General

EfD-Mak hosts the Annual Policy Day 2022 with a special call on Governments & donors to Finance Resilience & Adaptation

Published

3 years agoon

By

Jane Anyango

Uganda is among the most vulnerable countries to the effects of climate change in the world, being the 15th most vulnerable and 49th least prepared to adapt and recover from impacts of climate change.

Environmental economics from Makerere University and stakeholders from Environment and Natural Resources agencies have expressed the need for green financing for sustainable development, Optimum utilization of natural resource, Adaptation to climate change impacts, Increased climate change mitigation measure actions and Reduction in public expenditure on related natural disaster shocks.

The call was made was during the Annual Policy Day 2022 organized by the Environment for Development Initiative (EfD-Mak Centre) under the theme, “Green Financing and Capacity Gaps”.

The policy dialogue attracted over 100 participants from the academia, policy makers, experts and representatives from Uganda’s Ministries, departments and agencies, Civil Society Organisations, the private sector as well as members from the World Bank, the EfD network, and the EfD Global hub led by the EfD Global Director Prof. Gunnar Kohlin.

The Annual policy day was a wrap up of the EfD Annual conference 2022 hosted by Makerere University at the Speke resort Munyonyo on 22nd-26th September, 2022 where participants had fruitful engagements intended to find solutions to the most pressing environmental problems affecting the continent.

The annual policy day was officially opened by the EfD-Mak Advisory Board Chair, who is also the Deputy Vice Chancellor in charge of Academic Affairs of Makerere University.

“The EfD-Mak Centre is proud to be part of the global network of environmental economics research centers working to solve the world’s most pressing environmental and development challenges through policy-relevant research, capacity development and policy engagement. Allow me, at this juncture, to sincerely thank our long term partner – Sida, as well as the EfD Global Hub for having established an EfD Centre at Makerere University”, Kakumba said.

Annual policy day and theme timely for centennial celebrations and climate change

Kakumba said, the Annual policy day is significant on two fronts in that it comes to fit in a series of activities and celebrations marking Makerere University’s 100 years of excellent services to humanity:-having opened its doors to only 14 students in 1922, Makerere University has grown to become one of the most prestigious Universities in Africa and the world over.

Secondly, Kakumba noted that the theme of the policy day, focusing on Green Financing and Capacity gaps, is quite timely especially during this time when climate change is seriously affecting different parts of the world, including Uganda as witnessed by the changed weather patterns.

“There is a great need for Government and development partners to finance resilience and adaptation activities or projects. However, I must note that resilience and adaptation are new areas. Hence, governments have not been deliberately allocating resources in their favor.

Therefore, as Makerere University, we have a great task of building the capacity of government officials in these new areas of resilience and adaptation to climate change”, he said.

Kakumba reported that the university held productive engagements with officials from the World Resources Institute (WRI) who are interested in supporting the university to kick-start the Resilience and Adaptation Mainstreaming Programme (RAMP). RAMP is proposed to be a long-term capacity building programme for MDAs to integrate climate risk considerations into their macroeconomics, fiscal, public financial management, procurement, and other processes and research.

In February 2022, Kakumba said, Makerere University signed a MoU with the University Network for Strengthening Macro financial Resilience to Climate and Environmental Change. The Network, whose Secretariat is hosted by SOAS, at the University of London, was established to build capacity in RAMP. This resilience and Adaptation Mainstreaming Programme will complement the inclusive Green Economy Programme for Senior Civil Servants and Policy Makers in Eastern Africa, which we are implementing in collaboration with the University of Gothenburg.

The Deputy Vice Chancellor thanked theEfD Global Hub for not only establishing an EfD-Mak Centre but also working very hard to ensure that all the aforementioned initiatives to the EfD-Mak Centre thrive.

“The EfD-Mak Centre has continuously received funding and equipment from EfD Global Hub to support its administrative and research activities. This has widely contributed towards strengthening the connection between the Centre’s researchers and academicians to policy makers and implementers.

We can now attest to a number of policy engagements that the Centre has conducted, some of which have already resulted in tangible policy reforms and good outcomes. I once again thank the Global Hub for its role towards changing this landscape where we can now collaborate effectively with government officials for research activities, policy discussions and uptake.” Kakumba commended.

Kakumba added that this Annual policy day was in line with a series of policy engagements that the EfD-Mak Centre has implemented since inception. He however, stressed that this wasvery special because the EfD Global Hub Director and the EfD Network members were here in person to contribute to the debate and discourse in the important area of Green Financing.

Green financing and capacity building huge tasks for the university

In his welcome remarks,the Principal Makerere University College of Business and Management Sciences Assoc. Professor Eria Hisali welcomed participants to the EfD-Mak policy day and in a special way welcomed the EfD Global Director Kohlin Gunnar to the EfD-Mak centre thanking him for choosing Uganda to host the EfD Annual meeting 2022 congratulating the network upon successful hosting.

Hisali thanked the board of the EfD-Mak Centre chaired by the Deputy Vice Chancellor Academic Affairs for the continued guidance on the strategic direction of the centre, noting that this was a manifestation that the centre was institutionalized in the university structures.

The Principal appreciated the EfD -Mak centre for its contribution of the visibility of the college and the university at large pledging continued support to the centre activities and urged the centre to take advantage of the infrastructure at the college to conduct activities;

Hisali reported that the college has established a number of facilities that the centre can take advantage of including working paper series, rolled out the policy laboratories at the college that bring together policy makers, implementers, the private sector development partners and researchers to regularly discuss policy related issues.

He expressed hope that the next annual policy day would be handled under the auspices of the policy laboratory noting that the advantage is that it brings together different actors in one place and they contribute to the discussion which increases uptake.

The policy laboratory he said,was also handling a special assignment on behalf of government on the Parish Development Model. He also said the college received notification from Uganda National Council for Science and Technology on the clearance of the college’s institutional review board for purposes of accreditation and going forward whoever wants to go for field activities is welcome to use the college research and ethics committee.

“We are all are alive to the dangers that changes in the environment affects sustainable growth and the future planning. I salute the center for holding the dialogue because the discussions held are not only important but also hybrid providing insights into the problems being faced and what needs to be done in the perspective of financing and capacity gaps that exist..

Green financing as we know, lies at the future of our growth, the future of our existence as human beings both for the current and future generations to come and therefore deserves all the attention;This is important n our context as developing countries because much of our activities in our setting directly depends on nature but also facing a lot of pressure from the ever increasing population”, Hisali stated.

Hisali challenged participants to look at a number of issues including the categorization of the target groups for green financing factions, the most appropriate instruments for the different target groups, the framework for auditing progress and impacts of these interventions and the need to discuss the optimal balance between what needs to be done by the private sector, governments, public sector and other actors.

“With regard to capacity building I also want to agree that we need to build capacity at all levels right from the capacity to domesticate what is enshrined in international conventions into our domestic plans and activities.

But we also need to think about capacity through which we can equip the grassroots actors, the green financing actions are not stopping at the macro national level. These actions have to go up to the grassroot”

Hisali stressed that the issues of capacity gaps was a huge task and asked participants to deliberate and focus on where to start from to create the impact being looking for, how the EfD-Mak Centre can partner with other actors in this space to speed up the capacity building efforts, how to take advantage of the location at the university and mainstream the capacity building initiatives into the curriculum of some of the academic programs and which programs would it be and where to start from.

Other insights according to Prof. Hisali were the need to ask how to take advantage of the internship and outreach activities of the university to build capacity at the grass root level, how to equip these interns to deliver the right message to the grass root actors and whether there is hope for increasing the frequency of the short course capacity building initiatives.

The EfD Global foot print

The Director Global Hub Prof. Gunnar Köhlin said the hub has international researchers and academic institutions involved in research projects with the EfD Centers in the Global South, Africa, Asia and the America and EfD Partners in the Global North. In Africa, it operates in Makerere University, university of Dar es salaam and university of Nigeria, Ghana and other countries

“EfD is based on the frustration that there is so much knowledge in universities and that it so hard to get traction of that research and there is so much gaps to make that happen.

In research and policy interaction the hub provides funds for tailor research results for target groups, creates platforms for interactions and co-production of knowledge.

Under Institutional development, funds are availed for infrastructure and staff investments, mutual learning within the network”, Gunnar explained.

Under research collaboration, Prof. Gunnar said the hub provides Research fund and collaborative research, organizes collaborative research and policy relevant topics and capacity building for different actors.

“The first most fundamental is the need to build capacity of academics in universities but they should also provide the relevant information and build capacity for other actors in their respective societies for these people to work. Provision of information and capacity building is not enough but must work hard to influence policy by organizing collaborative programs,” Gunnar added

He said funds are provided for PhD specialization courses, PhD Program in Climate Economics At the University of Gothenburg and then PhD and MSc program support to the network centres

Prof Gunnar explained that they have implemented a program, Inclusive Green Economy for senior civil servants and policy makers, a capacity development program connecting societal needs with research capacity in five areas of transformation namely Sustainable energy transition, Low carbon transition, Biodiversity transition, Circularity transition, Financing and managing IGE transition

The network has had a number of publications categorized by SDG with highest number on SDG 17 (331) and SDG 15(291)Other programs sponsored include; Blue Resources for Development (BlueRforD), Emission Princing for Development (EPFD), Inclusive Green Economy, Natural Capital Collaboration (Natcap), Sustainable Energy Transition (SETI), Women in Environmental Economics

The Annual Policy Day 2022 very Special

The Director EfD-Mak Centre Prof. Edward Bbaale thanked the participants for honoring the invitation to attend this special policy day;

Bbaale recognised the Director EfD-Global network Prof. Gunnar Kohlin and other network members for coming to Makerere for the first time to engage in the discussion making it very special adding that the centre had previously held policy dialogues with national stakeholders.

Bbaale appreciated the local stakeholders from government ministries, departments and agencies,senior civil servants and policy makers from Uganda for reserving time amidst their tight schedules to attend.

“I also appreciate the panelists . You have started a discourse in the area of green financing which the center will follow up and came up with research projects to create evidence to guide government on policy changes.

There is need for capacity building in the area of green financing in terms of research and training. We need to pay attention to Climate parameters and macro-economic modelling issues and also pay attention in and outside the university on tailored short courses for government and other officials”.

Prof. Bbaale hailed Makerere University management for offering space for the dialogue and the local organising committee for the job well done.

Panelists speak on green financing

The Natural Resources officer Wakiso district Ms. Rebecca Sabaganzi,said Green financing seems to be very far and advocating for it seems far.

“The ENR sector has not been a priority in government programs and budget but this has been slowly and progressively having impact on us and we have been forced to act. There are several policy statements that push us to act but the actual implementation is the issue.

In local governments, however much you advocate for green financing, it’s the councilor’s allowance that come first. Because of the increasing number of policy makers amidst the limited budgeting, advocacy for green financing is not prioritized.

The facilitation to enable meaningful engagements and green financing are limited by budget as government priority is in other sectors such as roads, health and education,”. She said

World Bank representative Victoria Plutshack, Energy Access Project at Duke university observed that Climate Finance’s Adaptation is problematic and not meeting needs of the low and medium income countries.

Victoria noted that Climate investments targeting adaptation have been especially lacking because of, in part, a lack of data and clarity regarding the potential impact of these investments.

“Data-driven financial mechanisms that quantify and monetize adaptation impacts are needed to mobilize climate finance and prioritize development for greatest impact.

There is domestic financing available but is predominantly available in higher income countries and where the private sector play a significant role.

In sub-Saharan Africa, we see climate financing by private companies. Sub-Saharan Africa receives about 100 million dollars from multinational agencies and about 18million dollars from the private sector. In terms of progress it is abit slow but hope that with the proposals and problems faced today the situation will be better,”she said.

Dr. Sam Mugume Koojo from the Ministry of Finance highlighted major challenges facing green financing in Uganda.

“ Challenges of green financing include; Lack of expertise and knowledge in green financing by financial institutions in Uganda. Green financing is not clearly integrated in financial regulatory policies of the country while investments in the green financing areas are not very attractive to private sector. The central bank has not fully internalized the concept, emphasis is mostly on the risk side” He said.

He said the major areas for green financing include: Renewable energy and energy efficiency, Pollution prevention and control, Biodiversity conservation, Circular and blue economy initiatives and Sustainable use of natural resources and land.

He said government has come up with Toolkits for Greening the Financial Sector including the Green finance road map tool, the National task force, Climate and Environ Risk assessment, Disclosure and Reporting, Greening FIs and Corporate green bonds.

Dr. Ronald Kaggwa from the National Planning Authority Uganda reported that the authority develops indicators and NDPIII has a results framework based on three pillars namely;. environment and natural resource, industry and also based on governance.

To harmonise the indicators Kaggwa said they issue planning guidelines at the central level and local government showing results, measurements and what level and targets to achieve.

The authority he added has also the green growth indicators developed.Those guidelines give a good framework on which these indicators are anchored. MDAs are also requested to develop planning frameworks which must be aligned to the NDPIII and Vision 2040 while all sectors contribute to the attainment of the national vision.

“There is a section on monetary framework which has a targets of attaining the broader NDP targets and vision 2040. It is the private sector outside the planning horizon but are influenced through taxation and other financial instruments but are not captured in the planning matrix “ Kaggwa said.

The planning is based on government programs and sector programs are tuned towards attaining common results to allow harmonization of projects and institutional goals working together asa team.

NDPIII also addresses that through program based planning which have targets such as the human capital development and all sectors like health, education, gender contribute to it to harmonise the budgets.

Jane Anyango is the Communication Officer, EfD-Mak Centre Uganda.

You may like

-

Mak 76th Graduation Ceremony: CoNAS Presents 16 PhDs & Best Performing Male Student in the Sciences

-

Medical graduates urged to uphold Ethical values

-

CAES Presents Overall Best Performing Student in the Sciences & a Record 28 PhDs at the 76th Graduation Ceremony

-

Over 9,200 to graduate at Makerere University’s 76th Graduation

-

Philliph Acaye and the Making of Uganda’s Environmental Health Workforce

-

76th Graduation Highlights

The Board Chairperson of the Makerere University Endowment Fund (MakEF), Dr. Margaret Blick Kigozi, has urged graduands in Health and Life Sciences to uphold professional ethics and serve humanity with diligence and compassion.

Her appeal came during the passing out of graduates from the College of Natural Sciences (CoNAS), the College of Veterinary Medicine, Animal Resources and Bio-Security (CoVAB), the College of Health Sciences (CHS) and the School of Public Health (SPH) on Day Two of the 76th Graduation Ceremony of Makerere University.

“Class of 2026, you are now part of the Makerere legacy. Wherever you go clinics, laboratories, farms, boardrooms, or classrooms, you carry this institution with you. Serve your patients with skill and compassion. Care for animals and communities responsibly. Question boldly and keep learning,” Dr Kigozi, said.

Delivering the commencement address, Dr. Kigozi lauded the graduates for their dedication to careers that directly impact lives and communities. She encouraged them to use their knowledge generously and exercise their power gently.

“Your education has trained you to ask better questions. Your humanity must guide the answers. Never forget that behind every chart, every case, every animal, every experiment, there is life. And life deserves care, patience, and dignity. Give every person you come in contact with care, patience and dignity,” Dr Kigozi, noted.

As the graduates embark on their professional journeys, Dr. Kigozi emphasized the importance of cultivating basic business acumen and financial literacy to ensure sustainability in their work.

“You do not need to become accountants but you must be able to read the essentials: understand simple financial statements, budgets and key metrics so you can judge whether a clinic, lab, or program is sustainable. You are encouraged to start your business. There are numerous investment opportunities in your areas of training. You can provide services to our people and create jobs,” Dr Kigozi, said.

She shared candidly how, when she first stepped into leadership, she realised she did not understand balance sheets or budgets well enough. So, she returned to Makerere for short courses to strengthen herself.

“A well-run Hospital, clinic or lab delivers better outcomes, attracts staff, and secures funding. Business savvy is not only about profit, it’s about sustainability and the freedom to serve ethically and effectively. Carry clinical skill with business sense so your work endures and grows,” Dr. Kigozi, noted.

Quoting renowned writer and producer Shonda Rhimes, creator of Grey’s Anatomy, who once reflected that succeeding in one area of life can sometimes mean falling short in another, Dr. Kigozi encouraged women graduates to intentionally balance professional ambition with family responsibilities.

“When one area thrives, another is often under strain. When Navio was graduating from school I had to manage the Presidential Investor Round Table on the same day as Executive Director Uganda Investment Authority. I chose my job and delegated his siblings to attend Navios graduation. I learnt from this. I choose family always after that thing you achieve once and keep forever,” Dr Kigozi, said.

In his speech, the Prof Barnabas Nawangwe, the Vice Chancellor, informed the congregation that Makerere’s ranking on all university ranking platforms has remained stable, placing Makerere among the top 10 African universities and within the top 4.5% globally.

“In the Times Higher Education global ranking, Makerere University made a formidable jump from the 1200-1500 bracket to the 800-1000 bracket. This was no mean achievement and I congratulate all members of the Makerere Community on this stellar performance,” Prof Nawangwe, said.

General

Graduation marks the next phase of accountability, graduates told

Published

1 day agoon

February 25, 2026

“A degree is not a finish line. Graduation is not the end of learning, It is the beginning of accountability,” Prof. Nicholas Ozor, the Executive Director of the African Technology Policy Studies Network Nairobi, Kenya (ATPS), said.

Delivering a keynote address under the theme ‘Knowledge with purpose’, during Makerere University’s 76th graduation ceremony on Tuesday 24th February, Prof Ozor, challenged graduates to see their degrees not as status symbols, but as instruments of responsibility.

In his speech, he painted a candid picture of the world the graduates are stepping into, one marked by climate change, technological disruption, inequality, food insecurity and the rapid spread of misinformation. Yet rather than framing these challenges as obstacles, he described them as opportunities for purposeful leadership.

“Into this world, you step, armed with knowledge, credentials, and potential. Your degrees do not make you better than others. They make you responsible for others,” Prof Ozor, said.

Addressing graduands from College of Agricultural and Environmental Sciences (CAES)

College of Computing and Information Sciences (CoCIS), College of Education and External Studies (CEES) and School of Law (SoL), Prof. Ozor tailored his message to each field of study.

To graduates of the School of Law, he described the legal profession as a moral calling, urging them to use the law to protect the vulnerable and uphold justice with courage.

“Uganda, Africa, and the world do not need lawyers who only know how to argue. They need lawyers who know why they argue. Use the law to protect the weak, not intimidate them. Use your knowledge to defend justice, not delay it. Let integrity define your reputation not merely your résumé,” Prof Ozor, said.

For graduands who might feel that shortcuts will be tempting and silence will feel safer than truth, Prof. Ozor reminded them that justice does not need clever people, but courageous ones.

To the College of Education and External Studies, he underscored the transformative power of teachers, reminding them that classrooms shape nations long before policies do.

“Every nation rises and falls on the quality of its teachers. Never underestimate the power of a classroom. Teach not only for examinations, but for understanding. Teach not only content, but character. Teach learners how to think not what to think. Education is quiet work but its impact echoes across generations,” Prof Ozor, noted.

He called upon graduands from the College of Computing and Information Sciences, to use technology to solve African problems, not merely to imitate foreign solutions.

“Technology is powerful, but it is not neutral. Every line of code carries values. Every system you design affects real lives. Build for inclusion. Build for accessibility. Build for truth. Do not let innovation outrun ethics. The future will not belong to those who know the most technology, but to those who use it wisely,” He noted.

During the ceremony, Prof Ozor announced that the African Technology Policy Studies Network is offering PhD scholarships and postdoctoral fellowships in Artificial Intelligence, inviting deeper collaboration with Makerere.

For graduates of the College of Agricultural and Environmental Sciences, he highlighted their critical role at the intersection of sustainability and survival, calling on them to blend indigenous knowledge with scientific innovation to secure Africa’s food systems and protect its ecosystems.

In closing, he reminded graduands that their integrity will open doors their degrees cannot, their humility will teach them lessons success never will, and their resilience will matter more than their grades.

Five principles to be remembered:

- Embrace lifelong learning. The world changes too fast for static knowledge.

- Choose purpose over comfort. Impact matters more than income.

- Build character before career. Skills get you hired; character sustains you.

- Serve something larger than yourself. Give back to your communities and your country.

- Believe in Africa, and act. Do not wait for solutions from elsewhere. Be the solution.

General

Over 9,200 to graduate at Makerere University’s 76th Graduation

Published

2 days agoon

February 24, 2026

Pomp and colour defined the opening day of the Makerere University’s 76th Graduation Ceremony as thousands gathered to celebrate academic excellence and new beginnings.

The historic ceremony has brought together scholars, families, friends and industry partners in a vibrant celebration of achievement and possibility. Throughout the four-day event, the University will confer degrees and award diplomas to 9,295 graduands in recognition of their dedication and hard work.

Among the graduates, 213 will receive Doctor of Philosophy (PhD) degrees, 2,503 will graduate with Master’s degrees, and 6,343 will earn Bachelor’s degrees. In addition, 206 students will graduate with postgraduate diplomas, while 30 will be awarded undergraduate diplomas.

Of the total number of graduands, 4,262 are female and 5,033 are male. According to Vice Chancellor, this marks the first time in 15 years that male graduands have outnumbered their female counterparts.

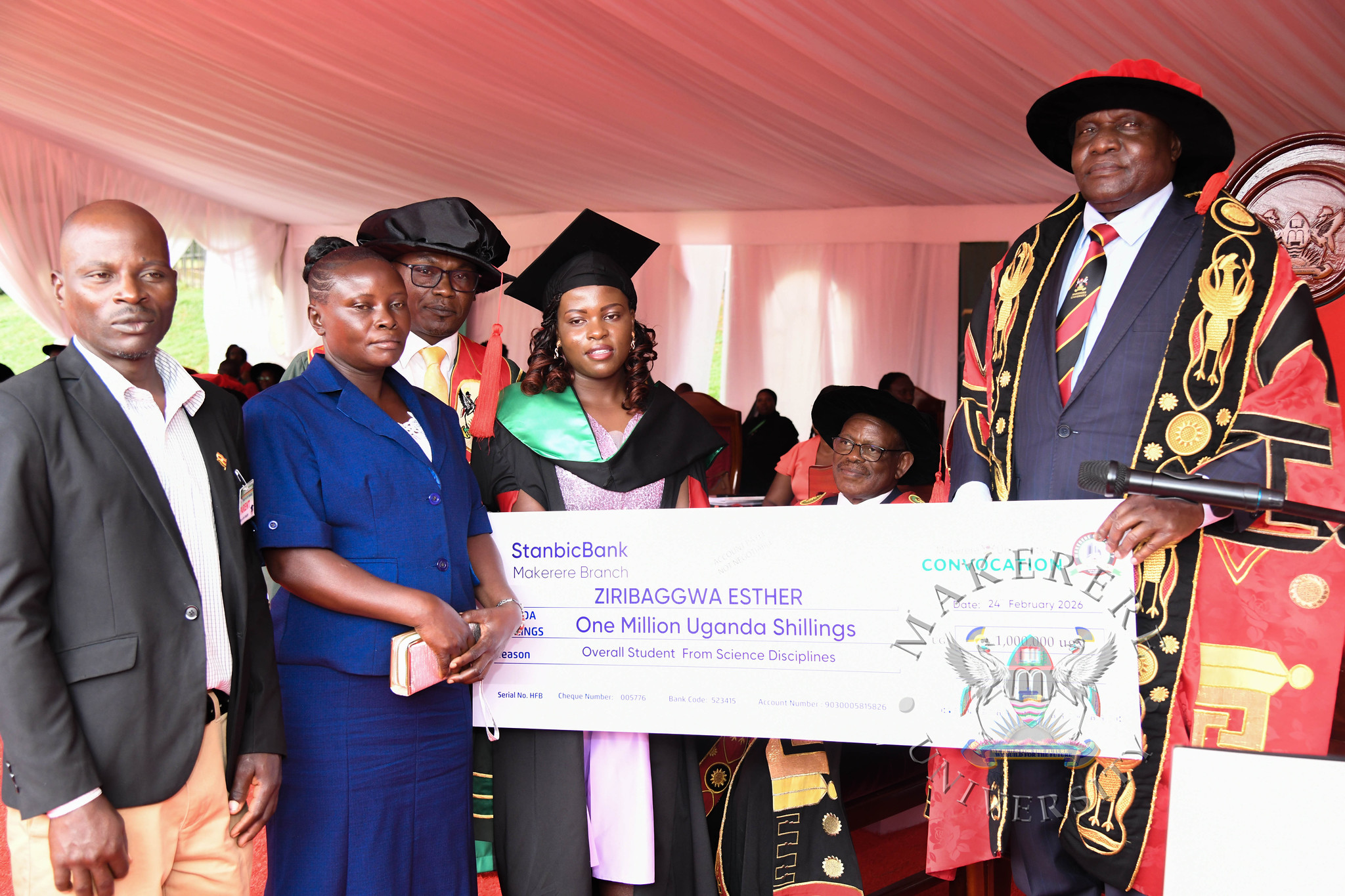

The best overall graduand in the Sciences, Esther Ziribaggwa, graduated on the opening day with the Bachelor of Agricultural and Rural Innovation and an impressive Cumulative Grade Point Average (CGPA) of 4.77.

The ceremony marks a proud moment for Makerere University as it continues to nurture top-tier professionals across diverse fields.

While presiding over the graduation, the State Minister for Primary Education, Hon. Dr. Joyce Moriku Kaducu, on behalf of the First Lady and Minister of Education and Sports, Hon. Janet Kataaha Museveni, pointed out that Makerere University is a model institution, where leaders are nurtured, scholars are sharpened, and where dreams have been given direction.

In her address, Hon. Museveni, highlighted Government’s deliberate investment in research, innovation, and infrastructure to strengthen higher education in Uganda.

“The establishment of the Makerere University Research and Innovation Fund (RIF), supports high-impact research and innovation that directly contributes to national priorities and development. Through this initiative, thousands of researchers and innovators have pursued practical, scalable solutions that are transforming communities and key sectors across Uganda,” Mrs Museveni, said.

The Minister also noted that Parliament’s approved a USD 162 million concessional loan to upgrade science, technology, and innovation infrastructure at Makerere University. The funding will facilitate the construction of modern laboratories, smart classrooms, and state-of-the-art facilities for Engineering and Health Sciences, investments expected to position the University firmly within the Fourth Industrial Revolution.

“Government has embarked on the construction of a National Stadium at Makerere University and other institutions of higher learning across the country. This will promote physical education, strengthen talent identification, and boost investment in the sports sector,”

Turning to the graduands, the Minister encouraged them to see themselves not merely as job seekers, but as job creators and solution-makers.

Uganda and Africa need innovators who will modernize agriculture; engineers who will build quality infrastructure; healthcare professionals who will strengthen health systems; and educators who will inspire the next generation,” the Honourable Minister said.

She reminded graduates that they are entering a rapidly changing world shaped by Artificial Intelligence, climate change, and shifting global markets. To thrive, she advised them to remain adaptable, creative, and committed to lifelong learning.

She also encouraged graduates interested in entrepreneurship to tap into the Government’s Parish Development Model, which provides community-based financing and production support.

Quoting Proverbs 3:5–6, the Minister urged the graduates to trust in God as they embark on their next chapter.

She extended special appreciation to the Mastercard Foundation for its 13-year partnership with Makerere University in expanding access to education and empowering young people in Uganda and beyond.

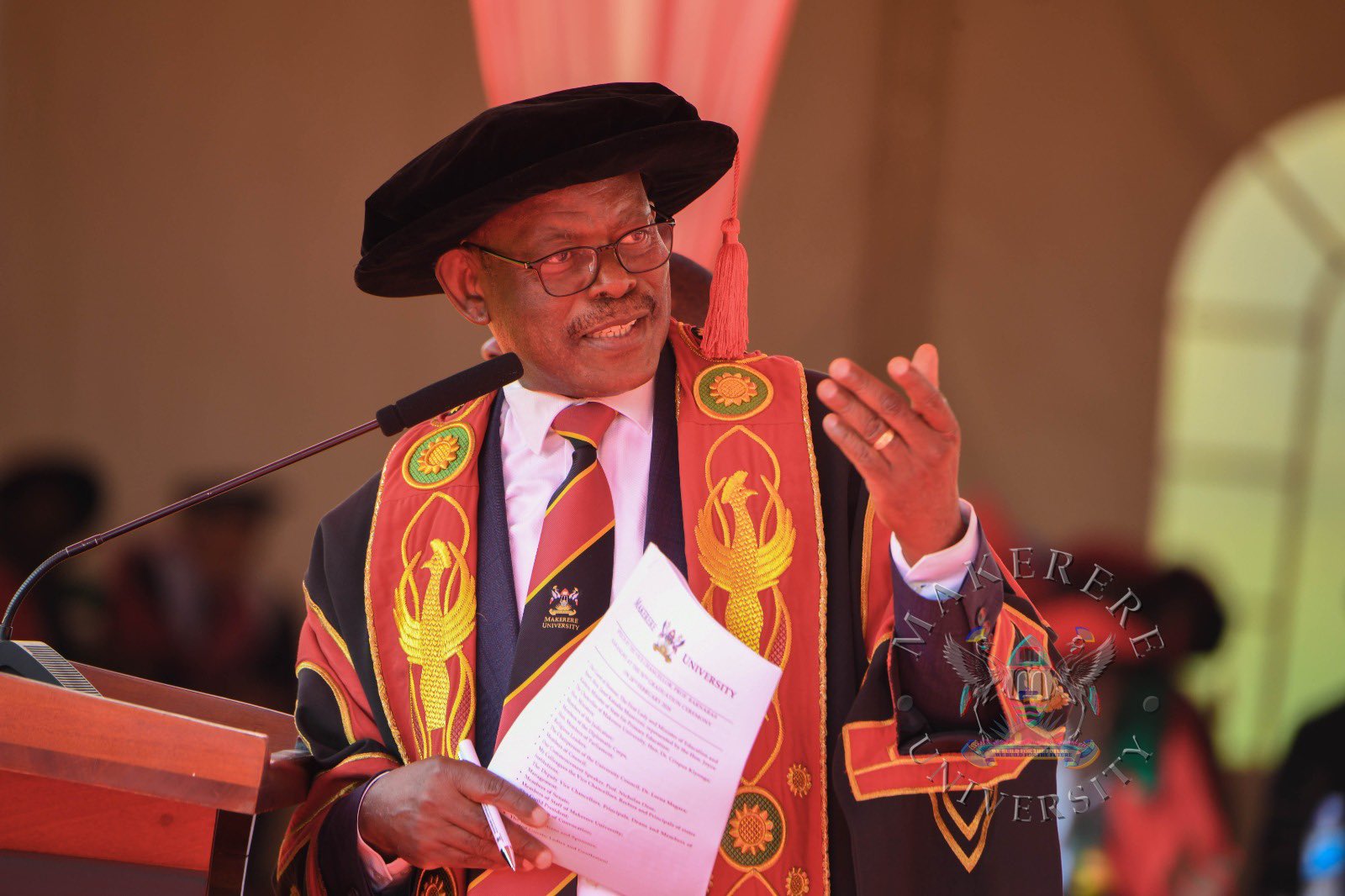

In his speech, the Chancellor of Makerere University, Dr Crispus Kiyonga, urged graduands to harness research, innovation and technology to drive Uganda’s transformation.

“This is a milestone in your lives. You have invested time, discipline and hard work to attain these qualifications. It is important that you derive value from this achievement, not only for yourselves, but for your families and for society.” Dr Kiyonga, said.

Dr. Kiyonga expressed gratitude to the Government of Uganda for its continued financial support to the University, particularly the funding allocated under MakRIF, which he described as critical in strengthening the institution’s research capacity.

“Research plays a very vital role in the development of any community. Makerere as the oldest University in the country is doing a significant amount of research, However, more work is required to mobilize additional resources to further strengthen research at the University.” Dr Kiyonga, noted.

Acknowledging the challenges of a competitive job market, Dr. Kiyonga encouraged graduates to think beyond traditional employment pathways.

“It is true that the job market may not absorb all of you immediately. But the knowledge you have acquired is empowering. You can create work for yourselves, individually or in teams.” Dr Kiyonga, said.

He advised the graduands to embrace discipline, integrity and adaptability in the workplace, and to take advantage of technology and digital platforms to innovate and respond to societal challenges.

“Every development challenge presents an opportunity. Believe that you can apply your knowledge to create solutions with impact.” He said.

Addressing the congregation, the Vice Chancellor, Prof Barnabas Nawangwe, congratulated the graduands, particularly staff and societal leaders on their respective achievements.

“I congratulate all our graduands upon reaching this milestone. In a special way I congratulate the members of staff, Ministers, and Members of Parliament that are graduating today as well as children and spouses of members of staff,” Prof Nawangwe, said.

In his speech, Prof Nawangwe, recognized outstanding PhD students, particularly members of staff. who completed their PhDs in record time without even taking leave from their duties.

He called upon graduates not to despise humble beginnings but rather reflect on the immense opportunities around them and rise to the occasion as entrepreneurs.

“You are all graduating with disciplines that are needed by society. We have equipped you with the knowledge and skills that will make you employable or create your own businesses and employ others. Do not despair if you cannot find employment. Instead, reflect on the immense opportunities around you and rise to the occasion as an entrepreneur,” Prof Nawangwe, said.

Prof Nawangwe called upon the graduands of PhDs to use their degrees to transform the African continent.

“As you leave the gates of Makerere I urge you to put to good use the knowledge you have received from one of the best universities in the World to improve yourselves, your families, your communities, your Country and humanity. Let people see you and know that you are a Makerere alumnus because of the way you carry yourself in society with dignity and integrity. Put your trust in God and honour your parents and opportunities will be opened for you,” Prof Nawangwe, said.

Delivering a key note address, Prof. Nicholas Ozor, the Executive Director of the African Technology Policy Studies Network Nairobi, Kenya ((ATPS). Reminded the graduates that a degree is not a finish line but the beginning of accountability. “The world is a complex, fast changing and deeply unequal. Degrees make you responsible for others not better than them,” Prof Ozor, said.

Trending

-

Humanities & Social Sciences3 days ago

Humanities & Social Sciences3 days agoMeet Najjuka Whitney, The Girl Who Missed Law and Found Her Voice

-

Health1 week ago

Health1 week agoUganda has until 2030 to end Open Defecation as Ntaro’s PhD Examines Kabale’s Progress

-

Agriculture & Environment6 days ago

Agriculture & Environment6 days agoUganda Martyrs Namugongo Students Turn Organic Waste into Soap in an Innovative School Project on Sustainable Waste Management

-

General1 week ago

General1 week agoMastercard Foundation Scholars embrace and honour their rich cultural diversity

-

General2 days ago

General2 days ago76th Graduation Highlights