, particularly at the close of financial years.

Participants also benefited from insights by Hon. Justice Musa Ssekaana of the Court of Appeal, who offered an in-depth analysis of judicial review and its significance in promoting lawful, transparent university governance. He called on university legal officers to act with clarity, timeliness, and accountability.

Lady Justice Joyce Kavuma, Judge of the High Court, delivered a comprehensive presentation on dispute and claim management involving public universities. She addressed emerging trends in civil litigation, emphasizing the importance of due process, transparency, and clear communication in resolving employment, student, and contractual disputes. Drawing on real case examples, she urged institutions to strengthen internal systems, embrace participatory governance, and adopt regional best practices to minimize litigation and protect institutional reputation.

The training reflects a shared commitment among public universities to build a more accountable, legally sound, and strategically aligned higher education system in Uganda. Through peer learning and collaboration, participating institutions aim to reduce litigation, enhance institutional autonomy, and uphold the rule of law.

Participating universities include Makerere University, Kyambogo University, Mbarara University of Science and Technology, Busitema University, Mountains of the Moon University, and Lira University.

The training concludes on July 18th 2025, with sessions focusing on employment dispute management in public universities and the implications of recent PPDA Appeals Tribunal decisions on procurement and disposal practices within public entities.

General

Celebrating the Life of Prof. Livingstone Sserwadda Luboobi

Published

2 days agoon

July 17, 2025By

Mak Editor

A Visionary Leader, Seasoned Mathematician, & Humble Academician

It is with profound love and respect that we celebrate the life of Prof. Livingstone Sserwadda Luboobi, a distinguished scholar, transformative leader, and beloved Vice Chancellor Emeritus of Makerere University. His legacy is woven in the fabric of African higher education, marked by intellectual brilliance, unwavering commitment to academic excellence, and a life of selfless service.

A Life of Purpose and Vision

Prof. Luboobi was more than a mathematician. He was a visionary, whose work transcended equations and research papers. Serving as Vice Chancellor from 2004 to 2009, he led Makerere University through a critical period of growth and transformation. Under his guidance, the university expanded its reach, strengthened its academic rigor, and embraced innovation and reform. His calm demeanour and principled decision-making earned the admiration of students, faculty, and peers alike.

Prof. Luboobi was deeply committed to nurturing talent and fostering intellectual curiosity, leaving an indelible mark on the institution’s culture and future direction.

Beyond Uganda, Prof. Luboobi’s influence resonated across the global academic community. He was a passionate advocate for the transformative power of science and education, often speaking at international forums and collaborating on research that bridged continents and disciplines. His work helped elevate the profile of African scholarship on the world stage.

His legacy endures not only in the impressive body of work he left behind but also in the countless lives he touched – students, educators, and leaders who continue to draw inspiration from him.

Academic and Leadership Journey at Makerere University

An illustrious alumnus of Makerere University, Prof. Luboobi graduated with First Class Honours in Mathematics, laying the foundation for an extraordinary academic journey. He pursued further studies at the University of Toronto (MSc in Operations Research, 1971-72) and the University of Adelaide (PhD in Biomathematics, 1978–80). His scholarly journey spanned prestigious institutions worldwide, including UCLA, the University of Bergen, and the University of Dar es Salaam, establishing him as a scholar of global repute and a proud ambassador of African intellectualism.

Prof. Luboobi’s service to Makerere begun in 1970 as a Special Assistant-remarkably, while still an undergraduate, rising through the ranks to full Professor in 1997. He served as Head of Department, Dean of the Faculty of Science (1994–2001), and later became the university’s first elected Vice Chancellor. His tenure brought new energy to institutional leadership, characterized by transparency, inclusivity, strategic direction and accountability.

Strategic Reforms and Institutional Impact

A true architect of transformation, Prof. Luboobi chaired the development of Makerere’s first locally-conceived Strategic Plan (1990–91). He was instrumental in securing a UGX30 billion grant from NORAD in 1999, which revitalized key academic areas such as computing, gender studies, and food science. He co-founded the Makerere University Private Sector Forum, bridging the gap between academia and industry, and strengthening alumni engagement and resource mobilization.

Pioneering Biomathematics and Mentorship

As one of Africa’s pioneering biomathematicians, Prof. Luboobi introduced mathematical modeling to tackle real-world problems in epidemiology, ecology, and operations research. His scholarly contributions – over 150 publications – reflect the depth and breadth of his research. Yet, perhaps his most lasting impact lies in mentorship: he supervised more than 35 PhD and over 50 MSc students, including Makerere’s first female PhD graduate in Mathematics, nurturing a generation of scholars and leaders.

Prof. Luboobi’s Contribution to the Internationalization of Makerere University

Prof. Luboobi played a pivotal role in advancing the international profile of Makerere University. Demonstrating remarkable personal commitment, he utilized his own resources to support the establishment of the University’s International Office. This strategic initiative laid the foundation for a more structured and effective engagement with global academic institutions, development partners, and international students. As a result, Makerere University significantly enhanced its global footprint, forming numerous international collaborations and attracting increased academic and research opportunities from abroad.

In addition to his contributions to internationalization, Prof. Luboobi was also instrumental in revitalizing the University’s Public Relations Unit. Under his guidance, the unit adopted more proactive and professional communication strategies, which greatly improved the institution’s public image. This, in turn, fostered greater public trust and strengthened the university’s reputation both locally and internationally. His visionary leadership in these areas has had a lasting impact, positioning Makerere University as a leading institution in East Africa and beyond.

Global Recognition and Enduring Legacy

Prof. Luboobi’s contributions earned him widespread recognition. In 2008, the University of Bergen awarded him an Honorary Doctorate for his role in internationalizing academia. Makerere University honoured him with a Lifetime Achievement Award in 2013, and the Government of Uganda conferred upon him a National Gold Medal for his unwavering service to education and national development.

Even after retirement, Prof. Luboobi remained an active contributor to academic life-lecturing, supervising, and advising the university.

A Lasting Light in African Academia

Prof. Livingstone Sserwadda Luboobi’s life was a model of scholarship anchored in service, leadership tempered with humility, and an unshakable belief in the power of education. He leaves behind a vibrant academic legacy and a trail of inspired minds. His contributions will continue to shape Makerere University, Uganda, and the global academic community for generations to come.

We extend our heartfelt condolences to his family, colleagues, and the entire Makerere University community during this difficult time.

May his soul rest in eternal peace.

Trending

-

General2 weeks ago

General2 weeks agoRe-advert: Admission to Undergraduate Programmes 2025/2026

-

General1 week ago

General1 week agoRe-Advert for Applications for Diploma and Certificate Training

-

General5 days ago

General5 days agoMakerere University Fees Waiver for 40 First Year Female Students 2025/2026

-

General2 weeks ago

General2 weeks agoPress Statement on Ranking

-

Health1 week ago

Health1 week agoCall for Applications: Responsible Conduct of Research (RCR) Training Course