Business & Management

Address Financial Literacy to Improve Household Income-Study

Published

4 years agoon

Findings by a team of researchers from the College of Business and Management Sciences (CoBAMS) have recommended that the Government through its agencies should partner with private financial institutions to organise financial literacy trainings to teach households on how to access capital, save and invest in productive ventures. The recommendations were made at a research dissemination workshop for the project titled: Evaluation of the effectiveness of financial inclusion on household’s welfare in Uganda: A case study of Busoga region.

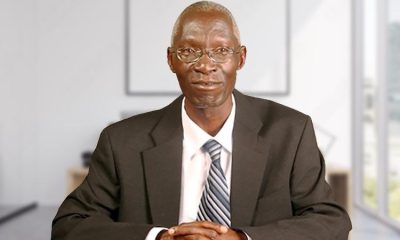

While officially opening the hybrid dissemination workshop held on Wednesday 29th September 2020 in the School of Business Conference Room and virtually, the Principal CoBAMS, Dr. Eria Hisali thanked the Government of Uganda for funding the project through the Makerere University Research and Innovations Fund (Mak-RIF). He equally commended the Principal Investigator (PI), Dr. Eric Nzibonera and his team on successfully completing their project and achieving the set objectives.

Dr. Hisali proposed four options to ensure that the findings from the study reach a wider audience.

- Immediately upload the findings on the College’s new working paper series website, which will enable staff to read the document and provide feedback

- Proceed to transform the working paper into a journal article so as to reach audiences from different parts of the world

- Proactively review curricular in preparation for the possibility of gradually using research from Makerere as part of course outlines and teaching materials.

- Take advantage of the College’s planned framework of engaging policy makers formally through policy labs that will be held every quarter.

Presenting the findings from the project, the PI Dr. Nzibonera thanked the Principal for his advice and his research team for their hard work. Other members of the team that sampled 430 heads of households included the Dean School of Business Dr. Godfrey Akileng and Ms. Hellen Nambi.

“Financial Inclusion is a process through which financial services are delivered to the disadvantaged and low-income sections of the society on a timely basis and at affordable costs” defined Dr. Nzibonera, adding that “the relationship between financial inclusion and poverty alleviation has been widely discussed but only few studies explore the effect of financial inclusion on household welfare.”

He therefore shared the twofold objective of the project as; to establish the extent to which the rural households engage in financial inclusion and to examine the nature of household welfare and establish the extent to which financial inclusion enhance households’ welfare. The latter, he noted, would help guide policy recommendations to the Government and private sector.

Dr. Nzibonera noted that financial inclusion is measured through establishing the extent of availability and accessibility to financial services, affordability, usage and quality of financial products. He added that household welfare is improved through access to quality education and health services, improved shelter, food production and consumption as well as access to information.

The findings on availability and accessibility to financial services revealed an interesting pattern. “Whereas households still find it hard to access formal financial services for savings and deposits’ and services provided by bank agents are irregular, they easily access mobile money services for withdrawals and payments” he shared.

In terms of affordability, findings revealed that although the cost of accessing financial institutions and withdrawing funds from mobile money agents is still high, the cost of accessing financial services through bank agents and carrying out financial transactions through financial institutions is affordable.

Investigations into the usage and quality of services showed that households find it easy to use mobile money and village SACCOs to make deposits and payments for school fees. Despite the ease of use, households find it hard to save with banks, microfinance institutions and SACCOs.

“The accounts opened in banks and SACCOs are not frequently used and the services offered by banks or their agents are not regular” added Dr. Nzibonera.

The research team’s findings showed that financial inclusion has partly enhanced the welfare if households in Busoga.

“The study revealed improvement in income levels as a result of accessing loans from financial institutions and SACCOs. The number of school going children has also increased as a result of borrowing opportunities from SACCOs” said the PI.

Dr. Nzibonera added that although it is easy for households to access information about financial services relevant for welfare improvement, “there is limited income to enable households gain access to good healthcare and carry out construction.”

The team therefore made the following policy recommendations;

- Financial and microfinance institutions should employ agents to at least every parish or sub-county to grant households easy access to financial services.

- Government through District commercial officers should encourage households to organise into village savings and credit cooperative organisations (SACCOs) at parish level and identify unique financial products that promote savings and investments for different groups.

- Government agencies such as the Micro Finance Support Centre and Operation Wealth Creation (OWC) should partner with private financial institutions to organise financial literacy trainings for households on how to save as well as identify and invest in productive investment ventures.

- The cost of financing should be reduced to rates that are affordable by households. This will improve household income for both consumption and investment.

- Financial institutions should design financial products that would enable households to access funds for construction as long as there is a clear payment plan and evidence of source of income for loan repayments.

Speaking on behalf of the Mak-RIF Grants Management Committee (GMC) Chairperson Prof. William Bazeyo, Dr. Helen Nambalirwa Nkabala congratulated the research team upon the successful dissemination and thanked Dr. Hisali for proposing policy labs as a means of engaging policy makers.

She urged Dr. Nzibonera as a firsthand witness on the state of financial inclusion to go beyond the policy recommendations and draft a successor project proposal on solutions that can clearly and precisely take financial inclusion at the grassroots level to the next level.

“You are the right people to guide Government on what unique product the community will get and how it will help improve their financial knowledge” she recommended.

Dr. Nkabala thanked the Government for funding research and innovations that inform national development priorities and the University Management for creating an environment conducive to conducting research. In the same breath she thanked the GMC for providing oversight and the GMC Secretariat for ensuring that the projects run smoothly.

“This is a clear example of taking the Ivory Tower to the community” she concluded.

Representing Mr. John Peter Mujuni, Executive Director, Microfinance Support Centre (MSC) and Chief Guest at the dissemination, Mr. Godfrey Mangeni thanked the research team for a job well done, and pledged take the findings and policy recommendations very seriously.

“Please share these findings so that we can work with you in other areas like Bukedi and Karomoja to improve our services” he remarked.

Mr. Mangeni shared that there still remains a lot of work to be done to support Government’s Parish Development Model in the Busoga region despite MSC’s zonal office in Jinja and a satellite office in Iganga and as such, called upon researchers from Makerere to share their expertise.

Delivering the concluding remarks, Dr. Akileng in his dual capacity as Research Team member and Dean noted that Financial Inclusion is an important topical issue for national development and therefore expressed happiness that the Government had found it fitting to fund the project.

“As a nation, we need to reflect reflect on Government interventions aimed at addressing gaps of financial inclusion that financial institutions have not been able to fill” he rallied. This reflection, he said, ought to be guided by the question ‘Where have been the successes in social impact and where have been the failures?’

He noted that although Financial Technology (FINTECH) is the buzzword when it comes to improving service delivery, its success is hinged on how easy it will be for end-users at the grassroots level to adopt the various solutions offered.

“I believe that a highly informed community with the ability to easily access financial services and mobilise savings is key to the improvement of household earnings as well as boost demand and productivity in the country” he added.

In the discussion that preceded the concluding remarks, Mr. John Emoi, the Manager Investments at Uganda Development Bank who joined the conversation virtually had expressed his organisation’s keen interest in the days topic and research findings. Particularly, he had urged the research team to include the development of FINTECH models as a means of disseminating financial services among their policy recommendations.

In conclusion, Dr. Akileng called for affirmative action for business teaching institutions, “Business touches every sector and it is important to appreciate that if we must make money in any sector, we must understand business.”

You may like

-

Simplicity, Service & Scholarship: Hallmarks of Professor Livingstone Luboobi’s Legacy

-

EfD-Mak Holds 2nd Advisory Board Meeting: Charts Path for Growth

-

Public University Legal and Accounting Officers Trained on Governance and Compliance

-

Celebrating the Life of Prof. Livingstone Sserwadda Luboobi

-

Fare Thee Well Prof. Luboobi

-

Strengthening Grants Management Through Institutional Collaboration and Capacity Building

Business & Management

EfD-Mak Holds 2nd Advisory Board Meeting: Charts Path for Growth

Published

13 hours agoon

July 18, 2025By

Jane Anyango

KAMPALA, Uganda | July 16, 2025. The Director of the Environment for Development Initiative–Makerere University Centre (EfD-Mak), Prof. Edward Bbaale, outlined key achievements, challenges, and future plans during the 2nd Advisory Board Meeting held at Makerere University with members calling for expanded scope and sustainable funding for the center’s activities.

The Advisory Board comprises 13 members drawn from Makerere University, government ministries and agencies, civil society, and the private sector. The Board’s role is to provide oversight and strategic guidance to EfD-Mak.

The EfD-Mak Centre is part of the global Environment for Development (EfD) network, comprising 15 research centers worldwide. It aims to promote evidence-based environmental policy through interdisciplinary research, academic training, and stakeholder engagement.

Addressing the board, Prof. Bbaale highlighted the center’s progress since its inception in 2019, including impactful policy engagement, capacity-building programs, and pioneering research in environmental economics.

“Our journey started in Vietnam when Makerere University was formally admitted into the EfD network. Since then, we’ve worked toward a mission of promoting inclusive growth and environmental sustainability,” said Prof. Bbaale.

Chaired by Prof. Buyinza Mukadasi, Makerere’s Academic Registrar and Acting Deputy Vice Chancellor (Academic Affairs), the meeting also welcomed the new Deputy Director of EfD-Mak, Dr. Alice Turinawe, who replaces Prof. Johnny Mugisha.

Prof. Bbaale reported significant growth in research output, including over 150 publications and collaborations with national and international bodies such as the National Environment Management Authority (NEMA), the National Planning Authority, and the Ministry of Finance. The center is currently implementing projects on forestry, climate finance, and sustainable agriculture with partners across Uganda and the wider EfD global network.

The center’s interdisciplinary approach, drawing researchers from the Colleges of Business and Agricultural Sciences, was praised for its alignment with Makerere’s research strategy.

Notably, the center has launched a new Master’s in Economic Investment Modeling, designed to integrate climate variables and natural capital into macroeconomic frameworks. “This is a timely addition as the world looks for tools to understand the economic impact of climate change,” said Bbaale.

The center has intensified policy engagements through dialogues and training programs for government officials, focusing on environmental valuation, energy transitions, and macroeconomic modeling. The Inclusive Green Economy (IGE) program, funded by SIDA, has trained senior policymakers across East Africa on sustainable finance and green transition strategies.

EfD-Mak also played a role in shaping Uganda’s National Development Plan IV, with several fellows contributing to mainstreaming environmental concerns such as clean cooking and e-mobility.

“We were proud to be recognized as a runner-up globally for policy influence on clean cooking,” Bbaale noted, adding that Makerere’s visibility within the EfD network and international platforms continues to grow.

Despite the progress, Prof. Bbaale cautioned against over-reliance on a single funder, the Swedish International Development Cooperation Agency (SIDA), stating that diversified funding is essential for sustainability.

“While SIDA remains our main supporter, we recognize that this model is not sustainable in the long term,” he said, urging the board to support efforts to secure institutional status for the center within the university’s research policy framework.

For 2025, EfD-Mak will focus on climate-smart agriculture as a thematic policy dialogue and strengthen its footprint in local government engagement. A grant targeting environmental valuation at the local level and a new project on macroeconomic modeling for climate resilience are expected to launch.

Prof. Bbaale also cited a clean audit and positive external evaluation as indicators of the center’s strong governance and operational efficiency.

Quoting Pope Francis, he closed with a warning on the urgency of environmental action: “God always forgives. Men sometimes forgive. But nature never forgives.”

Board Chairperson Calls for Stronger Alignment with SDGs and Inclusivity in Research Programs

Prof. Buyinza Mukadasi, Chairperson of the Advisory Board called for deeper integration of the Sustainable Development Goals (SDGs), inclusivity, and results-based reporting in the Centre’s research and academic programs.

Prof. Buyinza congratulated the EfD-Mak team led by Director Prof. Edward Bbaale on their notable achievements across academic training, research, and policy engagement.

“We want to congratulate you and your entire team for all the academic and impact achievements you have made,” Prof. Buyinza said. “You can clearly see the success at the academic training level, at the research level, and policy engagement. These are strong pillars of your program.”

However, the Chairperson emphasized the need to explicitly link the Centre’s work to Uganda’s national development agenda and global frameworks.

“What we want to see more of in future presentations is a clear connection to the Sustainable Development Goals,” he said. “Any investment going into research or human capital development must be traceable to the SDGs and the National Development Plan. This is essential, especially when responding to expectations from institutions like the National Planning Authority.”

Prof. Buyinza also urged the Centre to enhance inclusivity in its fellowship and research programs by targeting underrepresented groups, including students and researchers with special needs.

“You are doing well with your agenda and research priorities, but now it is time to move further toward inclusivity,” he said. “Let’s also see data on gender representation and the involvement of individuals with special needs. That would reflect equitable capacity development.”

He applauded the Centre’s results-based management approach and its focus on tangible outcomes. “I’m happy you did not dwell on challenges,” he added. “It shows maturity and strategic focus.”

Prof. Buyinza concluded by inviting reflections from other board members on areas where the Centre could improve, encouraging a collaborative approach to continuous development.

Board Members Call for Stronger Private Sector Links, Local Engagement, and Global Positioning for EfD-Mak Centre

Members of the Advisory Board for the Environment for Development Initiative praised the Centre’s achievements in research and policy influence but called for greater integration with the private sector, deeper engagement with local development initiatives, and enhanced visibility on the global stage.

Several board members shared constructive feedback following a presentation by the Centre’s Director, Prof. Edward Bbaale, outlining the Centre’s milestones and strategic direction.

Julius Byaruhanga representing the Private Sector Foundation Uganda (PSFU), applauded the Centre for bridging the gap between academia and policymaking but urged for a similar approach with the private sector.

“Much of the research generated in academia doesn’t speak to private sector investment,” Byaruhanga said. “We need partnerships that show how climate and energy research can guide private sector financing, especially around energy efficiency.”

He proposed collaboration between EfD-Mak and PSFU in energy efficiency and policy advocacy, noting PSFU’s experience with several donor-funded projects and its role as the apex body influencing government policy on behalf of the business community.

Onesmus Mugyenyi, from acivil society organisation, emphasized the need for coordination among actors working on similar thematic issues, especially in policy advocacy.

“When we don’t coordinate, we duplicate efforts and end up with incomplete or stuck projects,” Mugyenyi said. “Mapping stakeholders and integrating practitioners into training would greatly enhance both policy impact and student learning.”

He also stressed sustainability and advised leveraging the Board’s networks to support resource diversification and long-term institutionalisation of the Centre’s initiatives.

Dr. Sam Mugume, representing the Ministry of Finance, recognized the Centre’s contribution to national capacity building, particularly in climate finance and macroeconomic modeling.

“You’re doing important work,” Mugume said. “But we now need to scale up and integrate your training and modeling capacity into broader macroeconomic planning for climate resilience, both nationally and at the African continental level.”

He noted the Ministry’s current engagement with a coalition of African finance ministers on climate action, urging the Centre to establish itself as a key academic partner in that process.

Apollo Kagwa, from the National Planning Authority (NPA), commended the Centre for its academic rigor but highlighted the need for grassroots relevance.

“EfD-Mak still operates at a high level,” Kagwa observed. “We need to bring its research down to address real issues in communities—how does it inform programs like the Parish Development Model (PDM)?”

He proposed the Centre tap into government consultancy opportunities and leverage alumni networks to generate internal revenue. Kagwa also encouraged participation in global climate policy spaces, such as the upcoming COP meeting in Brazil, and to develop capacity in climate economics.

Chairperson Prof. Buyinza Mukadasi welcomed the feedback and praised board members for offering actionable insights.

“These are excellent observations,” Prof. Buyinza said. “The next phase must involve deepening our links with the private sector, coordinating better with government and civil society actors, and preparing to expand our impact from local to global levels.”

Jane Anyango is the Communication Officer EfD Uganda.

Business & Management

Makerere’s PIM Centre Concludes Training on Certificate of Financial Implications (CFI)

Published

7 days agoon

July 12, 2025

July 11, 2025 | Jinja, Uganda

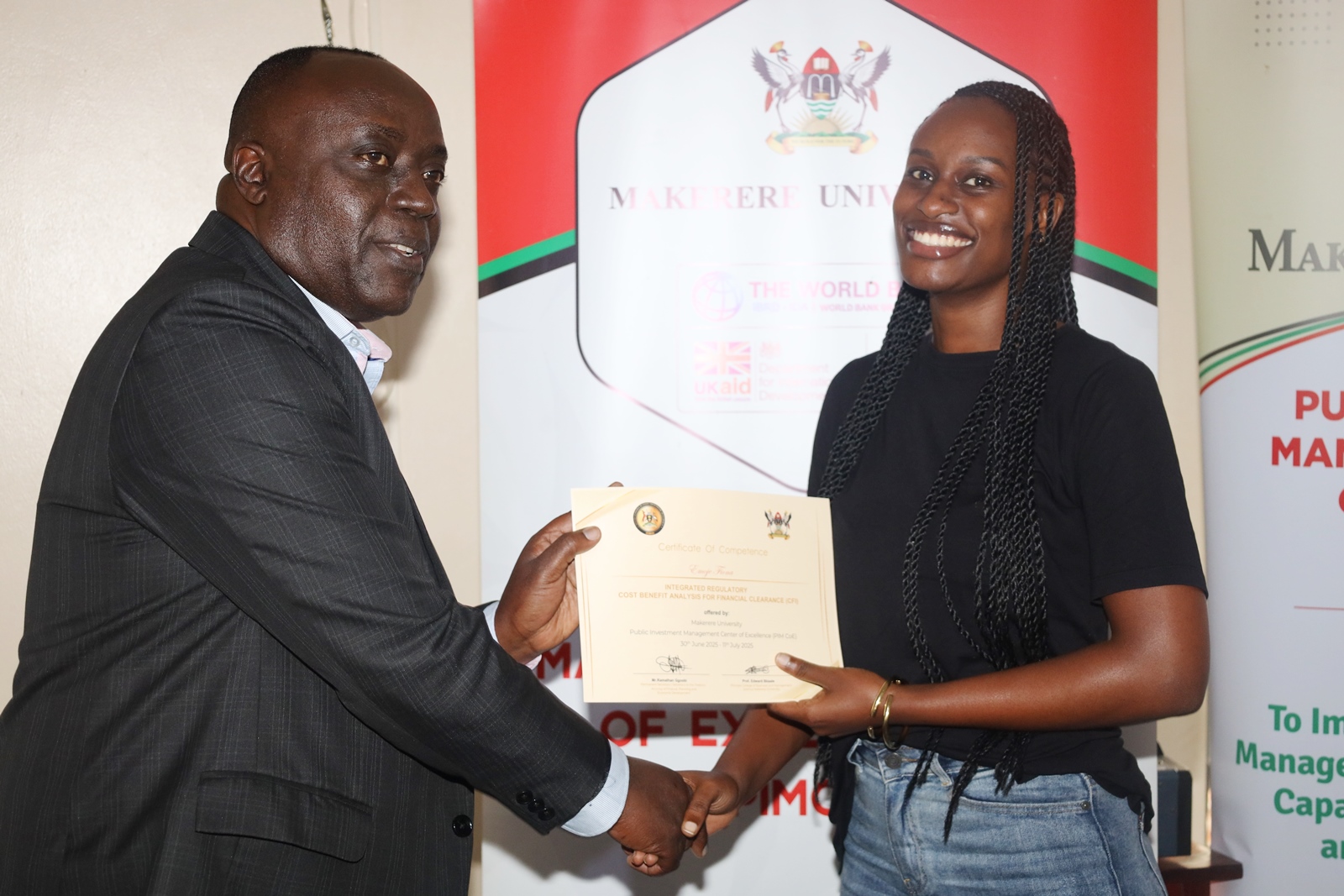

The Public Investment Management (PIM) Centre of Excellence at Makerere University successfully concluded a two-week training on the Certificate of Financial Implications (CFI) – Integrated Regulatory Cost-Benefit Analysis, equipping 34 economists from various Ministries, Departments, and Agencies (MDAs) with critical policy evaluation and fiscal analysis skills.

The closing ceremony, held at the Pearl on the Nile Hotel in Jinja on July 11, 2025, marked a significant milestone in Uganda’s public finance management reform agenda. Participants received certificates in recognition of their commitment and newly acquired competencies under the revised Guidelines for Financial Clearance, which took effect on July 1, 2025.

Commissioner Paul Mwanja, who represented the Permanent Secretary and Secretary to the Treasury, officiated the ceremony. In his remarks, he commended participants for their dedication despite the demanding timing, coinciding with the financial year-end and the launch of the Fourth National Development Plan (NDP IV). He emphasized that the training comes at a critical moment as Uganda enters a growth-focused fiscal year and prepares for the 2026 general elections.

“The Revised Guidelines for Financial Clearance mark a paradigm shift towards a more data-driven, transparent, and inclusive approach to policy and legislative evaluation,” Mwanja stated. “You are the first wave of reformers. Go back as champions, create demand for quality analysis, and drive the change we want to see.”

The CFI training was designed to deepen participants’ ability to assess the financial and economic implications of government proposals, identify potential winners and losers, and design safeguards for vulnerable groups. It also aims to strengthen MDAs’ capacity to prepare their own Statements of Financial Implications and align with Regulatory Impact Assessments.

Representing the PIM Centre, Prof. Ibrahim Mike Okumu, Dean of the School of Economics at Makerere University, lauded the Ministry of Finance, Planning and Economic Development (MoFPED) for its foresight in establishing the Centre in 2023. He described the training as a powerful response to Uganda’s triple policy challenge: scale, scarcity, and speed.

“This certificate program doesn’t just teach you to ask if a project is beneficial,” Prof. Okumu said. “It trains you to assess whether it is beneficial, affordable, and resilient in real-world fiscal contexts. That is how we build trust in public spending and deliver smarter infrastructure, services, and jobs.”

Prof. Okumu also charged graduates to apply their skills at project, portfolio, and policy levels—prioritizing value for money, institutionalizing evidence-based decision-making, and mentoring future cohorts. “Go forth and make every shilling count,” he concluded.

The Ministry announced that the next CFI training cohort will commence in August 2025, as part of a nationwide rollout to ensure all government institutions are staffed with analysts capable of implementing these reforms. The long-term goal is to establish a government-wide foundation of professionals committed to fiscal discipline, data integrity, and evidence-based policymaking.

The event closed with optimism and a renewed commitment to strengthening Uganda’s public finance systems through knowledge, rigor, and reform-minded leadership.

Business & Management

School of Business Conducts Strategic Leadership Training for Makerere University Managers

Published

2 weeks agoon

July 8, 2025

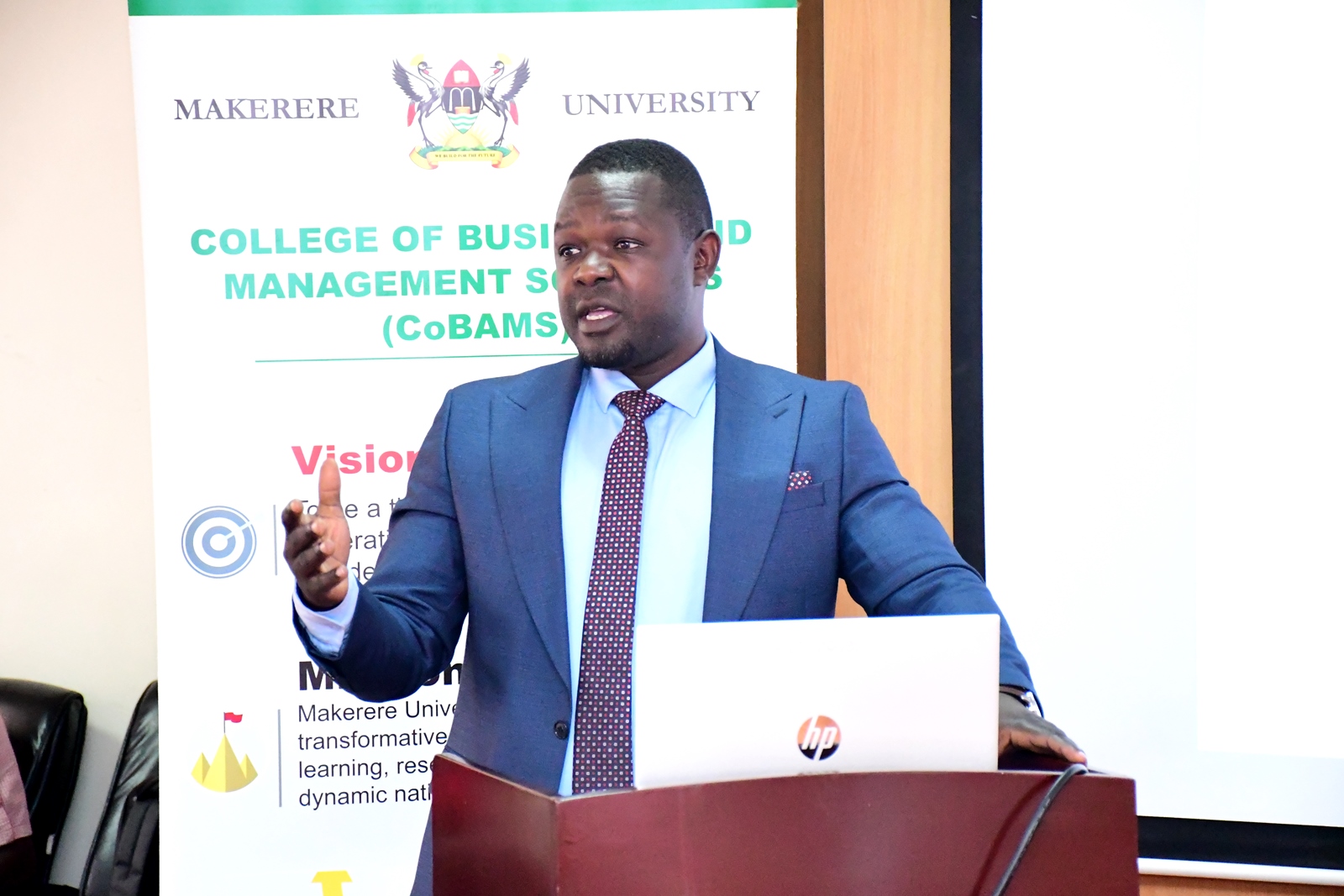

Makerere University School of Business under the College of Business and Management Sciences (CoBAMS) is conducting a five-day strategic leadership training for the first cohort of University managers.

The Executive training (7th to 11th July 2025) for middle and top level managers seeks to foster leadership capacity in line with the University’s strategic goals. The participants nominated from the different units within the University include: Deputy Principals, Deans, Heads of Departments, and Heads of sections in Administrative Units.

The Strategic Leadership course covers critical areas such as Strategic leadership overview and contemporary issues, Driving strategic leadership to promote organizational performance and success, Leading people in Organizations, Organizational culture and productivity, Strategic Communication, and Organizational change and development.

The course is delivered by seasoned facilitators from the School of Business, the private sector, industry and business community namely Associate Prof. James Wokadala, Associate Prof. Godfrey Akileng, Dr. Martin Bakundana, Dr. Sam Eyamu, Dr. S.B. Wanyama, Ms. Irene Nayera, Mr. Henry Rugamba, and Mr. Ronald Bbosa.

Addressing the participants, the Dean-School of Business, Associate Prof. Godfrey Akileng pointed out that learning was a continuous process, stating that the training was aimed at fostering professional leadership development and lifelong learning.

He elaborated that the training brings on board university leaders who are entrusted with managing people. Emphasizing that people are the most important resource in an organization/institution, the Dean highlighted the need to train and equip those managing offices, with strategic leadership knowledge, skills and values.

Unpacking the concepts of leadership and management, Associate Prof. Akileng revealed that most organizations need leaders, and not managers. In light of this, he stated that most business schools in the world were emphasizing leadership more than management. He explained the paradigm shift from traditional management practices to leadership-focused training, with a special call to leaders to always adapt and navigate complex organizational environments.

The Principal of the College of Business and Management Sciences, Prof. Edward Bbaale, represented by the Deputy Principal-Associate Prof. James Wokadala underscored the College’s pivotal role as a hub of excellence in Business, Economics, and Management. The Principal highlighted the growing significance of strategic leadership in today’s academic and professional landscapes, noting that even seasoned leaders must continue evolving in their leadership practices.

Sharing his lived experience, Associate Prof. James Wokadala, disclosed that a significant number of people entrusted with offices or managerial positions fear to make decisions. “One of key challenges faced by several organisations and universities is the fear by leaders and managers to take bold decisions. To address this challenge, this strategic leadership training conducted by the School of Business has been designed to empower you, with knowledge and skills in strategic decision making,” he stated.

The Coordinator of Partnerships and Collaboration, Dr. Martin Bakundana highlighted the importance of the program in developing leadership skills in a dynamic business environment. He acknowledged the growing relevance of leadership concepts such as transformational and thought leadership.

“We are at a turning point in the world of leadership, and it is essential for Makerere University to prepare its leaders for the challenges ahead,” Dr. Bakundana said. He encouraged participants to engage with the support team throughout the training, reinforcing the collaborative nature of leadership development. Dr. Bakundana is a Lecturer in the Department of Accounting and Finance, School of Business, at the College of Business and Management Sciences.

The remarks from the aforementioned University officials, set the pace for the training sessions. The first day featured two topics: Strategic Leadership Overview and contemporary issues by Associate Prof. Godfrey Akileng, and Driving Strategic Leadership to promote Organizational performance and success by Dr. Sam Eyamu.

Presenting the Strategic Leadership overview and contemporary issues, Associate Prof. Akileng tackled the following: The concept of change and the need to adapt, disruption being the new normal, strategic leadership styles, strategic leadership skills, as well as the principles of strategic leadership.

He kicked off his presentation by a powerful quote that enabled the audience to understand and appreciate the current business terrain. “We stand on the brink of technological revolution that will fundamentally alter the way we live, work, relate to one another. In its scale, scope and complexity, the transformation will be unlike anything humankind has experienced before,” Klaus Schwab Founder and Executive Chairman World Economic Forum.

Associate Prof. Akileng stated that change is a fact that is inevitable in our lives, with the landscape in which we work, constantly changing. He mentioned that organizations/institutions as well as Organizational settings do change, which necessitates leaders and staff to adapt to the trends by doing things differently. “I implore the leadership and staff to change the way they do things, if we are to survive,” he said.

Acknowledging that disruption is the new normal, he encouraged the participants to confront VUCA situations through strategic decision making. Coined in the early 2000’s, the military-derived an acronym-VUCA, which stands for Volatility, Uncertainty, Complexity and, Ambiquity.

Cognizant that change is inevitable, and that VUCA situations are prevailing in most organizations and business settings, Associate Prof. Akileng introduced the different strategic leadership styles namely transformative, visionary, transactional, and collaborative. He challenged the participants to apply the best leadership style or a blend of them.

For instance, Associate Prof. Akileng advised the middle and top level managers to utilize the collaborative leadership style when marketing a brilliant idea or an innovation. “You must work with others or behind the scenes to ensure that those in authority understand and support your idea.”

Drawing on lessons from past industrial revolutions, Associate Prof. Akileng emphasized that embracing technological advancements is critical for staying relevant. “History shows us that industries that failed to adapt to new technologies inevitably failed to compete,” he remarked.

Specific to education, he explained that COVID-19 disrupted teaching and learning. He added that most of the Universities in Africa that were pre-dominantly delivering lectures through physical interaction had to change and adapt to the terms and conditions dictated by the new normal. Universities embraced blended learning in order to overcome the disruption that threatened their comfort zones and preferred way of doing things.

He cited Makerere University, which deployed a blend of transformative, participant, and collaborative strategic leadership styles to rejuvenate its online learning systems/platforms. The Office of the Deputy Vice Chancellor (Academic Affairs), the College of Education and External Studies through its Institute of Open, Distance and e-Learning (IODel) worked with Colleges and the Directorate of ICT Support services (DICTS) to bring on board academic staff.

The Dean, School of Business indicated that the new normal in university education involves integration of online teaching, digital pedagogies, artificial intelligence (AI), Virtual Reality (VR), and Augmented Reality (AR) in teaching and learning, research and community engagements.

He called upon the participants to take into account the following strategic leadership skills: Foresight, curiosity, decisiveness, active listening, communication and diplomacy. He stressed that active listening is a key skill for a strategic leader.

Tackling the principles of Strategic leadership, the Dean-School of Business pointed out that strategic leaders are always on the top. He added that strategic leaders are innovative individuals, who are always pushing through brilliant ideas.

He notified the participants that strategic leaders take on the format of an eagle. “You must have a great vision with ability to navigate stormy turbulence, exhibit fearlessness, take the initiative, and have a high sense of self determination.”

Presenting to the participants, Dr. Sam Eyamu, from School of Entrepreneurship and Management at Kyambogo University, provided insights into strategic leadership with an emphasis on organizational performance. He defined leadership as the ability to create a lasting legacy through collaboration. “Effective leadership inspires and unites teams, ensuring that their collective efforts have a long-term impact,” he said.

Dr. Eyamu guided that strategic leaders must work with others, be able to influence, and must create change. He articulated that strategic leaders should embrace Artificial Intelligence (AI). He advised university leaders and staff to accept that AI is the new normal, and work together to come up with policies and approaches on the integration of AI in the university systems and processes.

He added that strategic leaders should be resilient with ability to survive and lead the team to the desired goal. He called upon the participants to set goals, use key performance indicators, come up with work plans, score cards, and among other methods that measure performance. He introduced several tools designed to align strategy with performance, including the Balanced Scorecard, Objectives and Key Results (OKRs). Dr. Eyamu disclosed that celebrating small successes can accumulate into significant organizational momentum.

Dr. Eyamu highlighted two distinct leadership approaches: Rapid Fire Leadership, which encourages trying multiple strategies quickly and the Sniper Leadership that focuses on a more deliberate and calculated approach.

He argued that both approaches are valid depending on the available resources, with resilience and persistence being key to success in either model. He also emphasized the importance of clear strategic direction, ensuring that all team members understand their roles in achieving organizational goals.

Additionally, Dr. Eyamu stressed the critical importance of performance measurement tools, such as Key Performance Indicators (KPIs), work plans, and the Balanced Scorecard, to track progress toward strategic goals. He introduced performance dashboards, which provide real-time data, and benchmarking, which allows organizations to compare their performance with industry best practices.

Dr. Eyamu introduced the Triple Bottom Line (TBL) framework, which balances social impact, environmental sustainability, and financial performance. He said that organizations must take a holistic approach to success, considering more than just the financial outcomes.

Presenting the practical tips for success, he encouraged the participants to; adopt a performance measurement framework and tool, foster and reward a culture of accountability and results, lead by example, be transparent by ensuring a consensual decision-making process, and empower team members through delegation of duties and trusting them to deliver.

The first day of the Strategic Leadership Training ignited the strategic leadership potential of the participants, which involves getting out of the comfort and safe zone, to champion the transformation at the institutional or Unit levels. The University leaders and participants in general, were encouraged to take charge by being alert, studying the times and trends, as well as coming up with innovations and strategies to create a positive difference.

The Strategic Leadership Training was moderated by Dr. Martin Bakundana-Coordinator of Partnerships and Collaboration assisted by Ms. Ritah Namisango-Principal Communication Officer.

Trending

-

General2 weeks ago

General2 weeks agoRe-advert: Admission to Undergraduate Programmes 2025/2026

-

General1 week ago

General1 week agoRe-Advert for Applications for Diploma and Certificate Training

-

General5 days ago

General5 days agoMakerere University Fees Waiver for 40 First Year Female Students 2025/2026

-

General2 weeks ago

General2 weeks agoPress Statement on Ranking

-

Health1 week ago

Health1 week agoCall for Applications: Responsible Conduct of Research (RCR) Training Course