Business & Management

Environmental Economists want a “Green Fund” Established

Published

2 years agoon

By

Jane Anyango

Environmental Economists from Makerere University and stakeholders in environment and natural resources sectors have expressed the need for Uganda to establish a Green Fund to finance green initiatives.

The dons have also proposed and re-echoed known initiatives that require mind-set change and government commitment to infrastructural developments that can reduce environmental pollution.

Environmentalists also want part of the Green Fund to come from greatest polluters in the country and the developed countries relative to the damage caused.

In addition, they want the African voice heard in the global discussion towards mitigation, commitment and transitioning to low carbon economies.

The call was made during the policy dialogue organised by the Environment for Development Initiative (EfD-Mak Centre) at the Kampala Sheraton Hotel as one of the mainstream activities. The dialogue held on December 20, 2023 brought together members of the academia, representatives of private sector, government ministries, departments and agencies, CSOs, manufacturers, and commercial banks on the theme, “Green Financing in Uganda: From Paper to Practice”.

The main aim of the workshop was to engage with the government to have a healthy debate how to finance green transitions and greening starting from the household level. The key message was that there is need to transit, but the transition is not cheap, it is expensive and requires deliberate effort.

While opening the workshop, the Principal, College of Business and Management Sciences Assoc. Prof. Eria Hisali said the engagement was hinged on twin objectives of attaining low carbon outcomes and high growth outcomes which are environmentally friendly.

As researchers and policy makers, Prof. Hisali interested participants to discuss and understand the current growth landscape, where growth is coming from, and main activities that drive growth and livelihoods.

Within that landscape, the professor advised participants to address the main concerns with regard to sustainability, the environmental concerns with regard to the current sources of growth and the status quo.

Hisali also told participants to pose a question of the disruptive effects that come along with the transitions to low carbon sources of growth; and closely related, the best options to make the transitions and finally, how the green financing strategies can be made attractive for the different actors to take them on.

Outside the green financing alone, Prof. Hisali challenged participants to debate on other options that policy makers can consider to enable the transition to low carbon sources of growth to start taking place.

The Professor also guided participants to have discussions on the framework for enforcement and auditing of the transition process itself, asking, what is it that they can do to ensure that they are tracking the progress made and whatever has been agreed upon at policy level, and ensure it is enforceable and that there are institutions and agencies to enforce that.

“The other issues we should be discussing is that what is our voice as Uganda and as the developing world in these discussions towards a low carbon economy. Do we have the voice as anyone else? Or is it that for us we should be making the transition while others are not, where is the equaliser. Are we in future for example going to talk about green imports or it is about us only ensuring that we go green and possibly some powerful nations look on and go to the extent of lip service”. Hisali asked.

In an interview, Prof. Hisali said, the discussion of the African voice in mitigation carbon emissions has picked traction at the global- level questioning whether all countries of the world have the same voice and commitment to addressing matters of environmental sustainability.

“This discussion is important because the transition to low carbon economies come with certain disruptions the way things are done and those disruptions are a cost. They disrupt livelihoods, slow growth and the only way we can be committed to that transition, is when we are sure that it is not only us but that everyone else has the same commitment. We all belong to the planet and we should have the same level of commitment,” Hisali stressed.

The Director EfD-Mak Centre Prof. Edward Bbaale noted that although there are more than one SDGs focused on the environment and green financing, many countries are not living up to the set aspiration of the SDG. Bbaale is also the Director, Directorate of Research and Graduate Training at Makerere University.

As a university, Prof. Bbaale said, they must undertake research and establish to what extent the country has achieved green energy transitions and inform government where the country is, and what should be done. Through research Bbaale said the university has done a lot to come up with innovations as solutions to the green transitions such as solar energy solutions and others.

Bbaale reported that the EfD-Mak Centre is focusing on environment and natural resources, on how to harness and manage the environment for sustainable development, satisfying the needs of the present generation without compromising the needs and the benefits of the future generation.

As the Environment for Development initiative, Bbaale said, the topic of green financing is based on the fact that the environment has been the most affected resources through deforestation, reclaiming of wetlands, and most of these have come partly through agriculture where forests have been cut unsustainably and for infrastructural developments.

Bbaale warned that most of these developments have taken place without minding about the environment adding that unlike human beings who forgive and forget, nature does not.

“Nature does not forgive and nature does not forget. Actually, at one-time nature will hit back badly. You have seen in Kampala during this season, in the last three months, floods swallowing up people, our fellow human beings dying, cars being swallowed up in a place where you least expect that you are going to meet your death.

We have seen that one being caused by the environment hitting back. Maybe because that very area was a wetland, but during the construction of the house or the building or the road, this was not catered for.” The Director decried.

It is time to protect the environment through mindset change, best practices and investment in green initiatives

Prof. Edward bbaale

Prof. Bbaale stressed that it is now time to talk about protecting the environment against greenhouse gases and, one sure way, apart from mindset change and preaching to the population on the best ways of life, one other way, is through investment.

He observed that almost 85% of Uganda’s households depend on biomass for cooking, mainly firewood and charcoal. He said, it is dangerous and leads to deforestation, pollution and respiratory diseases. The alternatives he said, can come through, for example, using LPG and electricity which are very expensive and require subsidies to make sure that an average household can afford consistently.

Bbaale called for mindset change among the citizenry and re-orientation of the country’s infrastructure to allow citizens ride bicycles to short distance workplaces to reduce on use of vehicles and pollution.

“You do not need to board a vehicle if you are coming from 1.5 kilometers away. A bicycle can do that, even 20 kilometers away. But now we need to establish the infrastructure for that. Have lanes that are for bicycles alone. And when you’re riding your bicycle, you are very safe. You will not meet your death because of riding a bicycle.

I’ve interacted with the professors elsewhere in the developed world, and the head of the university, the president of the university rides a bicycle to work. But these people are safe. So the question is, are you safe when you ride a bicycle to go to your place of work? But now, for us to re-orient, we require financing. And also how would you ensure that most of us will be riding electric motorcycles which don’t emit any gases?”. Bbaale said.

The don also welcomed the move to the manufacture and use of electric vehicles.

“Okay, how can we, all of us, ensure that we shall at one time be driving electric cars which require that they are charged to make sure that you have enough current that will take you to Mbarara. This means that as you drive to Mbarara, somewhere, there must be a point where you go and refill your current as you drive an electric car.

But now, government investment requires that the planning, programming and the budgetary processes are in view or in perspective of the need to finance these green investments.”, He added

The Director explained that some of the issues might require doing adaptation, and so need adaptation finance while some of the issues would require to finance the disaster, because,for example, the floods bring disasters, landslides and all of these. And so it requires that there is a fund for disasters that happen because people suffer through climate shocks.

Part of the Green Fund should come from the greatest polluters in the country and the Developed countries

prof. edward bbaale

Prof. Bbaale also noted that Neither Uganda as a country, nor Africa as a continent of Africa, is not solely responsible for climate issues faced.

“…Because our colleagues in the north that are already developed, America, Europe and all that, during the industrial revolution released a lot of greenhouse gases into the environment. And that’s why actually negotiations are going on that the developed countries that actually polluted the environment in the first place should pay.

So, part of the fund that I’m talking about should come from the developed countries. Part of the fund should come from China, Europe and, part of the fund must come from the United States”, Bbaale asserted.

Bbaale added that greatest polluters in the country must pay correctly for what they have damaged.

“We must map and know globally who are the greatest contributors to the climate fund. The same applies to Uganda. We have had the debates. Who are the greatest polluters? If you are running an industry and you are releasing waste products into Lake Victoria, you must pay so that government can use the money you have paid to correct what you have damaged.

…even if you were just releasing, because of your industrial activity greenhouse gases into the atmosphere, government should be in a position to compute the extent of damage you are causing and therefore you, the private investor, be able to pay for that. And so, government requires to finance activities that constitute green transitions”, Bbaale advised.

He said transiting into a green environment has two phases. Number one, is mindset change that is, what we do as human beings, and it also has to do with the real costs which is not cheap.

EfD-Mak Policy Engagement Specialist for Inclusive Green Economy (IGE) Program Dr. Peter Babyenda said, as a country, continent and globe, there is a lot on paper, but practice is lacking.

Babyenda expressed the need to involve everybody starting from the public, the academia, media, manufacturers and commercial banks among others.

“We have realized that whenever we are coming up with these policies, more so, to do with banking, the commercial banks which deal with the person are not part of the negotiations yet there is no local person who goes directly to the central bank. So we need to involve banks right away from planning to implementation”, He said.

Babyenda also said, there is need to invest in mindset change and be able to raise funds locally as a country.

“We cannot plan for green financing where 80% of the budget is from the donors So, we need to mobilise the funds locally through contributions from emitting manufacturers, people in Agriculture and fossil fuels,” He said

Babyenda also said there is need to define the products clearly starting where the green financing will go for instance investments in tree planting, subsidizing environmentally friendly technologies including the cooking among others.

Jane Anyango is the Communication Officer EfD Uganda

You may like

-

Call for Abstracts: Digital Health Africa 2025

-

Undergraduate Admission Lists for International Applicants 2025/2026

-

Admission Lists -Disability and District Quota Schemes 2025/26

-

Emorimor Calls for Makerere to Upgrade Parenting Course

-

Uganda Deepens Economic Governance with Training on Regulatory Cost-Benefit Analysis

-

UVCF Makes Case for HEAC Programme

Business & Management

Uganda Deepens Economic Governance with Training on Regulatory Cost-Benefit Analysis

Published

3 days agoon

June 30, 2025

The Ministry of Finance, Planning and Economic Development (MoFPED), in collaboration with the Public Investment Management Centre of Excellence at Makerere University, has commenced a two-week Integrated Regulatory Cost-Benefit Analysis (IRCBA) training in Jinja. The training, which runs from June 30 to July 11, brings together economists and policy analysts from Ministries, Departments, and Agencies (MDAs) across government.

The training was officially opened by Mr. Paul Mwanja, Commissioner for Infrastructure and Social Services at MoFPED, who represented the Permanent Secretary/Secretary to the Treasury. He was joined by Prof. Edward Bbaale, Principal of the College of Business and Management Sciences at Makerere University and head of the PIM Centre of Excellence.

In his remarks, Mr. Mwanja emphasized that the training marks a pivotal step in the operationalization of the Revised Guidelines for Financial Clearance (CFI), launched on June 20, 2025. “These guidelines are more than procedural. They are a critical instrument for ensuring that government policies and legislation are fiscally sound, inclusive, and developmentally aligned,” he said.

Prof. Bbaale echoed these sentiments, highlighting the strategic timing of the training. “This is the first opportunity for many participants to engage practically with the new guidelines. It is part of a long-term agenda to institutionalize a culture of evidence-based decision-making within government,” he noted.

The IRCBA training is structured to build technical capacity in appraising the fiscal, economic, distributional, and risk implications of public policy and legislation. Participants will be introduced to tools such as Net Present Value (NPV), Benefit-Cost Ratios, and Sensitivity Analysis to ensure that all policy proposals are well-justified and deliver value for money.

According to the Revised CFI Guidelines, all requests for financial clearance submitted to MoFPED from July 1, 2025, must now include comprehensive assessments aligned with Uganda’s national development agenda and medium-term expenditure frameworks. The guidelines aim to promote transparency, strengthen fiscal governance, and improve the quality of public expenditure.

“Through this partnership with the PIM Centre of Excellence, we are not only training individuals—we are building a critical mass of professionals capable of shaping sound public policies,” Mr. Mwanja stated.

The Centre of Excellence will continue to roll out similar trainings throughout the financial year, reinforcing MoFPED’s broader reform efforts under the Fourth National Development Plan (NDP IV) and the 10-Fold Growth Strategy.

Participants were urged to fully immerse themselves in the training and emerge as champions of high-quality, evidence-based policymaking. “This is how we ensure that every shilling spent by government reflects our national priorities and brings meaningful impact to citizens,” Prof. Bbaale said.

The training reflects the Government of Uganda’s commitment to professionalizing public policy formulation and ensuring that regulatory and legislative proposals are not only visionary but also fiscally responsible and socially inclusive.

Business & Management

Strengthening Europe-Africa Higher Education Collaboration through the NEAR-ER Project

Published

2 weeks agoon

June 20, 2025

Makerere University in Uganda, is implementing the Network on Europe and Africa Relations-Education and Research (NEAR-ER) project, which seeks to strengthen collaboration in higher education through dialogue, events, scholarly debates, exchange of best practices, and dissemination of research and techniques.

The NEAR-ER is a Jean Monnet policy network of 20 higher education institutions; 7 in Europe and 13 in Africa. The thematic areas include: Shared Peace, Shared Prosperity and Shared Spaces as expounded below:

Shared Peace-Democracy, Rule of Law, Justice and Positive Peace Initiatives; Shared Prosperity-Trade Relations, Development Cooperation and Sustainability; and Shared Spaces-Climate Change, Energy Cooperation and Population Movement

The implementation of the three year (December 2024 to November 2027), NEAR-ER project co-funded by the European Union, follows a successful response, to a call for proposals by researchers based at the School of Statistics and Planning under the College of Business and Management Sciences (CoBAMS). The NEAR-ER research team consists of the following: Dr. John M. Mushomi – Principal Investigator, Dr. Patricia Ndugga, Dr. Elizabeth Nansubuga, Dr. Olivia Nankinga, Dr. Nicholas Tunanukye and Dr. Fred Maniragaba.

Early Career Researchers and Graduate Students’ Dialogue

On 16th June 2025, Makerere University hosted the NEAR-ER dialogue targeting early career researchers and graduate students from higher education institutions in Uganda.

Featuring remarks from Makerere University officials, an overview of the NEAR-ER project, a panel discussion on the career prospects in the EU, and an interactive question and answer session, the dialogue presented an opportunity to participants to engage with leading scholars in Europe-Africa relations, network with academics across continents, explore research and career prospects in EU-Africa partnerships, contribute to meaningful discussions on contemporary challenges affecting both continents, and gain insights into current trends and future directions in Europe-Africa cooperation.

The following members of the NEAR-ER project tipped early career researchers and graduate students on Africa and Europe relations including research, partnerships, academics, access to scholarships, mobility, networking, and among other important aspects: Prof. Muller Gustavo-the Overall Principal Investigator from KU Lueveni, Prof. Chris Nshimbi-Africa Principal Investigator from University of Pretoria, and Dr. John A. Mushomi-Principal Investigator at Makerere University.

Tour of Makerere University Innovation Pod

Prior to the dialogue, the NEAR-ER delegation toured the Makerere University Innovation Pod (Mak Unipod). Reflecting on the tour, Prof. Muller Gustavo lauded the level of innovation, describing it as a promising space for African-centered academic advancement.

NEAR-ER delegation Courtesy meeting with the Vice Chancellor

The delegation participated in a courtesy meeting with the Vice Chancellor, Prof. Barnabas Nawangwe, who was represented by the Acting Deputy Vice Chancellor (Academic Affairs), Prof. Buyinza Mukadasi. The following University officials participated in the courtesy meeting held in the Vice Chancellor’s Board Room: Associate Prof. James Wokadala-Deputy Principal-College of Business and Management Sciences, Associate Prof. Ibrahim Mike Okumu-Dean, School of Economics, Dr. Margaret Banga-Dean, School of Statistics and Planning, and Dr. John A. Mushomi-Principal Investigator of the NEAR-Project at Makerere University.

Official Opening of the NEAR-ER dialogue

Opening the NEAR-ER Dialogue on behalf of the Vice Chancellor, Prof. Barnabas Nawangwe, the Acting Deputy Vice Chancellor for Academic Affairs-Prof. Buyinza Mukadasi, underscored the significance of the event, as a defining moment in research collaboration in Africa and Europe. He emphasized that the academic convening provided a strategic platform for deep reflection, meaningful reconnection, and a renewed commitment to joint scholarship that promotes peace, shared prosperity, and inclusive development.

Prof. Buyinza Mukadasi noted that the activities of the NEAR-ER project were aligned with Makerere University’s strategic vision as well as Uganda’s national development agenda. He expressed optimism that the deliberations would spark innovative thinking, strengthen solidarity between Africa and Europe, and help shape a future rooted in shared values, mutual respect, and purposeful collaboration.

He encouraged the participants in the NEAR-ER dialogue to ensure that Africa embraces the Fourth Industrial Revolution through optimizing digitalization systems and processes. He challenged the participants to view the dialogue, as a call to action, and a catalyst for cultivating transformational African leaders equipped with relevant digital skills and employable knowledge. He stressed that the continent’s future hinged on preparing the next generation to confidently navigate and address the demands of the digital age.

Putting across a strong case for African institutions to take on leadership in the co-production of knowledge, Prof. Buyinza Mukadasi said: “Africa’s development trajectory depends on homegrown ideas, African-led innovation, and the strategic harnessing of global partnerships to address local and global challenges.”

Highlights by the College Principal

The Principal, Prof. Edward Bbaale represented by the Deputy Principal, Associate Prof. James Wokadala, described the NEAR-ER project as a foundational moment in the redefinition of global academic cooperation from the heart of Africa. The Principal called upon the participants to utilize the dialogue to form enduring partnerships.

He underscored the College’s central role in advancing global academic collaboration, within the framework of EU-Africa partnerships in education and research. He noted that the dialogue marked a significant milestone through positioning CoBAMS as a vital conduit for strengthening cross-continental partnerships. He highlighted that the NEAR-ER network’s emphasis on education and research strongly aligned with the College’s mission to foster robust academic linkages between the Global North and South.

The Deputy Principal acknowledged CoBAMS’ unwavering dedication to advancing Makerere University’s agenda of becoming a global academic e-hub, particularly within the evolving landscape of EU-Africa relations. He reported that the College was actively undertaking strategic initiatives to deepen international engagement—initiatives designed to foster mutual learning, catalyze collaborative research, and create meaningful career development pathways.

“The College leadership has prioritized supporting young researchers and postgraduate students, thus empowering the next generation of scholars to thrive in an increasingly interconnected academic ecosystem,” he said.

Highlights from the Principal Investigator

Focusing on the critical role of students in academic institutions, Dr. John A. Mushomi, the Principal Investigator of the NEAR-ER project at Makerere University, said: “Our students are our main customers. We should therefore nurture and empower our learners through global research and engagements.”

Dr. Mushomi highlighted the importance of providing a “safe engagement space” for students and researchers. Reflecting on his academic journey, and postdoctoral fellowship, he acknowledged the relevance of seeking mentorship, citing it as an instrumental step in his path to the NEAR-ER network.

He also acknowledged the long-term collaborative efforts that led to the successful NEAR-ER grant proposal, notably involving both Makerere University and Kyambogo University.

Overview of the NEAR-ER project

Presenting the Overview of the NEAR-ER project, Prof. Muller Gustavo, a Senior Researcher at the London Centre for Global Government Studies underscored the critical importance of collaborative research and education between Europe and Africa. He noted that holding the first African convening/dialogue at Makerere University was both strategic and symbolic of the growing academic ties between the two continents.

Delving into the origins of the project, Prof. Gustavo revealed that the idea for the network was conceived approximately three years prior, where they envisioned a platform that would encourage dialogue, research, and exchange on topics central to Europe–Africa relations. They rallied scholars from diverse institutions, forming a vibrant and interdisciplinary consortium.

“Over the last three years, we put together a group of universities to foster and facilitate research and communication on relationships between Africa and Europe. The goal of the consortium is to disseminate the research and education practices, the best practices of education in Africa, in Europe, but also worldwide,” he said.

Prof. Gustavo highlighted that the NEAR-ER project will serve as a vehicle to foster best practices in education, research dissemination, and policy-relevant collaboration. He noted that the network intentionally included universities and institutions representing diverse linguistic and cultural contexts, affirming their commitment to inclusivity and comprehensive regional representation. According to Prof. Gustavo, this diversity strengthens the network’s mission to bridge educational and research gaps between the global north and south.

Beyond institutional collaboration, Prof. Gustavo emphasized the network’s commitment to public engagement and knowledge dissemination. He detailed a range of outputs already in motion, including research blogs, podcasts, newsletters, webinars, policy surveys, and country-specific forecasts.

Prof. Gustavo urged the students and young scholars to become active contributors to the NEAR-ER platform. He explained that the network is open to ideas from emerging voices—whether through blogs, podcasts, or other digital formats—and provides a unique opportunity for students to share perspectives and shape global discourse.

“There might be opportunities here for some of you that are interested in further increasing your knowledge on European integration, African integration, and the relationship between those two processes. You may be a student who has an idea on how to improve the relationship and looking at a particular aspect to get that idea out to the world, we can offer that destination platform for you as well,” Prof. Gustavo mentioned.

Remarks by the Dean, School of Statistics and Planning

Dr. Margaret Banga, the Dean of the School of Statistics and Planning, informed the participants, that the dialogue was a space to unite the varied disciplines and backgrounds present, all in pursuit of a shared vision for the future.

“The NEAR-ER initiative is more than a research collaboration. It is a bridge of solidarity between Europe and Africa—a platform where shared learning leads to shared solutions. It is not about the North teaching the south, but it is about learning from one another,” Dr. Banga said.

Standing as a firm believer in the transformative power of research, innovation, and youthful curiosity, Dr. Banga, underscored the importance of structure and strategy in translating ideas into impact. She encouraged the audience to treat planning as the bridge between possibility and progress. She stressed that without a clear methodology, timeline, partners, and budget, even the most brilliant ideas can fade into obscurity, but with a solid plan, those same ideas can evolve into funded projects, published policy briefs, and life-changing solutions.

To the young scholars, Dr. Banga issued a powerful call to action. “You are the thinkers who will unlock Africa’s economy,” she said. “You are the innovators who will shape climate resilience. You are the analysts and planners who will rethink development—not as something done for us, but as something shaped by us.”

With conviction and hope, Dr. Banga reminded the young scholars that they were not mere students, but emerging leaders, and agents of change. She urged them not to wait for some future moment of “expertise” before stepping up. She offered a critical reminder that every question they pose, every network they build, and every inquiry they pursue is already shaping the world, “Your research is not small because you are just starting out, your work has the power even now to improve lives and influence generations. Don’t just study the world. Change it.”

A voice from the PhD Students

Ms. Claire Cheremoi, President of the PhD Fellows at Makerere University, expressed her appreciation for the spirit of unity and collaboration fostered by the NEAR-ER dialogue. “Our voices matter. Coming together as students is powerful,” she said.

Ms. Cheremoi emphasized the value of collective engagement, stressing that such platforms were essential in facilitating the sharing of knowledge, fostering meaningful networks, and sparking critical discussions on the issues that matter most to young scholars. She stated their commitment to engaging in conversations on research funding, interdisciplinary collaboration, and broader academic partnerships.

A statement from the representative of undergraduate students

Mr. Ssozi Fahad Batte, Chairperson, Students Guild Council, College of Business and Management Sciences acknowledged the students had the zeal to learn, grow, and contribute meaningfully. In his view, the most significant outcome of such dialogues was the ability to extract value—something “to take home.”

He stated the critical role of documentation, urging fellow participants to write down their ideas, strategies, and action points in order to share them beyond the event. He also highlighted the importance of networking, stressing that connections and collaborations were central to growth in academia and beyond.

Panel discussion on Career Prospects in the EU

In a panel discussion moderated by Dr. Robert Ojambo from Kyambogo University, several international scholars shared invaluable insights on navigating academic and professional opportunities abroad—particularly for students and researchers from the Global South.

The panel discussion offered a wealth of practical insights for young scholars seeking academic and professional opportunities across borders. The panelists emphasized the importance of building trust-based networks, as well as, going beyond emails to form genuine relationships with professors, peers, and institutions.

Strategic planning emerged as a recurring theme during the panel discussion—highlighting the need to research language requirements, living costs, and cultural differences when selecting destinations. Participants encouraged scholars from the Global South to view their unique backgrounds as assets that contribute to valuable perspectives to global discourse.

Opportunities such as Intra-Africa Academic Mobility programs, and summer schools were also presented as transformative pathways that combine education, exposure, and networking. The discussion also stressed the power of initiative—actively reaching out, applying, volunteering, and making oneself visible in digital academic spaces. Importantly, career success was linked not just to passion, but to aligning one’s skills with institutional needs and being open to unpaid roles such as voluntary service that build experience and credibility. The overall message was clear: international academic success requires preparation, adaptability, and the courage to take the first step.

As participants engaged across these thematic areas, the NEAR-ER dialogue underscored the central role of universities in bridging regions, amplifying diverse voices, and generating research-driven responses to global emergencies. The NEAR-ER dialogue held at Makerere University was not just a reflection of academic solidarity—it was a declaration of shared purpose and a call to action in re-imagining a more just, peaceful, and sustainable future across continents.

Business & Management

Prudential Uganda invests UGX 135 million in Makerere’s Top 5 Actuarial Graduates

Published

3 weeks agoon

June 12, 2025

In a strategic move aimed at strengthening Uganda’s financial and insurance sectors, Prudential Uganda has awarded UGX 135 million to the top five graduates of Makerere University’s Actuarial Science program, underscoring its firm commitment to nurturing globally competitive actuarial talent within the country.

The initiative, operating under the Prudential Actuarial Support Scheme (PASS) is a transformative partnership launched in 2022 between Prudential Uganda and Makerere University, anchored in a five-year renewable agreement aimed at cultivating professional excellence in actuarial science through merit-based support. Under this scheme, the top five actuarial graduates from the College of Business and Management Sciences (CoBAMS) at Makerere University are each awarded a cash prize of USD 500—a tangible recognition of academic brilliance and perseverance.

Beyond the monetary reward, PASS provides a robust framework of academic and professional support, including sponsorship for globally recognized certification exams, industry mentorship, and hands-on training opportunities. This holistic approach ensures that Uganda’s brightest actuarial minds are not only celebrated, but also empowered to thrive on the global stage.

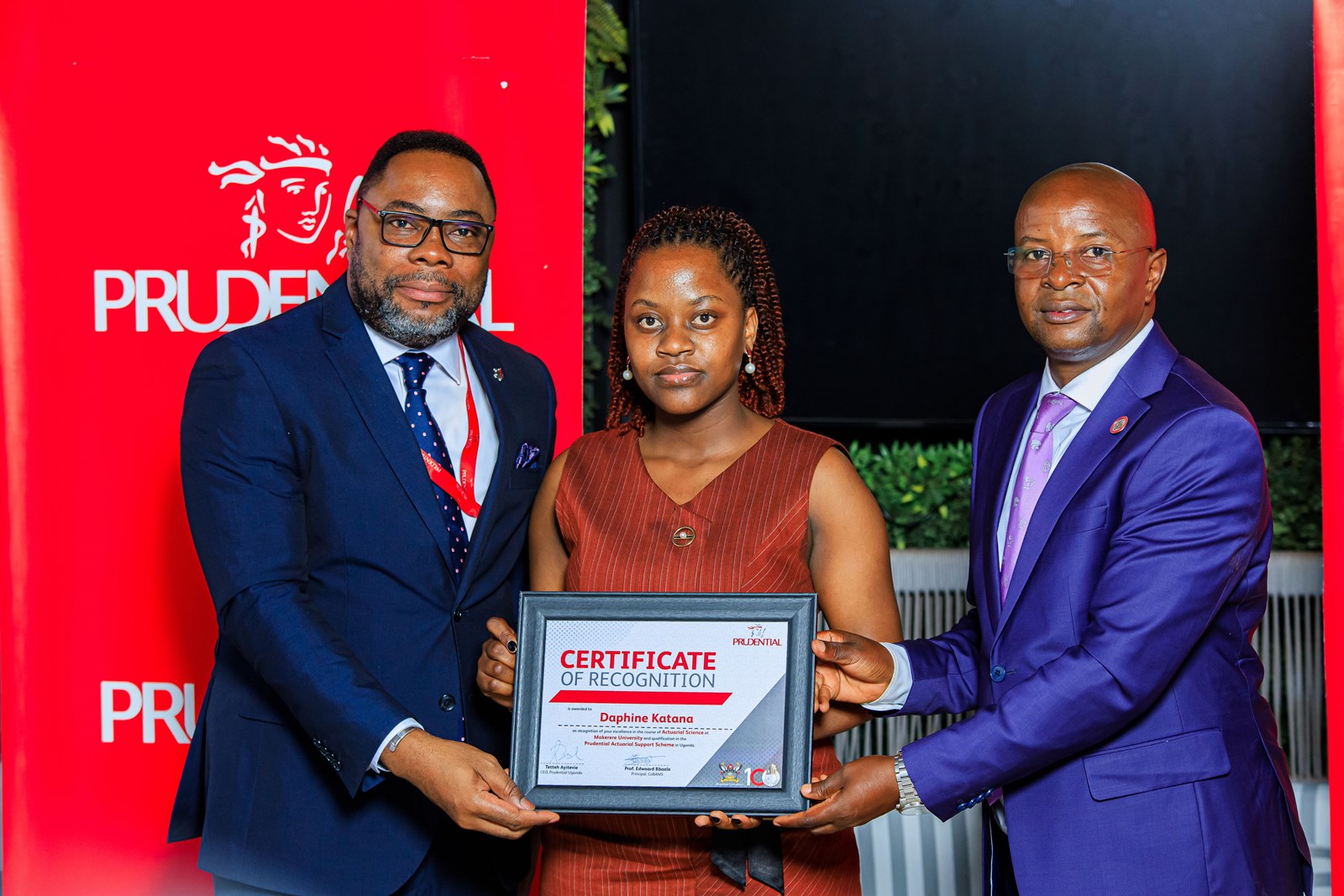

During a press conference held on 11th June 2025, the five exceptional graduates were recognized for their academic excellence and potential to shape the future of Uganda’s financial services industry. Mr. Brendan Joseph Lule, Mr. Gordon Twinomujuni, Mr. Allan Galabuzi, Ms. Daphine Katana, and Mr. Kenneth Inyangat—each received a cash prize of USD 500 and full sponsorship for globally recognized actuarial certification exams. This award positions them on an accelerated path toward international professional accreditation.

Speaking during the press briefing, Prof. Edward Bbaale, Principal of the College of Business and Management Sciences (CoBAMS), applauded the partnership between Makerere University and Prudential Assurance Uganda for coming up with an initiative that inspires students to aim higher and a clear message that their hard work is recognized and valued beyond the lecture halls.

Prof. Bbaale described the collaboration, formalized under PASS as a transformative coalition that would significantly shape the future of actuarial science education in Uganda. He emphasized the real-world value of the support offered through the scheme, noting that at least 10 students undertook professional actuarial exams under the initiative. He highlighted that the top-performing student is further rewarded with a one-year apprenticeship at Prudential Uganda—an opportunity he described a profound investment in hands-on experience and career development. He reported that at least two graduates had benefited from this prestigious placement, gaining invaluable industry exposure that bridges academic excellence with professional practice.

“The PASS is a visionary initiative that rewards academic excellence and builds professional capacity. Through this scheme, the top five actuarial science graduates each year will receive cash prizes of $500. They will also benefit from support for professional certification exams, including those offered by the Institute and Faculty of Actuaries and the Society of Actuaries,” Prof. Bbaale remarked.

At the national level, Prof. Bbaale emphasized that the collaboration between Makerere University and Prudential Uganda directly addresses Uganda’s pressing need for skilled actuaries in key sectors such as insurance, pensions, and healthcare. He noted that the Prudential Actuarial Support Scheme effectively aligns academic training with industry demands, thereby enhancing the relevance of university education in the context of national development. He remarked that this alignment contributes meaningfully to Uganda’s human capital development agenda and supports the broader goal of strengthening institutional capacity in financial risk management.

The Principal commended Prudential Assurance Uganda for their visionary support and long-term commitment. He said the partnership with Makerere University College of Business and Management Sciences (CoBAMS) represents more than a financial investment, but a bold step toward professionalizing actuarial education in Uganda and preparing students for leadership and service in the financial sector. “Together, we are building a stronger, more skilled Uganda—one actuary at a time,” he affirmed.

Describing the occasion as a celebration of excellence, resilience, and the immense potential of a new generation of actuaries destined to shape Uganda’s insurance and financial landscape, Mr. Tetteh Ayitevie, Chief Executive Officer of Prudential Uganda, expressed deep pride in the Prudential Actuarial Support Scheme.

He stated that the initiative is a bold and forward-looking investment in the country’s actuarial leadership. He commended the graduates for their academic tenacity and discipline, noting that their achievements reflected not only personal merit, but also the promise of a stronger, self-sustaining insurance sector.

“You have survived the course load, and now, you are stepping into the real world ready to contribute meaningfully. We see you. We believe in you. And we are proud of you,” Mr. Ayitevie said.

He reiterated the crucial role of actuarial science in modern economies, highlighting it as the engine behind robust insurance frameworks, risk modeling, and long-term financial planning. According to Mr. Ayitevie, despite its understated visibility, actuarial work underpins the stability of entire financial systems, and Uganda must rise to the challenge of building this critical professional cadre.

“Actuarial science may not be the loudest career path, but it is one of the most vital. It’s the heartbeat of any insurance company. It’s where math meets life. It’s where you predict risks, protect people, and create sustainable financial systems,” he stated.

He also drew attention to the glaring gap in Uganda’s actuarial landscape, noting the country’s limited number of certified actuaries in contrast to its population size. He stressed the urgency of cultivating homegrown expertise rather than relying on outsourced talent, positioning the Prudential Actuarial Support Scheme as a strategic intervention to reverse this trend.

Trending

-

General6 days ago

General6 days agoMature Age Scheme Exam Results for 2025/2026

-

General1 week ago

General1 week agoFreshers’ Joining Instructions 2025/2026

-

General1 week ago

General1 week agoMastercard Foundation Board pays its inaugural visit to Makerere University

-

General1 week ago

General1 week agoUVCF Makes Case for HEAC Programme

-

General2 days ago

General2 days agoUndergraduate Admission List Self Sponsorship Scheme 2025/2026