General

Makerere University Draft Fees Policy (Share your Comments)

Published

10 years agoon

The Prime Minister, Rt. Hon. Ruhakana Rugunda established a committee to review the Makerere University's Fees Policy. In the view of involving all stakeholders in the new fees policy fomulation, the comittee would like to receive comments/contributions from the general public.

Please leave a comment by filling in the form at the bottom of the draft policy.

The draft fees policy is as follows:

A. Policy Statement

Makerere University is committed to providing the best service to her students to ensure that they get the best higher education experience from the University. In order to achieve this, the University raises financial resources from different sources, including tuition and functional fees, charges for use of University facilities, endowments and donations. Tuition and functional fees payable by students form an important component of the University’s financial resources.

B. Legal Framework

Fees payable by students shall be fixed by the University Council in accordance with article 41(c) of the Universities and Other Institutions Act (UOTIA) of 2001 as amended and may be reviewed from time to time.

C. Objectives of the Fees Policy

The objective of this policy is to:

- Ensure the setting fees is compliant with government regulations while supporting strategic and financial imperatives

- Ensure that additional charges levied are compliant with the legal requirements while ensuring coverage of legitimate costs

- Provide clarity regarding the requirements for administration, invoicing, collection and refund of fees.

D. Scope

This policy applies to all categories of fees chargeable for services to students of Makerere University for programmes of study.

E. Guiding Principles

- The University will set tuition fees according to economic and strategic considerations.

- The University will levy fees and charges on students in accordance with legal requirements and University regulations.

- Fees for tuition are set and charged at different rates for different cohorts based citizenship status, level of study and other criteria in accordance with the UOTIA 2001 as ammended.

- The University will publish comprehensive and accessible information on fees and charges for students and will ensure that the administration of these fees and charges is consistent with the published information and in accordance with the legal requirements and University regulations, policies and procedures.

- The University will refund tuition fees or remit HELB debt in accordance with legal requirements and University regulations.

- The University recognises that students may face financial hardship during the course of their studies and provides fees payment options to enable eligible students to continue their studies.

F. Categories of Fees

University fees are categorized as tuition, functional and other fees as detailed below:

i. Tuition Fees (payable each ordinary and recess semester)

ii. Undergraduate Students Functional Fees (payable in the first semester of each semester)

(a) Registration

(b) Examination

(c) Book Bank

(d) Library

(e) Information and Communication Technology

(f) Guild

(g) Sports

(h) Identity Card

(i) Medical Capitation

(j) Field attachment supervision

(k) Development

(l) Caution

(m) Endowment

(n) Research Fee

iii. Graduate Students Functional fees (payable in the first semester of each semester)

(a) Registration

(b) Examination

(c) Book Bank

(d) Library

(e) Information and Communication Technology

(f) Guild

(g) Sports

(h) Identity Card

(i) Medical Capitation

(j) Development

(k) Caution

(l) Endowment

(m) Research Fee

iv. Other Undergraduate Fees (payable as and when required)

(a) Graduation

(b) Transcript

(c) Certificate

(d) Convocation

(e) Certification

(f) Academic Gowns

(g) Recess Term fee

(h) Late Registration

(i) Re-mark Fee

(j) Re-take Fee

(k) Late Fees Payment Fee

(l) Verification Fee

(m) Affiliated Institutions Fee

(n) Application Fee

(o) Any other fees as may be fixed by Council from time to time

v. Other Graduate Fees (payable as and when required)

(a) Graduation

(b) Transcript

(c) Certificate

(d) Convocation

(e) Certification

(f) Academic Gowns

(g) PhD Cylinder

(h) Recess Term fee

(i) Late Registration

(j) Re-mark Fee

(k) Re-take fee

(l) Late fees Payment fee

(m) Verification Fee

(n) Thesis Examination Fee

(o) Affiliated Institutions Fee

(p) Application Fee

(q) Any other fees as may be fixed by Council from time to time

G. Fees Regulations

1. General Provisions

- Payment of University fees is the responsibility of students. An account shall be opened for each student in the computerized information system of the University. Students who default on the payment of fees are subject to sanctions, including de-registration, payment of a fine and legal action.

- Fees are due on the first day of each semester.

- All students admitted for programmes at the University are personally responsible for the payment of fees. This includes arrangements where students obtain sponsorship for fees and the sponsor defaults.

- The specific fee applicable is confirmed at the point of admission.

- When there is a review between admission and registration, the applicable fee will be that given to the students at the time of registration.

- Students repeating a course unit or programme of study will be charged the appropriate fee for the unit or programme for continuing students and those who will have overstayed on the programme.

- Students repeating course units or programmes where the fee structure has been revised upwards will be charged the revised rates.

- Every student admitted to a programme of study of Makerere University shall be required to sign and undertaking regarding fees payment.

2 Specific Requirements

a) New Students

-

Every student admitted to a programme of study of Makerere University will be issued a provisional admission letter with an invoice for payment of the requisite fees.

-

All functional fees and 60% of tuition fees for new joining students must be paid before the admission letter is issued.#

b) Continuing Students

Every continuing student shall pay a commitment fee as may be fixed by the University Council, provided that at the time of approval of this policy the commitment fee shall be UGX 200,000/= (Uganda Shillings Two Hundred Thousand only), before the student is provisionally registered for the subsequent semester. Provisional registration must be completed within the first two weeks of a semester.

The commitment fee shall form part of fees due for the semester. A student who is not provisionally registered by the end of the second week of a semester shall be de-registered. However, a student who fails to provisionally register by the end of the second week of a semester for genuine reasons may apply to the Vice Chancellor for special consideration for late registration.

Students permitted to complete Late Registration must do so by the sixth week of a semester upon payment of a Late Registration Fee as may be determined by the University Council, provided that at the time of approval of this policy the Late Registration Fee shall be UGX 100,000/- (Uganda Shillings One Hundred Thousand only), this in addition to the commitment fee.

All fees should preferably be paid at the start of each semester. However, within the first week of a semester students may choose any of three fees payment windows outlined below for payment of the fees due.

i) Window 1

Students opting to pay fees through window 1 shall pay all the approved functional and tuition fees by the end of the sixth week of a semester. Upon completion of payment of the approved fees, a student shall be given full registration for that semester.

ii) Window 2

Students opting to pay fees through window 2 shall pay all the approved functional and tuition fees as well as a Late Fees Payment charge equivalent to 5% of all fees due for that semester by the end of the 12th week of a semester. Upon completion of payment of the requisite fees, a student shall be given full registration for that semester.

Upon choosing any of two fees payment windows, the student shall be invoiced accordingly.

iii) Window 3

In order to provide quality service to her students, the University must collect all the requisite fees. The University nevertheless appreciates that a few students, particularly those who raise their tuition fees through employment, might genuinely be unable to pay their fees using any of the two windows.

Students who have difficulty paying their tuition fees due to financial hardship may apply to pay their tuition fee under a monthly payment plan. Students must apply in writing to the Vice Chancellor, and provide documentation as evidence of their financial hardship. Applications are reviewed on an individual basis and arranged on a per-semester basis only. Payment plans cannot be applied retrospectively and are not available to new students.

Please note: an administrative fee as may be fixed by Council will be charged for the establishment of a fees payment plan. Students who wish to apply for a payment plan arrangement must submit a written request/application no later than the fee payment due date for the semester in which they are requesting a payment plan.

Applications received after the fee payment due date will not be considered. Students permitted to pay by plan will be required to pay the commitment fee before the payment plan will be approved. The application fee will be billed to the student and included in his/her schedule of payments. The remaining balance will be paid under a monthly payment. All fees must be finalised in accordance with the agreed terms and conditions of the individual payment plan and in any case not later than the 12th week of the semester. Payment plans will be limited to the semester in which the request is made and no further extensions will be granted.

The Monthly Payment Plan is available to all undergraduates and graduates. Students desiring to use the Monthly Payment Plan are encouraged to sign up as soon as possible to realize the maximum number of months over which to pay the balance due. There is no interest charge or finance charge (zero percent annual percentage rate) imposed for use of the Monthly Payment Plan.

Application forms for this plan may be obtained from the College accountant. Continued participation in the Monthly Payment Plan is contingent upon a satisfactory payment history. Makerere University reserves the right to deny continued participation to anyone who has previously not complied with the terms of the monthly payment plan billing schedule.

c) Prepaid Tuition Plan

The University’s Prepaid Tuition Plan allows new students to prepay all the semesters in their study plan thereby locking in the rate of tuition in effect at the time of the plan’s initiation. Payment must be received before the first semester of the student’s study programme. For a copy of the Prepaid Tuition Plan agreement that governs this plan, please contact the Bursar’s Office.

d) Financial Support and Advice

Students who are experiencing unforeseen financial difficulties in paying their tuition fees should seek help at the earliest opportunity. The University will assist by providing information about possible scholarships where possible. It must be noted, however, that payment of fees remains the responsibility of the student.

e) Students Who Have Overstayed on a Programme

Continuing students who have overstayed on a programme and are repeating a course unit or programme of study shall be charged the appropriate fee for the unit or programme of study

f) Students at Affiliated Institutions

Fees for students studying for Makerere University awards at affiliated institutions will be determined by the affiliated institution, provided that functional fees payable directly to Makerere University will be the same fees payable by Makerere University students.

g) Students With Sponsors

Students who have an approved sponsor shall be liable for any unpaid tuition fee costs if the sponsor defaults on payment in any given semester.

h) Accommodation Fees

Residence fees must be paid before allocation of a room.

i) Other fees

-

On completion of their programmes of study, students shall pay stipulated fees, e.g. certificate, convocation, graduation and academic transcript fees.

-

Students shall be required to pay for certification of their documents at rates determined by the University Council.

j) Fees Upon Withdrawal and Discontinuation From Studies

-

Students who withdraw from a programme of study are still liable for the fees which they owe to the University.

-

A student who is dismissed for academic or disciplinary reasons, prior to the end of semester, shall forfeit all tuition and other fees paid for that semester.

3 Defaulting Students:

-

Students who default payment of fees, or who are in debt to the University for any reason, shall not be allowed to write their examinations or proceed further with their studies or receive a University Transcript, degree or any award.

-

A student who fails to pay fees within the stipulated period may apply for withdraw from the programme and on resumption shall be required to pay all the requisite fees.

-

If, with notice, a student's enrolment is cancelled for abscondment from the programme of study and that student is subsequently permitted to have his/her enrolment reinstated, a UGX 500,000/=. re-instatement fee will be levied in addition to the requisite functional and tution fees not paid by the student at the time of abscondment.

-

Non-payment of fees within the prescribed period shall lead to cancellation of registration.

-

A student whose enrolment is cancelled will retain her/his fee liability, and re-admission in a subsequent year or semester will only be permitted when the debt is paid in.

-

A student who is in debt to the University at the time of graduation shall not be issued with Academic Transcript, Degree or Diploma certificate and will not be permitted to graduate.

-

The University reserves the right to take legal action, where appropriate, to effect recovery of monies from students who leave the University with outstanding debts.

-

Transfer of fees from one student’s account to another student’s account is not permissible.

H. Procedure for Paying Fees

The following is the procedure for paying University fees:

- Students are invoiced for the fees before the start of the semester.

- Payments are made to an approved Makerere University Bank collection account.

- Upon confirmation of payment, receipts are issued by the Finance Department to students after which the student may register on the computerized system of the University.

- Upon registration an account is opened and maintained in the computerized system of the University for each student.

I. Methods of Payment

Methods of payment of University fees include the following:

- Cash deposit in a University bank account

- Bank drafts

- Direct Transfer

- Other electronic transfer methods as may be approved by University Management

4 Fees Subsidy Schemes:

i. Biological children of members of staff who are less than 21 years on entry into the University may be permitted to pay ½ tuition fees and full functional fees in accordancewith the existing policy on fees subsidy for biological children of members of staff. Members of staff who are on the Staff Development programme on programmes offered at Makerere University will have a waiver of the tuition and functional fees.

5 Refund of Fees

- Students’ Withdrawal

Students who choose to withdraw from a programme may be refunded some tuition fees as detailed below.

5.1.1 Tuition fees

A student who has been permitted to withdraw from studies shall be refunded the Tuition Fees already paid prorata to the equivalent fees due for the time spent on the programme of studies.

In case an Academic Programme to which a student has been admitted is not conducted in a particular academic year, the University will refund the full tuition fees paid by the student.

5.1.2 All Functional fees are non-refundable

5.1.3 Residence fee – NIL

5.1.4 A refund may be granted to a student unable to notify the Registrar in writing by the dates required, provided evidence is supplied that the student had ceased attendance by the 6th week of a semester, and was unable to notify the Registrar for reasons beyond her/his control.

5.1.5 These applications will only be approved where the University is satisfied that:

- The circumstances were beyond the student’s control (and those circumstances were unusual, uncommon or abnormal) and

- The circumstances did not make their full impact on the student until after the census date for the course(s) they wish to withdraw from and

- The circumstances make it impracticable for the student to complete the requirements for the course.

2. Payment in excess of statutory fees

Students, who pay more than the University’s tuition and other fees requirement, shall be refunded the sum paid beyond the University statutory fee requirements to

- The student or sponsor upon completion of programme of study

- By special permission of the Vice Chancellor upon proof of excess payment

- Or rolled forward depending on the circumstances.

Any credit resulting from an overpayment or an adjustment/amendment to a student’s fee liability will be credited towards her/his fee liability for the following semester.

3. Application for Refund

In every case a refund will be made on production of University receipt. Students’ written application seeking for the refund shall be verified by the Academic Registrar and Bursar before a refund is paid.

4. Forgeries

i. Students who are registered on the basis of forged academic documents will not get fees refund.

ii. Students who present forged fees payment documents will be dismissed from the University and prosecuted.

J. Responsibility for Implementation of the Fees Policy

The overall responsibility for implementation of this policy is the Vice Chancellor, assisted by the Deputy Vice Chancellor (Academic Affairs) and the Deputy Vice Chancellor (Finance and Administration).

The operational responsibility for implementation of this policy lies with the University Secretary, the Academic Registrar, the Bursar, the College Principals, Directors of External Campuses, Deans and Heads of Department.

Every member of staff has the general responsibility of ensuring that this policy is implemented effectively.

You may like

General

Graduation marks the next phase of accountability, graduates told

Published

1 day agoon

February 25, 2026

“A degree is not a finish line. Graduation is not the end of learning, It is the beginning of accountability,” Prof. Nicholas Ozor, the Executive Director of the African Technology Policy Studies Network Nairobi, Kenya (ATPS), said.

Delivering a keynote address under the theme ‘Knowledge with purpose’, during Makerere University’s 76th graduation ceremony on Tuesday 24th February, Prof Ozor, challenged graduates to see their degrees not as status symbols, but as instruments of responsibility.

In his speech, he painted a candid picture of the world the graduates are stepping into, one marked by climate change, technological disruption, inequality, food insecurity and the rapid spread of misinformation. Yet rather than framing these challenges as obstacles, he described them as opportunities for purposeful leadership.

“Into this world, you step, armed with knowledge, credentials, and potential. Your degrees do not make you better than others. They make you responsible for others,” Prof Ozor, said.

Addressing graduands from College of Agricultural and Environmental Sciences (CAES)

College of Computing and Information Sciences (CoCIS), College of Education and External Studies (CEES) and School of Law (SoL), Prof. Ozor tailored his message to each field of study.

To graduates of the School of Law, he described the legal profession as a moral calling, urging them to use the law to protect the vulnerable and uphold justice with courage.

“Uganda, Africa, and the world do not need lawyers who only know how to argue. They need lawyers who know why they argue. Use the law to protect the weak, not intimidate them. Use your knowledge to defend justice, not delay it. Let integrity define your reputation not merely your résumé,” Prof Ozor, said.

For graduands who might feel that shortcuts will be tempting and silence will feel safer than truth, Prof. Ozor reminded them that justice does not need clever people, but courageous ones.

To the College of Education and External Studies, he underscored the transformative power of teachers, reminding them that classrooms shape nations long before policies do.

“Every nation rises and falls on the quality of its teachers. Never underestimate the power of a classroom. Teach not only for examinations, but for understanding. Teach not only content, but character. Teach learners how to think not what to think. Education is quiet work but its impact echoes across generations,” Prof Ozor, noted.

He called upon graduands from the College of Computing and Information Sciences, to use technology to solve African problems, not merely to imitate foreign solutions.

“Technology is powerful, but it is not neutral. Every line of code carries values. Every system you design affects real lives. Build for inclusion. Build for accessibility. Build for truth. Do not let innovation outrun ethics. The future will not belong to those who know the most technology, but to those who use it wisely,” He noted.

During the ceremony, Prof Ozor announced that the African Technology Policy Studies Network is offering PhD scholarships and postdoctoral fellowships in Artificial Intelligence, inviting deeper collaboration with Makerere.

For graduates of the College of Agricultural and Environmental Sciences, he highlighted their critical role at the intersection of sustainability and survival, calling on them to blend indigenous knowledge with scientific innovation to secure Africa’s food systems and protect its ecosystems.

In closing, he reminded graduands that their integrity will open doors their degrees cannot, their humility will teach them lessons success never will, and their resilience will matter more than their grades.

Five principles to be remembered:

- Embrace lifelong learning. The world changes too fast for static knowledge.

- Choose purpose over comfort. Impact matters more than income.

- Build character before career. Skills get you hired; character sustains you.

- Serve something larger than yourself. Give back to your communities and your country.

- Believe in Africa, and act. Do not wait for solutions from elsewhere. Be the solution.

General

Over 9,200 to graduate at Makerere University’s 76th Graduation

Published

2 days agoon

February 24, 2026

Pomp and colour defined the opening day of the Makerere University’s 76th Graduation Ceremony as thousands gathered to celebrate academic excellence and new beginnings.

The historic ceremony has brought together scholars, families, friends and industry partners in a vibrant celebration of achievement and possibility. Throughout the four-day event, the University will confer degrees and award diplomas to 9,295 graduands in recognition of their dedication and hard work.

Among the graduates, 213 will receive Doctor of Philosophy (PhD) degrees, 2,503 will graduate with Master’s degrees, and 6,343 will earn Bachelor’s degrees. In addition, 206 students will graduate with postgraduate diplomas, while 30 will be awarded undergraduate diplomas.

Of the total number of graduands, 4,262 are female and 5,033 are male. According to Vice Chancellor, this marks the first time in 15 years that male graduands have outnumbered their female counterparts.

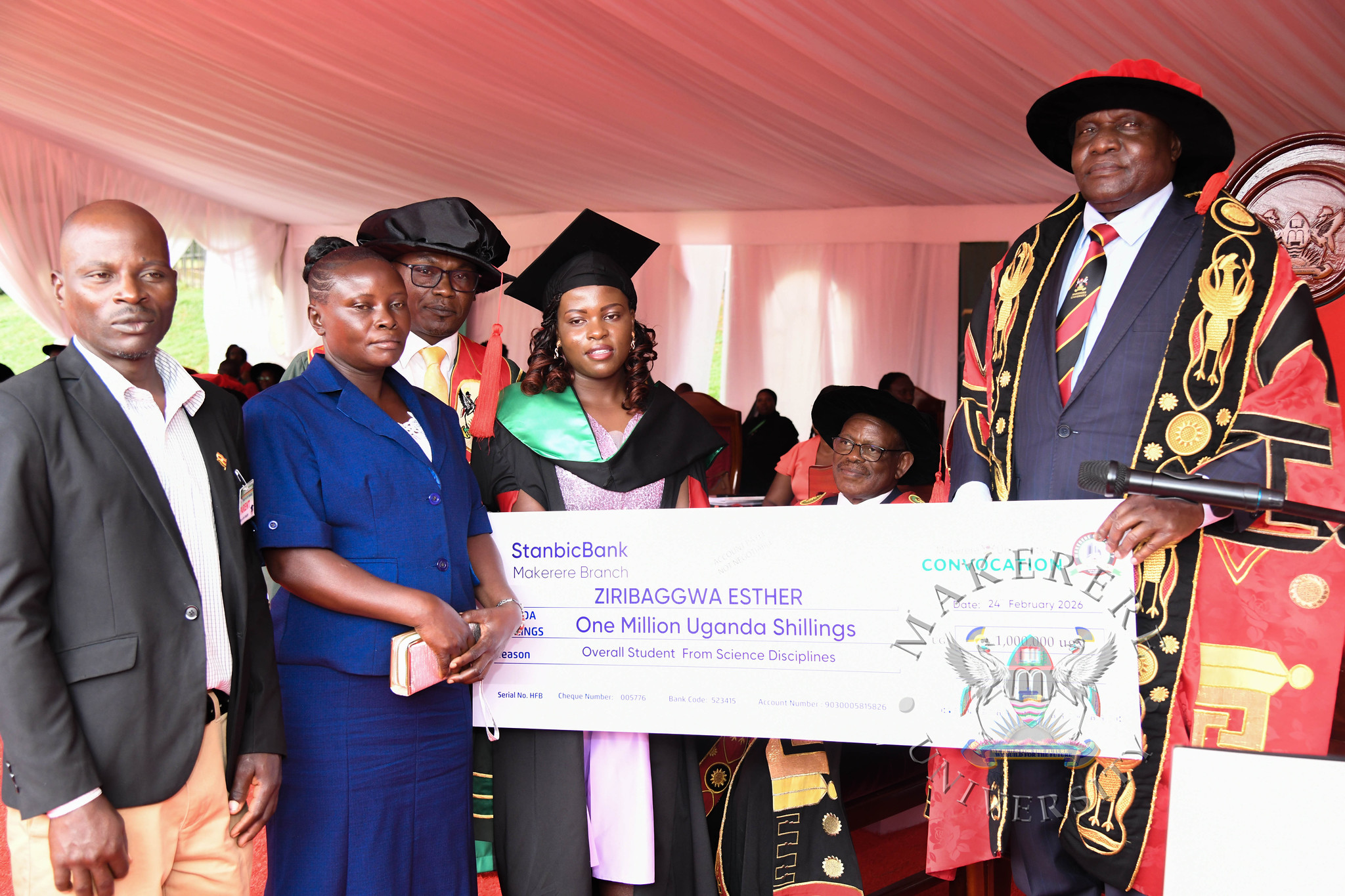

The best overall graduand in the Sciences, Esther Ziribaggwa, graduated on the opening day with the Bachelor of Agricultural and Rural Innovation and an impressive Cumulative Grade Point Average (CGPA) of 4.77.

The ceremony marks a proud moment for Makerere University as it continues to nurture top-tier professionals across diverse fields.

While presiding over the graduation, the State Minister for Primary Education, Hon. Dr. Joyce Moriku Kaducu, on behalf of the First Lady and Minister of Education and Sports, Hon. Janet Kataaha Museveni, pointed out that Makerere University is a model institution, where leaders are nurtured, scholars are sharpened, and where dreams have been given direction.

In her address, Hon. Museveni, highlighted Government’s deliberate investment in research, innovation, and infrastructure to strengthen higher education in Uganda.

“The establishment of the Makerere University Research and Innovation Fund (RIF), supports high-impact research and innovation that directly contributes to national priorities and development. Through this initiative, thousands of researchers and innovators have pursued practical, scalable solutions that are transforming communities and key sectors across Uganda,” Mrs Museveni, said.

The Minister also noted that Parliament’s approved a USD 162 million concessional loan to upgrade science, technology, and innovation infrastructure at Makerere University. The funding will facilitate the construction of modern laboratories, smart classrooms, and state-of-the-art facilities for Engineering and Health Sciences, investments expected to position the University firmly within the Fourth Industrial Revolution.

“Government has embarked on the construction of a National Stadium at Makerere University and other institutions of higher learning across the country. This will promote physical education, strengthen talent identification, and boost investment in the sports sector,”

Turning to the graduands, the Minister encouraged them to see themselves not merely as job seekers, but as job creators and solution-makers.

Uganda and Africa need innovators who will modernize agriculture; engineers who will build quality infrastructure; healthcare professionals who will strengthen health systems; and educators who will inspire the next generation,” the Honourable Minister said.

She reminded graduates that they are entering a rapidly changing world shaped by Artificial Intelligence, climate change, and shifting global markets. To thrive, she advised them to remain adaptable, creative, and committed to lifelong learning.

She also encouraged graduates interested in entrepreneurship to tap into the Government’s Parish Development Model, which provides community-based financing and production support.

Quoting Proverbs 3:5–6, the Minister urged the graduates to trust in God as they embark on their next chapter.

She extended special appreciation to the Mastercard Foundation for its 13-year partnership with Makerere University in expanding access to education and empowering young people in Uganda and beyond.

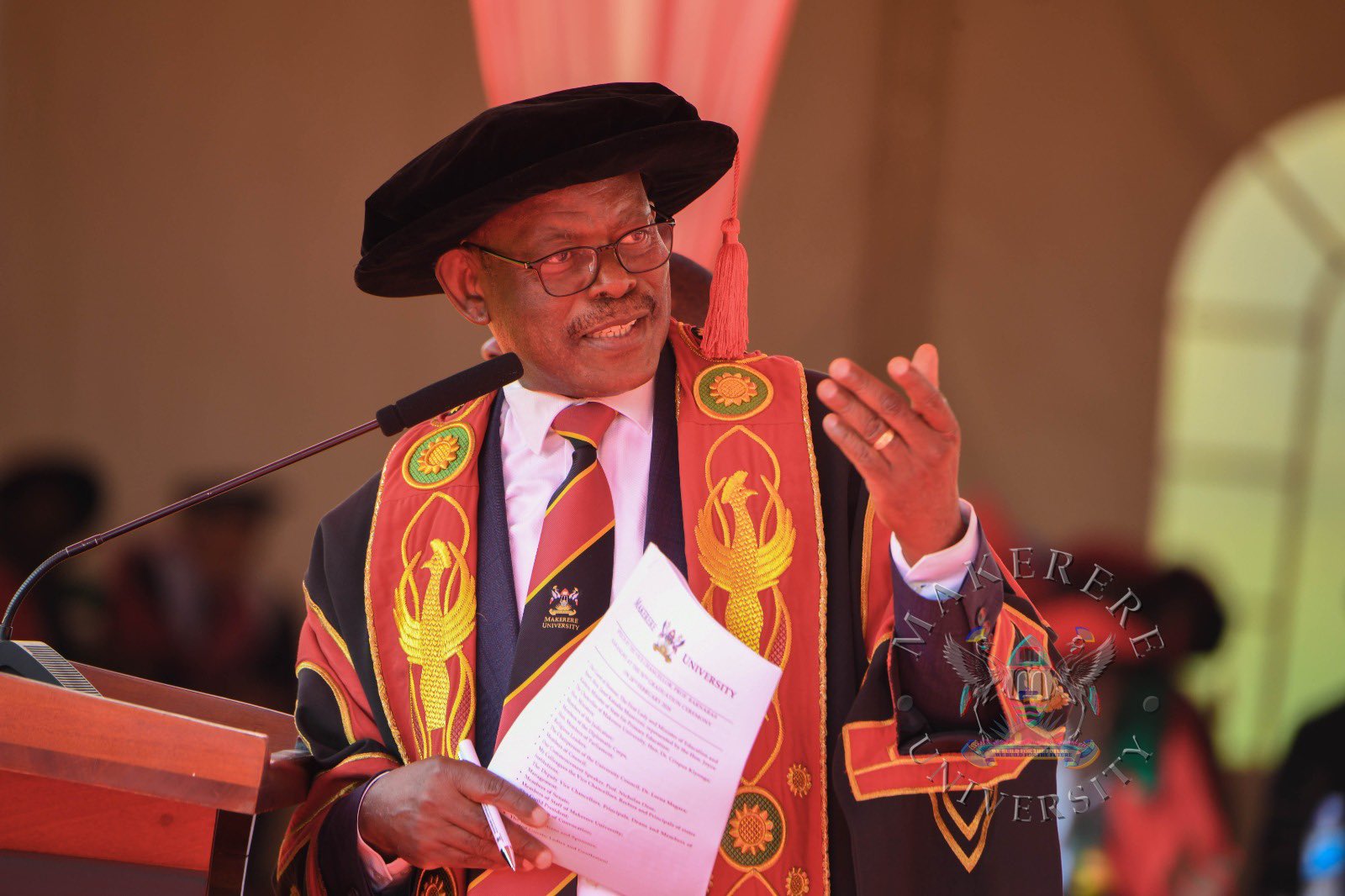

In his speech, the Chancellor of Makerere University, Dr Crispus Kiyonga, urged graduands to harness research, innovation and technology to drive Uganda’s transformation.

“This is a milestone in your lives. You have invested time, discipline and hard work to attain these qualifications. It is important that you derive value from this achievement, not only for yourselves, but for your families and for society.” Dr Kiyonga, said.

Dr. Kiyonga expressed gratitude to the Government of Uganda for its continued financial support to the University, particularly the funding allocated under MakRIF, which he described as critical in strengthening the institution’s research capacity.

“Research plays a very vital role in the development of any community. Makerere as the oldest University in the country is doing a significant amount of research, However, more work is required to mobilize additional resources to further strengthen research at the University.” Dr Kiyonga, noted.

Acknowledging the challenges of a competitive job market, Dr. Kiyonga encouraged graduates to think beyond traditional employment pathways.

“It is true that the job market may not absorb all of you immediately. But the knowledge you have acquired is empowering. You can create work for yourselves, individually or in teams.” Dr Kiyonga, said.

He advised the graduands to embrace discipline, integrity and adaptability in the workplace, and to take advantage of technology and digital platforms to innovate and respond to societal challenges.

“Every development challenge presents an opportunity. Believe that you can apply your knowledge to create solutions with impact.” He said.

Addressing the congregation, the Vice Chancellor, Prof Barnabas Nawangwe, congratulated the graduands, particularly staff and societal leaders on their respective achievements.

“I congratulate all our graduands upon reaching this milestone. In a special way I congratulate the members of staff, Ministers, and Members of Parliament that are graduating today as well as children and spouses of members of staff,” Prof Nawangwe, said.

In his speech, Prof Nawangwe, recognized outstanding PhD students, particularly members of staff. who completed their PhDs in record time without even taking leave from their duties.

He called upon graduates not to despise humble beginnings but rather reflect on the immense opportunities around them and rise to the occasion as entrepreneurs.

“You are all graduating with disciplines that are needed by society. We have equipped you with the knowledge and skills that will make you employable or create your own businesses and employ others. Do not despair if you cannot find employment. Instead, reflect on the immense opportunities around you and rise to the occasion as an entrepreneur,” Prof Nawangwe, said.

Prof Nawangwe called upon the graduands of PhDs to use their degrees to transform the African continent.

“As you leave the gates of Makerere I urge you to put to good use the knowledge you have received from one of the best universities in the World to improve yourselves, your families, your communities, your Country and humanity. Let people see you and know that you are a Makerere alumnus because of the way you carry yourself in society with dignity and integrity. Put your trust in God and honour your parents and opportunities will be opened for you,” Prof Nawangwe, said.

Delivering a key note address, Prof. Nicholas Ozor, the Executive Director of the African Technology Policy Studies Network Nairobi, Kenya ((ATPS). Reminded the graduates that a degree is not a finish line but the beginning of accountability. “The world is a complex, fast changing and deeply unequal. Degrees make you responsible for others not better than them,” Prof Ozor, said.

The 76th Graduation Ceremony of Makerere University will be held from Tuesday 24th to Friday 27th February, 2026. A total of 213 PhDs (87 female, 126 male), 2,503 Masters (1,087 female, 1,416 male), 206 Postgraduate Diplomas (80 female, 126 male), 6,343 Undergraduate Degrees (2,999 female, 3,344 male), and 30 Undergraduate Diplomas (9 female, 21 male) will be graduating from all the Colleges.

Ms. Sarah Aloyo and Ms. Nakato Dorothy both students of the Bachelor of Procurement and Supply Chain Management emerged as the best in the Humanities and Best Overall students with a CGPA of 4.93. Mr. Ssewalu Abdul, a Bachelor of Leisure and Hospitality Management student emerged second best in the Humanities with a CGPA 4.90. Ms. Esther Ziribaggwa emerged as the best student in the Sciences with a CGPA of 4.77 in the Bachelor of Agricultural and Rural Innovation, while Mr. Simon Mungudit emerged second best in the Sciences with a CGPA of 4.76 in the Bachelor of Science in Petroleum Geoscience and Production.

Commencement Speakers

- Day 1 – Prof. Nicholas Ozor, the Executive Director of the African Technology Policy Studies Network, Nairobi, Kenya

- Day 2 – Prof. Dr. Maggie Kigozi, Chairperson Makerere University Endowment Fund Board

- Day 3 – Dr. Patricia Adongo Ojangole, Managing Director, Uganda Development Bank Limited

- Day 4 – Ms. Reeta Roy, Former President & Chief Executive Officer, Mastercard Foundation

The 76th Graduation Ceremony will be held at the Freedom Square following the schedule below:

Tuesday, 24th February, 2026

College of Agricultural and Environmental Sciences (CAES)

College of Computing and Information Sciences (CoCIS)

College of Education and External Studies (CEES)

School of Law (SoL)

Livestream Link for Day 1: https://youtube.com/live/wVGPA0FJ9pU

Wednesday, 25th February, 2026

College of Health Sciences (CHS)

College of Natural Sciences (CoNAS)

College of Veterinary Medicine, Animal Resources and Bio-security (CoVAB)

School of Public Health (SPH)

Thursday, 26th February, 2026

Makerere University Business School (MUBS)

College of Business and Management Sciences (CoBAMS)

Friday, 27th February, 2026

College of Engineering, Design, Art and Technology (CEDAT)

College of Humanities and Social Sciences (CHUSS)

Institute of Gender and Development Studies (IGDS)

Makerere Institute of Social Research (MISR)

Trending

-

Humanities & Social Sciences3 days ago

Humanities & Social Sciences3 days agoMeet Najjuka Whitney, The Girl Who Missed Law and Found Her Voice

-

Health1 week ago

Health1 week agoUganda has until 2030 to end Open Defecation as Ntaro’s PhD Examines Kabale’s Progress

-

Agriculture & Environment6 days ago

Agriculture & Environment6 days agoUganda Martyrs Namugongo Students Turn Organic Waste into Soap in an Innovative School Project on Sustainable Waste Management

-

General1 week ago

General1 week agoMastercard Foundation Scholars embrace and honour their rich cultural diversity

-

General2 days ago

General2 days ago76th Graduation Highlights